-

Chinese automaker BYD recently marked a milestone in its global expansion by shipping over 5,800 electric and hybrid vehicles to Argentina, taking advantage of the Milei administration’s tariff-free quota for electric vehicles and reduced trade barriers.

-

This move not only extends BYD’s international reach but also underscores how shifting policy frameworks in emerging markets can rapidly reshape global EV competition.

-

Next, we’ll examine how BYD’s push into Argentina under favorable EV trade policies shapes the company’s broader investment narrative.

Trump has pledged to «unleash» American oil and gas and these 22 US stocks have developments that are poised to benefit.

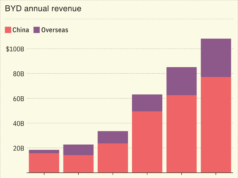

To own BYD today, you have to believe in its ability to convert scale and cost leadership into durable profitability while managing thinner margins than many global rivals. The Argentina shipment is a good example of what that thesis looks like in practice: policy tailwinds and tariff-free quotas giving BYD room to push volume and price aggressively in a new market. In the near term, the key catalysts still revolve around export growth, product mix moving slightly upmarket, and any signs that higher software and services revenue can lift returns above what its current 4.6% net margin suggests. At the same time, the Argentina news slightly sharpens two existing risks rather than changing them: rising political scrutiny of Chinese EV imports and the pressure that continued undercutting could put on already modest profitability.

But there is a less obvious risk around that volume focused model that investors should not ignore. BYD’s shares have been on the rise but are still potentially undervalued by 27%. Find out what it’s worth.

Twenty four Simply Wall St Community fair value estimates span roughly HK$121.89 to a very large HK$449.47, reflecting sharply different expectations. Set those against BYD’s policy driven export push and margin constraints, and you can see why it pays to compare several views before deciding how this growth story might affect long term performance.

Explore 24 other fair value estimates on BYD – why the stock might be worth over 4x more than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your BYD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

-

Our free BYD research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate BYD’s overall financial health at a glance.

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include 1211.HK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com