From January to August 2025, China’s passenger vehicle exports showed regional divergence, brand-led growth, and widening performance gaps. BYD remained dominant across Europe, Southeast Asia, North America, and Oceania, taking the lead with 183,276 units in Europe and a 271.5% YoY surge, showcasing the global strength of Chinese new energy vehicle (NEV) technology.

Emerging markets showed impressive growth: Leapmotor surged 740.4% YoY in Europe, Jiangsu Yueda Kia saw a 742.1% YoY rise in Oceania, and SAIC-GM-Wuling recorded an astounding 6,471.2% jump, driven by tailored products and strategic regional expansions.

However, market differentiation is widening. Tesla’s exports fell in Europe and Oceania, while SAIC PV’s plummeted 66.6% YoY in North America. This reflects the increasing importance of adapting to consumer needs and innovating product lines to stay competitive on the global stage.

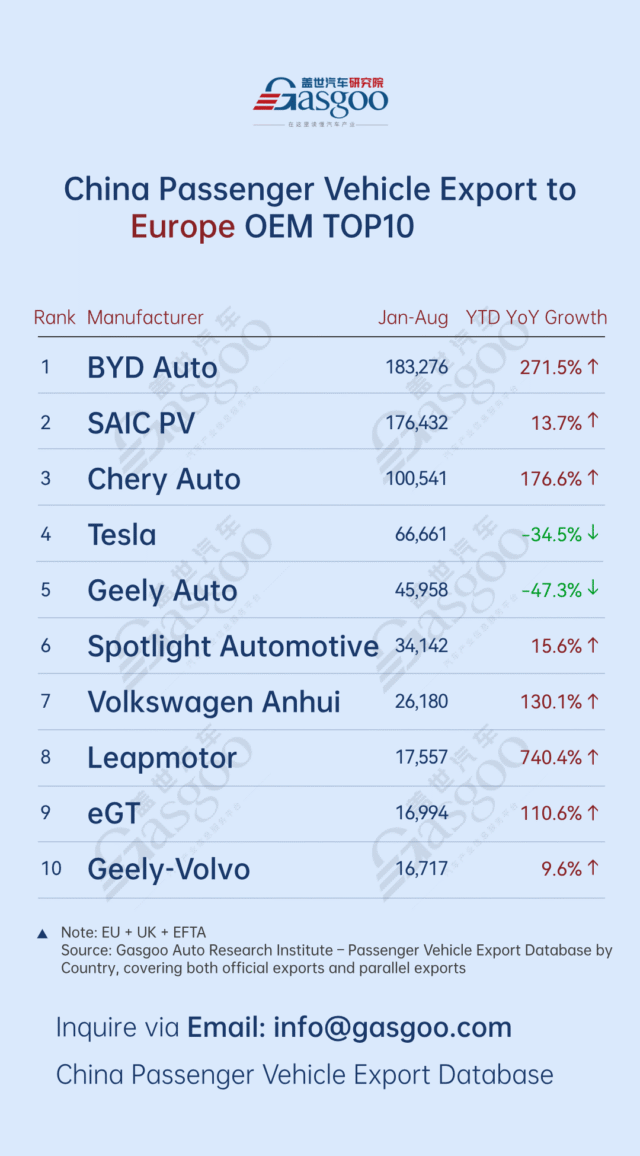

Top 10 Chinese automakers by passenger vehicle exports to Europe

BYD Auto: 183,276 units, up 271.5% year-on-year

SAIC PV: 176,432 units, up 13.7% year-on-year

Chery Auto: 100,541 units, up 176.6% year-on-year

Tesla: 66,661 units, down 34.5% year-on-year

Geely Auto: 45,958 units, down 47.3% year-on-year

Spotlight Automotive: 34,142 units, up 15.6% year-on-year

Volkswagen Anhui: 26,180 units, up 130.1% year-on-year

Leapmotor: 17,557 units, up 740.4% year-on-year

eGT: 16,994 units, up 110.6% year-on-year

Geely-Volvo: 16,717 units, up 9.6% year-on-year

The European market continued to show clear trends — top players led, emerging brands surged, and company performance diverged.

BYD Auto led the pack with 183,276 units exported, a remarkable 271.5% YoY increase that underscores its deepening global strategy and strong market penetration in Europe. SAIC PV maintained steady momentum with 176,432 units (+13.7% YoY), while Chery Auto reached 100,541 units (+176.6% YoY), reflecting solid product strength and continued success in regional market expansion.

