(Bloomberg) — A synchronized flock of drones lit up the sky above Rome’s Olympic Stadium last month to mark the European launch of the latest electric hatchback from Chinese carmaker BYD Co.Against the blackened night, the glowing orbs outlined an image of the new Dolphin Surf in front of classic Roman landmarks like the Colosseum, St. Peter’s Basilica and the Pantheon — a cinematic nod to the Fiat 500 and the postwar lifestyle it came to symbolize.

The message was as clear as it was audacious: BYD had arrived with an EV for the masses, a market segment its European peers have struggled to lock down. The Dolphin Surf aims to be a Fiat 500 or VW Beetle for the electric age — fun, accessible and built to put millions of drivers behind the wheel, only this time with a battery.

Behind the Roman light show is a deeper play. After a slow start, BYD is gaining sales momentum with sleek showrooms, bold pricing, and a dealer push that’s begun to rattle entrenched rivals. China’s biggest carmaker has overtaken Tesla Inc. in European EV sales, expanded its hybrid lineup to adapt to consumer tastes, and is hiring aggressively as it builds a factory in Hungary and poaches executive talent from the region’s top carmakers.

It’s a high-stakes bet in a region thick with red tape and rules that favor entrenched brands like Volkswagen, Fiat and Renault. But BYD sees a rare opening as the EV shift disrupts loyalties and cracks open a €500 billion ($576 billion) market where the average EV still sells for twice what it would in China.

