Tesla, the 23-year-old company that brought green cars into the mainstream, has been pushed off its perch as the world’s top electric vehicle seller.

Chinese EV manufacturer BYD sold hundreds of thousands more cars last year, and it’s not just in China.

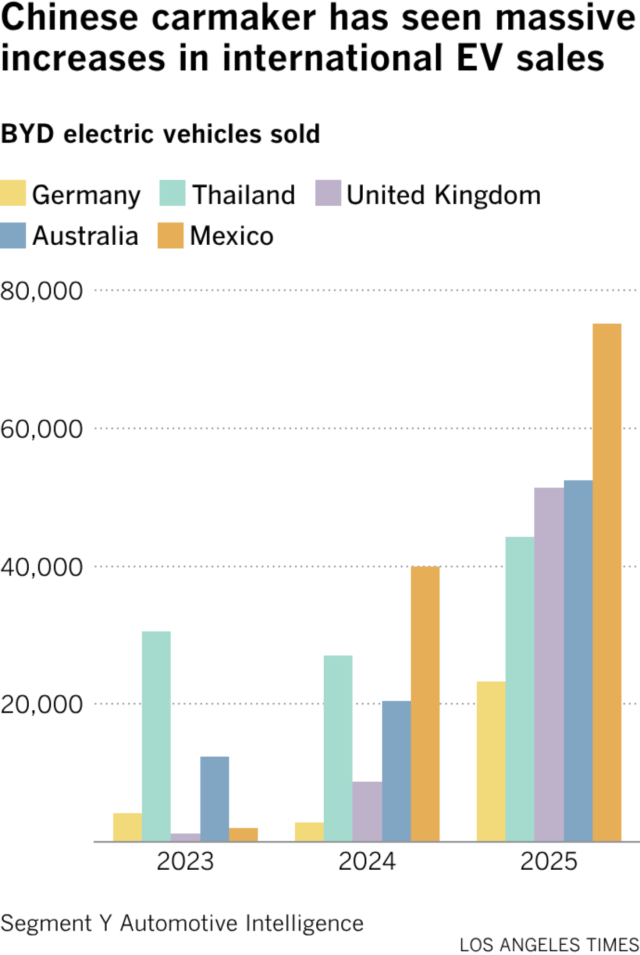

In most of the countries where the Chinese titan went head-to-head with Tesla — including Germany, Mexico, Thailand and Australia — Tesla lost market share at an unprecedented rate.

The end of federal support for EVs has bitten into Tesla’s sales in the U.S., while backlash against Chief Executive Elon Musk’s political posturing has damaged his company’s reputation both at home and abroad. Globally, BYD is dominating with newer models, better batteries and lower sticker prices.

“Tesla didn’t just lose its sales crown, it squandered its position as a leader,” said Paul Blokland, co-founder of automotive data company Segment Y Automotive Intelligence. “As the U.S. industry retreats behind a wall of tariffs and abandoned EV plans, Asia has taken the torch.”

In one of the most extreme examples of Tesla getting trumped, BYD vehicles swarmed roads in Europe last year. The Chinese company’s sales in the top 10 European markets quadrupled in 2025 compared with the previous year, according to calculations from Segment Y. Tesla sales slumped 30% over the same period.

As Tesla loses global market share, Musk has been trying to diversify Tesla away from its EV roots and rebrand it as more of an AI, robotics and robotaxi company.

On Tesla’s earnings call last month, Musk announced he would end production of the Model S and Model X and use the freed-up factory space to produce Optimus humanoid robots. He said he hopes to produce 1 million robots a year at the production plant in Fremont.

“It’s time to basically bring the Model S and X programs to an end with an honorable discharge because we’re really moving into a future that is based on autonomy,” Musk said on the call.

BYD was founded in 1995 in Shenzhen, China, starting out as a maker of low-cost rechargeable batteries for consumer electronics, eventually supplying Motorola, Nokia and others.

BYD has now emerged as a global electric-vehicle heavyweight by controlling much of its supply chain and rapidly rolling out new models. An early investment from Berkshire Hathaway helped legitimize the company abroad. As BYD expanded sales across China, Europe and other overseas markets, it has been reshaping competition in the auto industry everywhere it lands.

Due to steep tariffs and federal restrictions, you can’t buy a BYD passenger vehicle in the U.S. But according to experts and customers, BYD offers a higher-quality car for a much lower price in other countries. The BYD Dolphin, an all-electric hatchback, starts at less than $14,000 in China.

Experts said BYD has several advantages over Tesla, including a more diverse product offering, lower-cost access to rare earth metals used in batteries, and freedom from U.S. safety and labor laws.

“High visibility elements of BYD cars seem to be superior to not just Teslas but a lot of the cars that are being produced by non-Chinese companies,” said Karl Brauer, an analyst at iSeeCars.com. “Musk has got to find another concept to build his legacy on.”

Tesla offers a few main vehicles with some variation, including a compact car, a midsize SUV and the Cybertruck. BYD sells more than eight models that include sedans, several SUVs, minivans and trucks.

In countries where there is a choice between Tesla and BYD, customers say BYD cars look better, cost less and come with more options.

Amy de Groot, a resident of Melbourne, bought her BYD Sealion 6 about a year ago for around 55,000 Australian dollars. She said BYD vehicles are all over the roads in her community.

“Everyone that gets into the car is dead shocked at how nice it is,” De Groot said. “It’s a beautiful car to look at and to be inside.”

When she was shopping for an electric vehicle, De Groot didn’t give much thought to buying a Tesla. Teslas peaked in popularity in Australia about five years ago, she estimated, but Musk’s reputation has significantly deteriorated since then, she said.

“At the time that I was looking, the Tesla stocks bombed really hard, and resale is always top of mind for me,” De Groot said. “It was a real fad to have a Tesla, and I just don’t think that they’re competitive in any way.”

According to Segment Y Automotive Intelligence, BYD sold more than 52,000 electric vehicles in Australia in 2025, a 156% increase from the year prior. Tesla sales in the country fell 24%.

Even in California, where electric vehicles are extremely popular and BYD is nowhere to be found, Tesla is losing market share.

The number of new Teslas registered in California fell more than 11% from 2024 to 2025. Tesla’s market share among EVs in the state fell 5 percentage points over the same period, according to recent data from the California Auto Outlook. American automaker Chevrolet and Honda, a Japanese manufacturer, both gained market share at the same time.

“The scrapping of incentives no doubt impacted Tesla, but at least it does not have to worry about BYD in its own backyard yet,” Blokland said.

One of BYD’s competitive edges, analysts say, is its batteries. It started as a battery company and has developed batteries that are more affordable and powerful than the competition.

Another factor is that battery materials are cheaper to source in China, said Brauer with iSeeCars.com.

“When the most expensive part of an electric car is the battery, and you have a massive advantage on the cost of producing a battery, you have a massive advantage in the EV world,” he said.

BYD may also be getting some help from government backing as well as lower labor costs, experts say.

“Our rules and environmental regulations and our laws about how you treat workers are not globally instituted,” said Brian Moody, an automotive expert and analyst. “It seems to give BYD a financial advantage in that they can charge next to nothing for a car that maybe costs more than that to build.”

While BYD vehicles are not expected to land in the U.S. anytime soon due to trade and safety restrictions, they are increasingly going to be found just across the border.

More than 75,000 BYDs were sold in Mexico last year, according to Segment Y’s tally. Meanwhile, Canada recently reached a trade agreement with China that would allow more Chinese EVs into the country.