The rise of new players is becoming increasingly evident. Leapmotor exported 17,557 vehicles from January to August, a remarkable 740.4% YoY increase — setting a new growth record and opening doors to the European market with its differentiated products. Meanwhile, eGT exported 16,994 units, up 110.6% YoY, gaining traction with its niche models. These emerging companies are fast becoming the «new engines» of Chinese brands’ expansion in Europe.

At the same time, market polarization is intensifying. Tesla’s exports dropped 34.5% YoY to 66,661 units, while Geely’s fell 47.3% to 45,958 units. The decline for both may stem from heightened competition—as an influx of Chinese brands, the accelerated electrification of European automakers, and internal product or strategy adjustments all converge.

Overall, Chinese brands continued to gain traction in Europe, with established leaders consolidating their position and new forces breaking through. Yet the sharp divergence in growth rates signals fiercer competition ahead — where product strength, supply chain resilience, and regional execution will define who wins the European market

Top 10 Chinese automakers by passenger vehicle exports to Southeast Asia

BYD Auto: 92,490 units, up 130.5% year-on-year

Geely Auto: 53,308 units, up 41.4% year-on-year

Chery Auto: 52,697 units, up 136.7% year-on-year

Changan Auto: 23,462 units, up 43.8% year-on-year

Great Wall Motor: 13,500 units, up 31.1% year-on-year

Jiangsu Yueda Kia: 11,352 units, up 6.7% year-on-year

Tesla: 11,037 units, up 6.9% year-on-year

SAIC PV: 10,194 units, down 40.8% year-on-year

Jiangling Motor: 9,720 units, up 7.2% year-on-year

XPENG: 9,277 units

From January to August, China’s passenger vehicle exports to Southeast Asia kept rising. BYD Auto led with 92,490 units, up 130.5% YoY, showing strong competitiveness in new energy products and market expansion. Chery Auto and Geely Auto followed with 52,697 units (up 136.7%) and 53,308 units (up 41.4%), while Changan Auto and Great Wall Motor also maintained steady growth.

Overall, Chinese brands are strengthening their presence in Southeast Asia, with NEVs driving much of the growth. Differences in product focus and market strategy are widening the gap between companies, as leading players consolidate their advantages in products and channels. Southeast Asia has become a key export market for Chinese automakers, now shifting toward more refined competition.

Top 10 Chinese automakers by passenger vehicle exports to North America

BYD Auto: 76,696 units, up 109.2% year-on-year

SAIC-GM-Wuling: 72,108 units, up 7.7% year-on-year

Chery Auto: 22,192 units, up 3.9% year-on-year

Jiangsu Yueda Kia: 20,626 units, up 6.2% year-on-year

Changan-Ford: 20,252 units, down 30.9% year-on-year

SAIC-GM: 19,158 units, down 49.9% year-on-year

Geely Auto: 18,434 units, down 11.0% year-on-year

SAIC PV: 16,055 units, down 66.6% year-on-year

GAC Trumpchi: 11,588 units, up 52.2% year-on-year

Great Wall Motor: 9,721 units, up 57.6% year-on-year

The North American market shows clear polarization. New energy vehicle and transformation-driven automakers are surging ahead: BYD Auto led the pack with a 109.2% YoY increase, while GAC Trumpchi and Great Wall Motor both grew over 50%. Their advantages in NEV technology and global product development are rapidly translating into competitiveness in North America, where NEVs are becoming the key to market entry.

Traditional joint ventures and some independent brands faced headwinds—SAIC-GM, Changan-Ford, and SAIC PV all declined sharply, with SAIC PV down 66.6% YoY, the steepest drop among them.

Mid-tier players like Chery Auto and SAIC-GM-Wuling posted modest single-digit growth, showing steady but constrained performance. Compared with leading NEV players like BYD Auto, they urgently need to accelerate electrification and refine market positioning to expand share. Overall, Chinese automakers in North America are at a turning point in the battle between established and emerging forces—the depth of NEV transformation and global operational strength will define the next phase of competition.