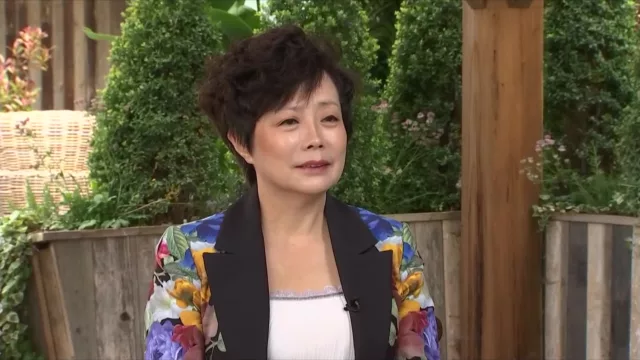

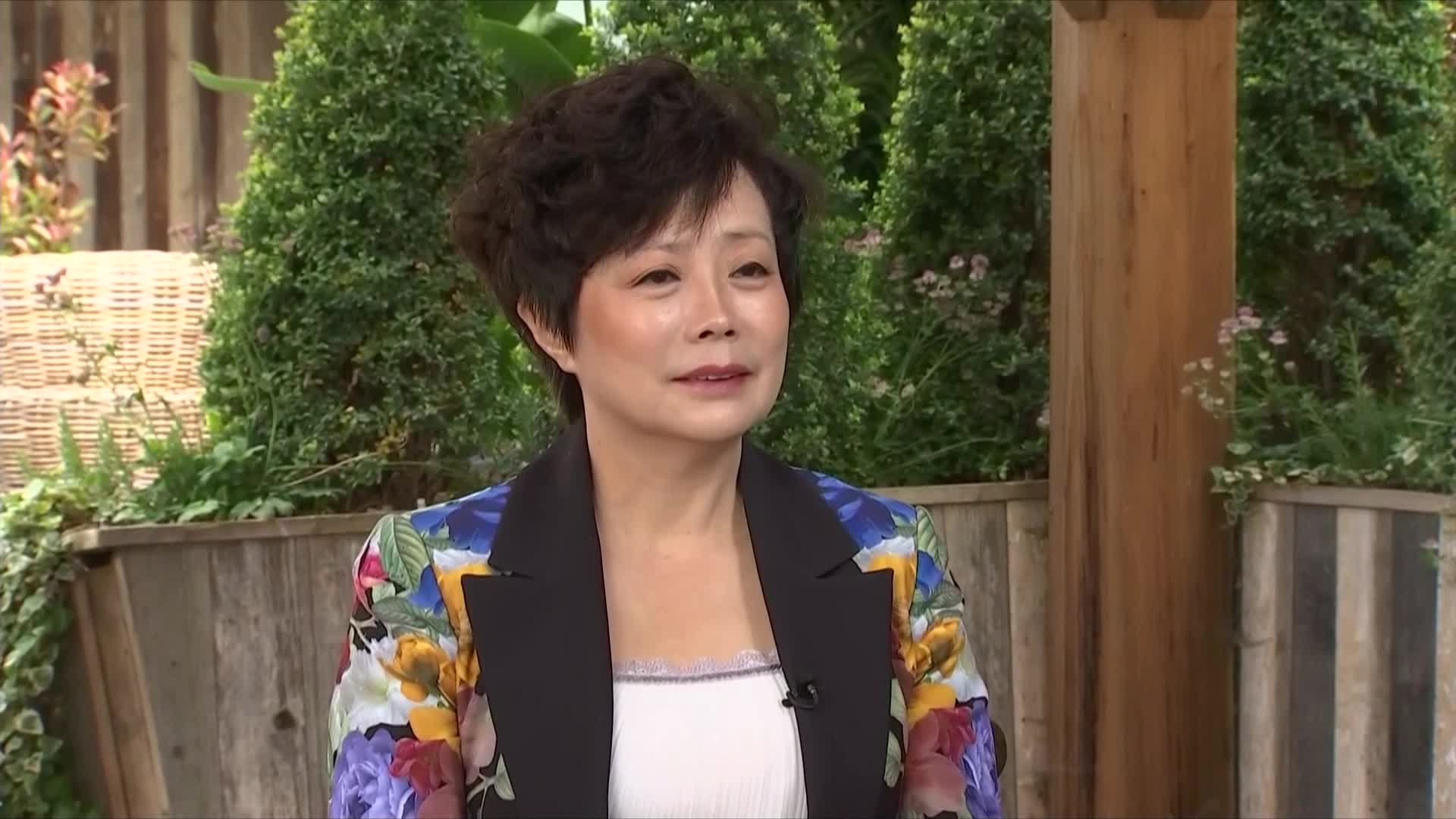

“If you’re winning here, it means you’re super good in every angle,” said Stella Li, BYD’s executive vice president and the face of the carmaker outside China. In an interview, she pledged to spend up to $20 billion in the region. “Europe is our most important market.”

BYD made a renewed push in Europe in 2022 with a gleaming stand at the Paris Motor Show, but struggled for traction with the sleek, premium models it put up against better-known Teslas and BMWs in EV-friendly countries like the Netherlands and Norway.

