Etiqueta: Product

BYD vehicle sales slump 30% in January as China demand cools

BYD Co. said sales dropped 30% in January, underscoring the challenges facing the electric vehicle maker’s efforts to boost sales just as a winding back of subsidies hurts demand in China.

Autonomous mining truck tech provider Boonray secures strategic investment from BYD

Boonray has secured a RMB 100 million ($14.4 million) investment from BYD to advance the adoption of new energy technologies in heavy-duty industries.

BYD and ExxonMobil Sign Strategic Cooperation Memorandum of Understanding

body { font-size: 16px; line-height: 34px; ...

BYD’s European EV Surge Puts Pressure On Tesla And Volkswagen

BYD (SEHK:1211) has rapidly increased electric vehicle sales in Europe, contributing to fully electric cars outselling petrol models for the first time. This shift highlights a change in European car buyer preferences toward battery electric vehicles. The development reflects the growing presence of Chinese automakers in European passenger car markets. BYD, known for its electric vehicles and batteries, is now a prominent name in Europe as buyers move toward fully electric cars instead of...

Gasgoo Daily: BYD and ExxonMobil extend hybrid tech partnership in China

body { font-size: 16px; line-height: 34px; ...

BYD, ExxonMobil sign MoU to deep cooperation in PHEV-dedicated tech area

body { font-size: 16px; line-height: 34px; ...

BYD and ExxonMobil deepen their PHEV alliance

Big oil sees an opportunity to extend its relevance by tightening its connections to the world’s biggest new energy vehicle player. By Stewart Burnett

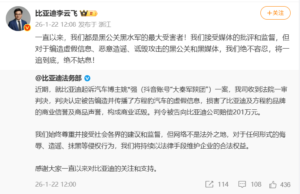

Li Yunfei: BYD is the Biggest Victim of Malicious PR and...

img:-moz-broken {-moz-force-broken-image-icon:1;min-width:24px;min-height:24px}

...

BYD Updates the Seal 06 Lineup and Previews the Seal 08...

BYD is accelerating its product cycle with optimized batteries for the Seal 06 range. Simultaneously, the brand has confirmed the Seal 08 and Sealion 08 will serve as the new high-end flagships for the Ocean series.

BYD wins defamation lawsuit over Denza B5 fuel consumption, ordering 290K...

BYD wins a defamation lawsuit over the Denza B5 SUV fuel consumption against a TikTok blogger, ordering compensation of over 2 million yuan.