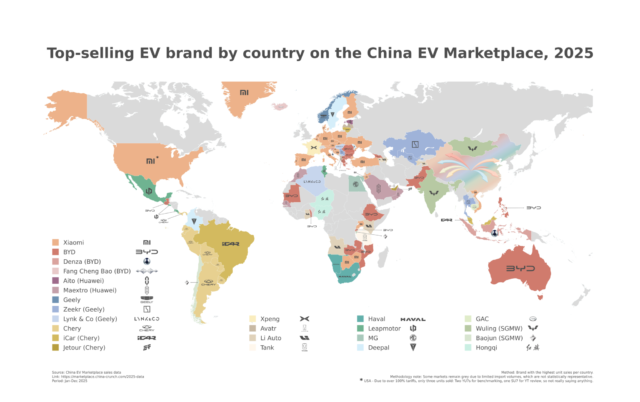

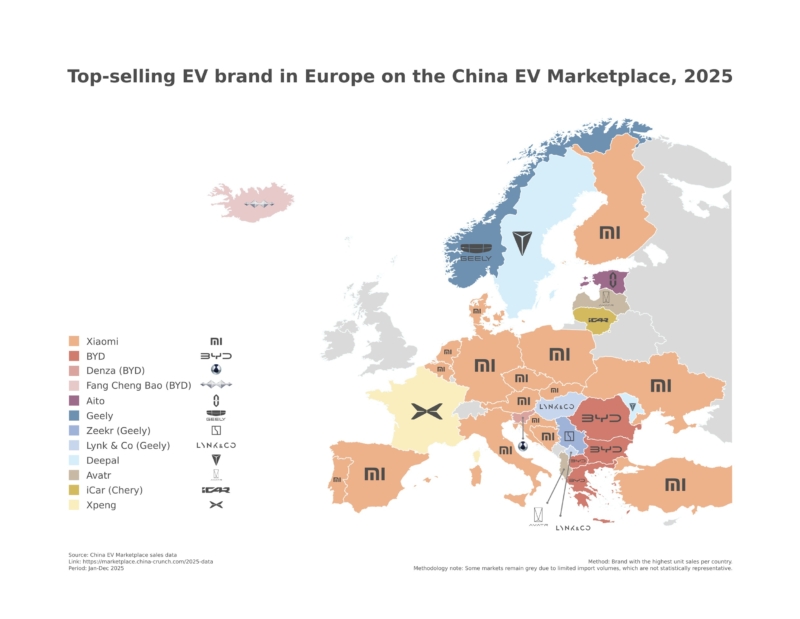

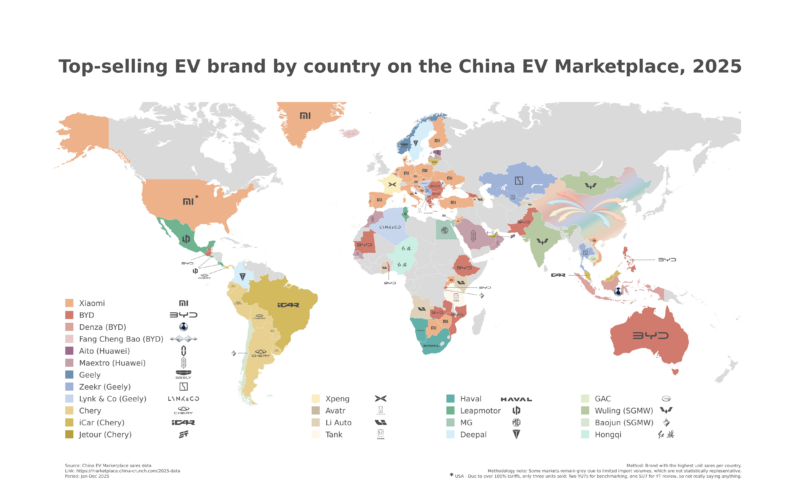

China EV Marketplace (CEVM) released its annual country-level overview of top-selling brands in overseas markets on Wednesday. Despite tariffs, Xiaomi was the clear best seller in Europe, while Huawei’s premium brands excelled in the Middle East, and Chery topped sales in South America.

In 2025, the company’s sales rose 224% to 11,000 delivered EVs, up from 3,400 in 2024. The increase was mainly due to a new product called EU door-to-door delivery, which launched in August last year.

EU door-to-door delivery means the customer orders the car in China. CEVM takes care of the transport, customs clearance, and the documents needed for registration in a member state, mainly EU IVA homologation under Article 45, the company said in a press release.

The platform plans to further focus on Europe this year: “In 2026, we will further strengthen our European presence by opening an aftersales service network in the first quarter and launching a pilot stock-vehicle program,” Gersl.

China EV Marketplace ditched selling ICE models in 2022 and focuses only on EVs (BEVs + PHEVs), especially passenger vehicles, commercial vehicles, golf carts, and even buses. CEVM is the largest platform for overseas deliveries of new and used electric vehicles (EVs) from China, according to the company.

Xiaomi was the best-selling brand on the platform across the main EU markets, including Germany, the Netherlands, Spain, Italy, and 12 others. Surpsisigly the 10% of the Xiaomi mix was the performance variant Ultra, which accounts for only for 2.5% brand share in China, according to China EV DataTracker. In 2025, Xiaomi sold over 400,000 cars.

Huawei’s premium brand Maextro was the best seller in Saudi Arabia and Oman. Maextro sells only one model, the Maybach competitor Maextro S800, which costs around 1 million yuan in China (143,000 USD).

Not surprisingly, Chery and Chery-affiliated brands were the best sellers in South American nations, with iCar being the best seller in Brazil.

However, the company admits that EU countervailing tariffs slowed potential growth as up to 35% duties were imposed on China-made all-electric vehicles. However, not on plug-in hybrid vehicles (PHEVs).

Interestingly, range-extender vehicles (EREVs) are treated as all-electric vehicles and are subject to up to 35% counterveiling duty. This is because EREVs are BEVs with an internal combustion engine (ICE) that operates only as a generator for the ICE and is not directly connected to the wheels.

Another name for EREVs is serial hybrid. When the car drivetrain is called a PHEV, it usually means a parallel hybrid if not stated otherwise.

China EV Marketplace claimed that EREV sales in Europe fell significantly, but expect a rebound in 2026 as the EU is under pressure to remove counterveiling tariffs on China-made BEVs and replace them with a minimum price.

“Our goal is to double overseas sales in 2026, as we expect potential changes in EU tariff policy and planned entry into a new market – Canada,” concludes Jakub Gersl, COO of China EV Marketplace.

Follow us for ev updates