Top 10 Chinese automakers by passenger vehicle exports to Central and South America

BYD Auto: 106,697 units, down 6.8% year-on-year

Chery Auto: 82,722 units, up 13.3% year-on-year

Great Wall Motor: 42,035 units, up 51.6% year-on-year

Jiangsu Yueda Kia: 31,378 units, down 9.7% year-on-year

Jiangling Motor: 25,320 units, up 119.3% year-on-year

Geely Auto: 16,776 units, down 5.7% year-on-year

SAIC-GM-Wuling: 15,794 units, down 22.9% year-on-year

DFSK: 14,013 units, up 68.9% year-on-year

SAIC PV: 12,706 units, up 14.9% year-on-year

Changan Auto: 12,551 units, down 16.3% year-on-year

From January to August, China’s leading automakers maintained a stable presence in Latin America, though growth patterns showed sharp contrasts. BYD Auto led the region with 106,697 units exported but saw a 6.8% YoY decline due to intensified global competition and a high base effect. Chery Auto grew steadily by 13.3%, demonstrating strong market resilience. Great Wall Motor (+51.6%), Jiangling Motor (+119.3%), and DFSK (+68.9%) emerged as key growth drivers—notably, Jiangling more than doubled its exports by aligning products closely with local demand, standing out as a market «breakthrough player.»

In contrast, SAIC-GM-Wuling and Changan Auto both recorded declines of over 16% YoY, signaling mounting competition and strategy shifts.

Looking ahead, competition in Latin America will increasingly hinge on product differentiation, localization depth, and the pace of technological iteration. The current divergence in growth rates underscores a clear message: only automakers that tailor their strategies to local energy structures and consumer preferences will achieve sustainable success in this vital export market.

Top 10 Chinese automakers by passenger vehicle exports to Middle East

Chery Auto: 177,276 units, down 36.9% year-on-year

BYD Auto: 73,187 units, up 157.7% year-on-year

SAIC PV: 62,206 units, down 5.2% year-on-year

Geely Auto: 60,915 units, up 1.0% year-on-year

Jiangsu Yueda Kia: 57,519 units, up 25.3% year-on-year

FAW-Toyota: 54,908 units, up 143.0% year-on-year

Great Wall Motor: 34,610 units, up 117.0% year-on-year

Southeast Auto: 33,504 units, up 251.5% year-on-year

Beijing Hyundai: 29,724 units, up 99.3% year-on-year

Changan Auto: 23,677 units, down 4.4% year-on-year

From January to August, China’s leading exporters to the Middle East showed a clear divergence. Chery Auto topped the list with 177,300 units, though its exports dropped 36.9% YoY due to intensified competition and a high comparison base. SAIC PV and Changan Auto also recorded slight declines of 5.2% and 4.4%, respectively, reflecting mounting pressure on some established players in the region.

In contrast, BYD Auto (+157.7% YoY) and FAW-Toyota (+143.0% YoY) saw explosive growth. Leveraging its strong lineup of NEVs, BYD rapidly expanded its presence in the Middle East EV segment. Southeast Auto posted the most impressive growth at +251.5%, highlighting the precise alignment of its product strategy with regional demand. Great Wall Motor and Beijing Hyundai also achieved strong gains, underscoring the rising acceptance of Chinese and joint-venture brands in the region—particularly those offering electrified and smart features.

Overall, the Middle East has become a strategic stronghold for Chinese automakers. The pace of electrification and product differentiation now drives market expansion, while traditional leaders must accelerate region-specific strategy adjustments to stay competitive.

Top 10 Chinese automakers by passenger vehicle exports to Oceania

BYD Auto: 33,322 units, up 148.5% year-on-year

Great Wall Motor: 30,670 units, up 26.2% year-on-year

SAIC PV: 28,722 units, up 5.6% year-on-year

Chery Auto: 28,179 units, up 303.9% year-on-year

Tesla: 24,391 units, down 20.2% year-on-year

Geely Auto: 7,851 units, up 62.8% year-on-year

Jiangsu Yueda Kia: 4,000 units, up 742.1% year-on-year

SAIC-GM-Wuling: 3,877 units, up 6471.2% year-on-year

JAC: 3,206 units, no data for YoY growth

SAIC-Maxus: 2,223 units, up 183.2% year-on-year

From January to August, leading Chinese automakers in the Oceania market saw explosive growth. BYD Auto (+148.5% YoY) and Chery Auto (+303.9% YoY) led the surge, while Great Wall Motor posted a steady +26.2% increase, reflecting its systematic competitiveness in the region. Notably, Jiangsu Yueda Kia and SAIC-GM-Wuling achieved remarkable jumps of +742.1% and +6471.2%, respectively, leveraging precise market insights and flexible product strategies for breakthrough growth. JAC, with 3,206 units exported, also made the top-10 list, signaling its active presence in Oceania despite no disclosed YoY data.

Overall, China’s automakers demonstrate strong results from their new energy transformation and global market strategies in Oceania. The market shows a diversified pattern of «established leaders driving growth, emerging players accelerating breakthroughs,» fueling continued expansion of Chinese auto exports.