Ahead of the intensive releases of April deliveries by electric vehicle (EV) makers in China due tomorrow, Deutsche Bank shared their preview as they have done before.

In a research note today, analyst Wang Bin expects Nio Inc (NYSE: NIO) to report retail sales of 25,000 units in April, up 60 percent year-on-year and up 66 percent sequentially.

Deliveries for Nio Inc’s three brands — Nio, Onvo, and Firefly — are expected to be 20,000 units, 4,400 units, and 600 units, respectively, according to Wang.

Nio Inc’s domestic retail sales in the first four weeks of April totaled 21,400 units, Wang noted.

Nio Inc’s new order flow for the full month of April is estimated to grow 80 percent sequentially to about 36,000 units, the analyst said, citing dealer feedback.

Nio, Onvo, and Firefly had new orders of 22,000, 7,000, and 7,000 units respectively in April, according to the note.

Firefly launched its first model on April 19 and deliveries started yesterday.

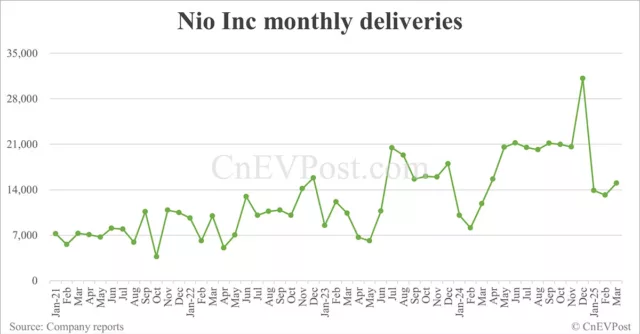

Nio Inc delivered 15,039 vehicles in March, up 26.74 percent from 11,866 in the same month last year, and up 14 percent from 13,192 in February, according to data it released on April 1.

The deliveries included 10,219 vehicles under the Nio main brand and 4,820 vehicles under Onvo.

Wang expects Tesla (NASDAQ: TSLA) to see retail sales of around 30,000 vehicles in China in April, the second-lowest monthly deliveries in the past 24 months. That represents a 7 percent decline year-on-year and a 58 percent decline sequentially.

Tesla’s domestic retail sales in China over the past four weeks totaled 26,000 units, according to the note.

New order flow for Tesla’s China operations is expected to be about 40,000 units for the full month of April, down about 23 percent year-on-year and down 35 percent sequentially.

Of those, about 30,000 were Model Y crossovers and about 10,000 were Model 3 sedans, according to Wang.

Tesla sold 74,127 vehicles in China’s domestic market in March, up 18.80 percent from 62,398 in the same month last year and up 176.83 percent from 26,777 in February, according to data compiled by CnEVPost.

Earlier this week, rumors surfaced that Tesla may begin production of a three-row version of the Model Y with an extended-wheelbase after the May 1-5 Labor Day holiday.

Deutsche Bank expects BYD (HKG: 1211, OTCMKTS: BYDDY) to report wholesale volume of about 360,000 to 370,000 units in April, down from 377,420 units in March.

Wang expects BYD to deliver around 268,000 units domestically in April, up 8 percent year-on-year but down 5 percent sequentially.

BYD’s domestic retail sales in the first four weeks of April totaled 238,000 units, according to the note.

BYD’s new order flow for April is expected to be about 320,000 units, flat year-on-year and down 14 percent sequentially, the analyst said, citing dealer feedback.

The main reason is that new orders for older models are expected to be down 40 percent sequentially, while new orders for newer models are up 25 percent sequentially, according to the note.

Deutsche Bank expects Xpeng (NYSE: XPEV) to deliver about 34,000 units in April, up about 260 percent year-on-year and up about 2 percent sequentially.

That includes domestic retail deliveries of about 31,000 units and overseas deliveries of about 3,000 units.

Xpeng’s domestic retail sales in the first four weeks of April totaled 28,000 units, according to the note.

Wang expects the Mona M03 sedan deliveries to be about 14,000 units, G6 SUV (sport utility vehicle) deliveries to be about 8,000 units, P7+ sedan deliveries to be about 7,000 units, G9 SUV deliveries to be about 3,000 units, and X9 MPV (multi-purpose vehicle) deliveries to be about 2,000 units.

Xpeng’s new order flow in April is expected to be around 31,000 units, which is in line with its domestic retail delivery estimates, the note said, citing dealer feedback.

The company delivered 33,205 vehicles in March, the fifth consecutive month of over 30,000 units, according to figures it announced on April 1.

Deutsche Bank expects Li Auto (NASDAQ: LI) to deliver about 34,500 units in April, up 34 percent year-on-year while down 6 percent sequentially.

Li Auto’s domestic retail sales in the first four weeks of April totaled 31,000 units, according to the note.

The company’s new order flow for April is expected to be around 40,000 units, including around 34,000 units of the L-series extended-range electric vehicle (EREV) models and around 6,000 units of the Li Mega electric MPV, according to Deutsche Bank.

New orders for the L-series were flat sequentially as Li Auto continued its promotional strategy in April. And the company launched the facelifted Li Mega last week, driving a jump in new orders for the MPV, according to Wang.

Deutsche Bank expects Xiaomi (HKG: 1810, OTCMKTS: XIACY) to see EV deliveries of 28,500 units in April, down about 2 percent from March, mainly due to the calendar day difference.

In other words, Xiaomi EV’s daily deliveries in April were flat from March at about 950 units, according to the note.

The business’s domestic retail sales in the first four weeks of April totaled 25,500 units, according to Deutsche Bank.

Xiaomi EV’s new order flow in April is expected to be around 36,000 units, down 55 percent from March, Wang said, citing dealer feedback.

The drop in new orders was mainly due to some negative impacts from a recent highway accident, as well as some buyers’ concerns that the seven-month-long waiting period will cause them to face additional costs in 2026, including vehicle purchase tax.

Deutsche Bank estimates that the order backlog for Xiaomi EV stood at around 210,000 units at the end of April.

Deutsche Bank expects Zeekr Group (NYSE: ZK) to report domestic deliveries of 33,000 units in April, up about 3 percent year-on-year but down about 9 percent sequentially. That includes about 13,000 units delivered under the Zeekr brand, and about 20,000 by Lynk & Co.

Taking exports into account, Wang expects Zeekr Group to have total sales of 38,300 units in April, up 10 percent year-on-year but down 6 percent sequentially.

The Nio and Onvo brands had combined insurance registrations of 7,970 units in China last week, up 29.17 percent from 6,170 units in the previous week.