BYD sharply declined in December from a year before, as it closed the curtains on a volatile year for China electric vehicles amid an aggressive price war and weak domestic demand.

The company recorded 414,784 deliveries in December, down from 474,921 in November, according to a Friday filing.

The latest reading brings BYD to hit its 2025 sales target, which it lowered by 16% to 4.6 million, amid increasingly weakening domestic demand.

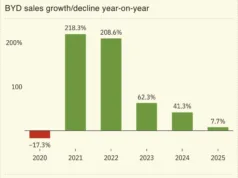

The EV behemoth also remained the clear market leader, delivering more than 4.54 million passenger vehicles for 2025 – a 6.94% increase from its 2024 deliveries.

That overshadows Tesla‘s recorded wholesale deliveries of 735,274 from Model Y and Model 3 vehicles in China, between January and November, based on CNBC’s calculation of data from the China Passenger Car Association. December numbers have yet to be released.

Affordable models offer edge

EV startups posted strong growth in 2025, as mass-market models and aggressive pricing increasingly outperformed premium-focused strategies.

Leapmotor emerged as one of the fastest-growing brands, making 596,555 deliveries in 2025, surpassing its target for the year. The automaker, which marked its 10th anniversary last year, nearly doubled its sales volume from 2024 and aims to deliver 1 million EVs in 2026.

Xpeng also posted a sharp increase, delivering 429,445 sales for the year – a 126% jump from 2024, the company said Thursday. The automaker’s deliveries peaked in September and October following the launch of its Mona series in September.

Nio posted 326,028 car deliveries in 2025, recording a 46.9% year-on-year increase, the company said in a Thursday release. About half of its deliveries were attributed to Nio’s premium namesake brand. The company also said in the release that it had set a record in China for the fastest delivery among EVs priced above 400,000 yuan ($57,172), with its flagship SUV ES8.

Without specifying its annual delivery numbers, Xiaomi recorded more than 50,000 sales in December, marking a new record. According to CNBC calculations of its monthly data, the smartphone maker made more than 380,000 car deliveries in 2025.

Li Auto bucks trend

By contrast, Li Auto delivered 406,343 vehicles for the whole of 2025, marking a sharp decline from its record performance in 2024.

The company delivered 44,246 vehicles in December, its first monthly total above 40,000 since May. The latest reading marks a recovery in growth since its sales were hit by a marketing misstep in September, around the launch of its competitively priced Li i8.

Meanwhile, Huawei-backed Harmony Intelligent Mobility Alliance – which includes brands such as Aito, Chery, and Maextro – recorded strong momentum, with about 589,107 vehicles delivered for 2025, a 32% year-on-year increase.

It clocked 89,611 deliveries in December, marking the third straight month of monthly delivery records, the company said.

The company did not specify Aito’s delivery figures.