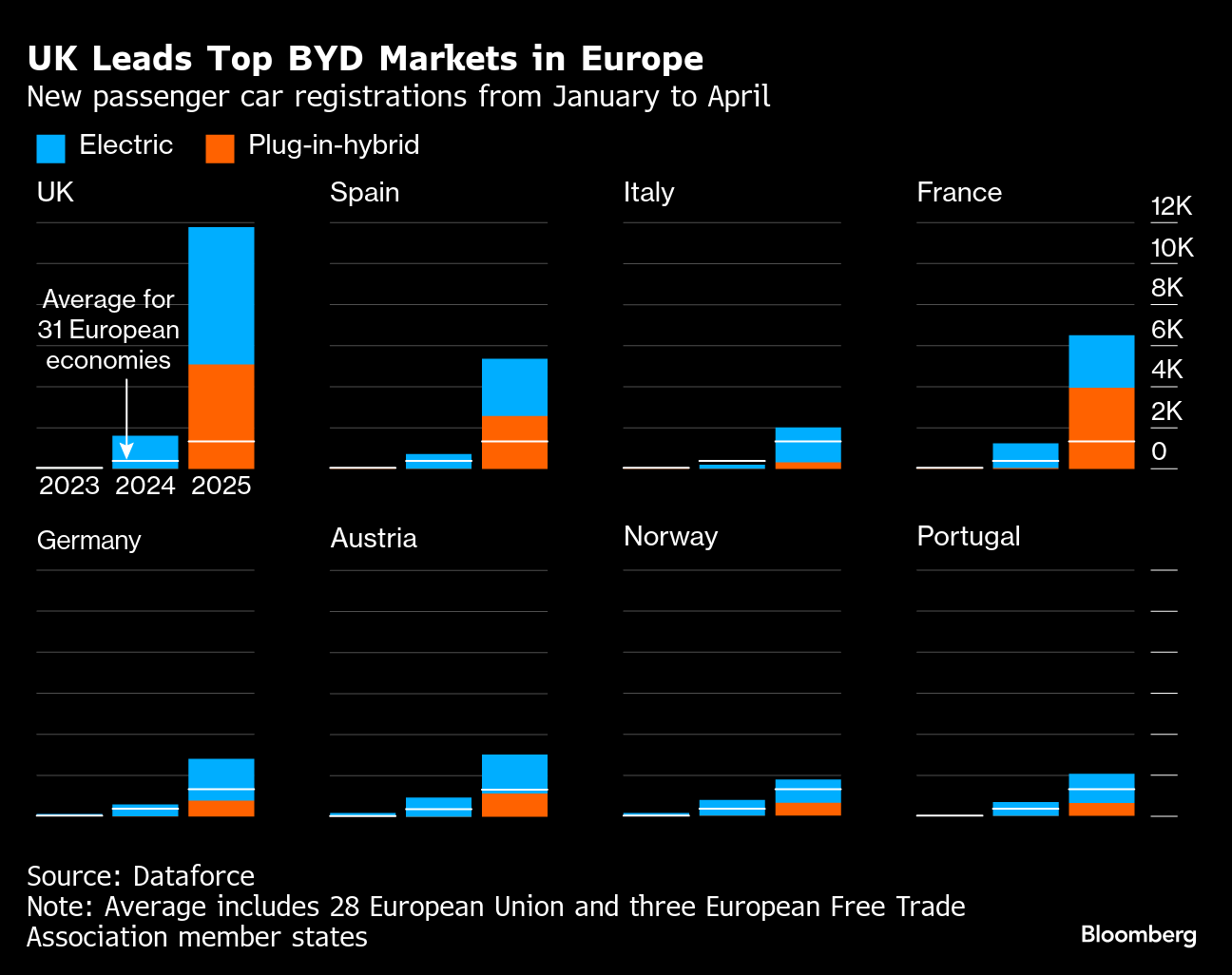

How the company responded explains a lot about how BYD nearly quadrupled European sales in the first four months of 2025, based on figures from researcher Dataforce.

By 2024, BYD had shifted downmarket with smaller, cheaper models to appeal to younger buyers. The company, carrying over a strategy that worked in Latin America, also took control of its own import operations, giving it flexibility to quickly adjust volumes and product mix including a rapid ramp-up of hybrid models. Li brought in seasoned European executives such as Maria Grazia Davino, the former UK head of Fiat parent Stellantis NV, who has rapidly reshaped BYD’s German dealer network.

“They are correctly hiring people from legacy carmakers in Europe, people who know how the business works. Everything has come together,” said Felipe Munoz, senior analyst at automotive researcher Jato Dynamics. “Their lineup is growing every day with very, very competitive products.”

BYD’s ultimate goal is to claim a place in Europe’s automotive hierarchy, planting the flag of a Chinese carmaker alongside Volkswagen AG, Fiat-Jeep-Peugeot owner Stellantis, and Japanese and South Korean manufacturers that have spent decades building their presence. Getting there would advance Beijing’s broader strategy to dominate key manufacturing sectors, including electric vehicles, robotics, and clean energy, and signal China’s arrival at the center of the 21st-century auto business.

“We want to bring the technology here, build a very strong after-sales service here, and then work with local partners to really merge us into part of a society, community here,” Li said.

BYD has chosen a good time to go on the offensive. Elon Musk’s political entanglements dented Tesla’s image in Europe, with recent sales figures showing a marked decline. Stellantis, meanwhile, is just starting to reckon with a drop in sales after the tightfisted reign of former Chief Executive Officer Carlos Tavares. Renault SA just lost talented CEO Luca De Meo, who revived the carmaker but is swapping autos for luxury at Gucci owner Kering SA.

The results are starting to show, with BYD generating growth rates of 200% or more through April in each of the five biggest European markets — Germany, the UK, France, Spain, and Italy, where BYD sold barely 200 cars in the first four months of 2024.

The company has had its biggest success in the UK. After selling just 1,611 cars through April 2024, BYD blitzed the market, signing up dealers and adding plug-in hybrid models to its repertoire. For the same period in 2025, sales had jumped to nearly 12,000 vehicles, according to Dataforce. At that pace, BYD is on track to leapfrog Fiat, Honda Motor Co. and BMW AG’s Mini — brands long entrenched in British driveways.

Bob Dalgliesh, a 50-year-old cybersecurity specialist from Lothian, Scotland, chose the BYD Seal U as his third plug-in hybrid through a company-car plan. The mid-sized SUV, which also comes fully electric, is aimed at families seeking space, tech and range at a lower price point. Though he typically prefers a European brand, it was £6,000 ($8,070) cheaper than an Audi A3 hybrid, he said, had more space and overall range and arrived from China in just two months.

“The clincher is that the Seal U offers all the add-ons — cruise control, 360 camera, head-up display — that other manufacturers would usually nickel and dime you for,” Dalgliesh said by phone. “So it ends up being just a choice of engine size and battery.”

At the center of BYD’s European charge is Li, who is based in China but visits Europe nearly every month. The executive acts as BYD’s chief evangelist — pitching to skeptical dealers, rallying local teams, and signaling that BYD is here for the long haul.

Colleagues describe her as relentless, obsessing over details such as lighting, signage and the spacing of vehicles on display. The preferred footprint for a BYD showroom in Europe is around 120 square meters (1,290 square feet), just enough to show off the company’s seven-model lineup without crowding the floor.

Li was based in Chicago in the 1990s, where she cut her teeth persuading US electronics firms like Motorola to switch to BYD batteries — its original business — from Japanese suppliers when few trusted Chinese tech manufacturing. It was a formative experience, battling for credibility and building trust for an underdog brand.

That frontline instinct hasn’t faded, according to colleagues. Li still jumps in on sales: she was the star attraction at the Rome event in May, pitching the Dolphin Surf. From the podium, she boasted of the car’s appeal to lower-income consumers. “They can make the change to EVs,’’ she said. “At the same time, they are driving a car that’s not only accessible, it’s intelligent, high-tech fun.”

In the UK, the Dolphin Surf costs £18,650 in its Active trim, below the Renault 5 E-Tech Evolution Urban and Citroën ë-C3, which offer greater range than the Surf’s 137 miles (220 kilometers) in combined city and highway driving. It’s also less expensive than the shorter-range Fiat 500e hatchback. Even in its most basic trim, the Surf features an infotainment system that can rotate, as well as a rear parking camera and adaptive cruise control — items either absent or only available with costlier packages on the Citroën and the Renault.

BYD had a bumpy start in Europe. Dealers were hesitant to stock its higher-end models, especially as subsidies began to vanish. As it remade its lineup, BYD bought out its import partners and splashed out an estimated €30-50 million sponsoring the UEFA Euro 2024 soccer tournament — stepping in after Volkswagen had walked away.

Behind the scenes, Li brought in Alfredo Altavilla, the former chairman of ITA Airways and longtime Fiat Chrysler Automobiles executive, as special adviser for the European market. He recruited Davino, a Stellantis veteran who had expanded FCA’s dealer footprint in Germany— an especially difficult market for outsiders. She now leads BYD’s operations in Germany and Central Europe.

Other hires from Stellantis include Alessandro Grosso, formerly head of brand sales in Italy, and Alberto De Aza to run BYD’s Spanish operations.

BYD’s ability to move quickly is backed by one of the world’s largest R&D operations, with a 120,000-strong team as of last year. As it prepares to begin shipping the Seal U from its Hungarian plant later this year, the company is also working to localize its formidable supply chain. Controlling everything from battery cells to shipping and importing, BYD is cutting out middlemen to deliver faster and expand its physical footprint across Europe.

The approach comes with real risk. BYD’s rapid expansion has left it exposed on multiple fronts: razor-thin margins that leave little room for error, a reliance on plug-in hybrids just as regulators in key markets begin to question their environmental credentials, and persistent consumer skepticism around quality, safety, and resale value. Brand recognition in Europe remains low, and loyalty is fragile — easily lost if early expectations aren’t met.

BYD is spending like a company that already has a major foothold in Europe — on marketing, sponsorships, logistics, and physical infrastructure. But if sales don’t scale quickly, the financial blowback could be significant. The company has come under fire in China for its aggressive pricing, drawing rare public criticism from central government officials, industry associations and state media. It recently joined a collective pledge with a dozen automakers to speed up payments to suppliers, a sign that its high cash-burn approach may be starting to strain even in its home market.

Meanwhile, incumbents like Volkswagen and Stellantis brands such as Fiat, Citroën, and Peugeot enjoy major advantages: loyal customer bases, deep roots in company car schemes, government fleets, and rental networks that BYD is only beginning to access. Without similar entrenchment, its aggressive push risks outpacing the brand recognition and trust it still needs to build.

“Establishing a car company is hard, exporting is relatively easy, but building a global organization is the hardest task of all,” said Andy Palmer, former chief operating officer at Nissan Motor Co. and ex-CEO at Aston Martin. “BYD still has a significant mountain to climb.”

Still, BYD’s factory in Hungary’s southern city of Szeged underscores the scale of its ambition. It will produce EVs and hybrids for the EU market and tap into China’s Belt and Road logistics project, via the modernized rail link from the Greek port of Piraeus — owned by Cosco Shipping Holdings Co. — to Central Europe.

The factory will help reassure dealers the company is in Europe for the long haul and that customers will be able to get their vehicles serviced reliably.

“If we decide to do something, we put all our resources behind it,” Li told Bloomberg this month.

©2025 Bloomberg L.P.