Tesla may have a little trick up its sleeve when it comes to China’s challenging market.

This year might as well be a game of whack-a-mole for investors in Tesla (TSLA 6.18%): When one problem disappears, another one — or two — pop right up in its stead.

Tesla is dealing with mounting lawsuits, an executive talent exodus, an aging vehicle lineup, declining sales, loss of revenue from zero-emission credit sales, and increased competition, among other developments. Another problem is China, where it is embroiled in a brutal price war against relentlessly price-competitive domestic brands.

But Tesla might have one trick up its sleeve to help boost its sales in the region: the Model Y L.

In need of a sales boost

Before we get to the Model Y L, let’s look at exactly how dire things appear in China. During the second quarter, Tesla sold 128,803 electric vehicles (EVs) in China, which was a 4.3% decline from the first quarter and down 11.7% from the prior year.

To complicate matters further, after making a marketing push with discounts and incentives, Tesla sales had a minor resurgence in June before falling lower again in July.

Worse still is the fact that the sales declines came after a refreshed Model Y lineup was available. Weaker-than-anticipated production during the first quarter led to disappointing sales, but once production was up to speed, deliveries still failed to rebound.

Weakness in China helped drive Tesla’s global deliveries down 13.5% during the second quarter, the worst quarterly decline in more than a decade. The environment isn’t getting better, with China’s domestic brands continuing to unleash price cuts. One recent example was Nio, with an across-the-board price cut on its vehicles equipped with long-range batteries by lowering the price of its optional 100-kWh battery.

What’s the Model Y L?

Tesla is facing a slowdown in one of its most crucial markets, with the previously mentioned price war and slowing economy. One way the electric vehicle (EV) maker thinks it can make up some sales ground is with the newly launched Model Y L. The new version of the Model Y is a stretched six-seat version of the popular SUV made for Chinese buyers.

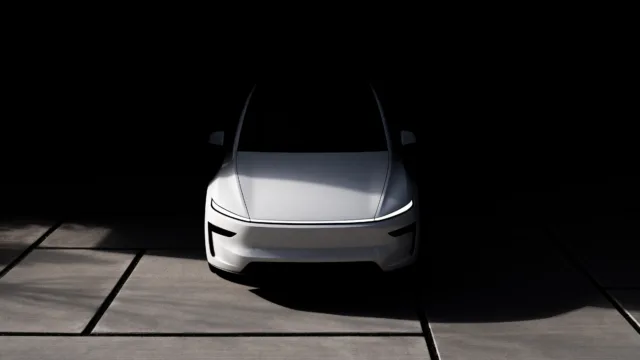

The new Tesla Model Y, which will soon be available as an SUV in China. Image source: Tesla.

The reason is pretty basic: Chinese customers prefer larger family cars with more seating capacity, and that’s where the Model Y L comes in – the «L» standing for long wheelbase, meaning a six-seat layout and more legroom.

The question is whether or not the Model Y L is priced competitively enough to move the needle on Tesla deliveries. Its price tag is higher than the five-seat variant, at roughly 339,000 RMB, or $47,180, but still more competitive than the 400,000 RMB ($55,700) many analysts expected.

The Model Y L is aimed at families who want extra space without being forced into a higher-priced luxury option, but it will have growing competition. That’s because six-seat SUVs in China have become a hot segment. Li Auto recently launched its six-seat SUV, named the Li i8, which is due to arrive before Tesla’s Model Y L deliveries begin in September.

What it all means

While this is somewhat of a no-brainer move from Tesla to expand its segment coverage, especially considering the six-seater’s growth in popularity, it’s unlikely to seriously move the needle for deliveries in China. Long-term investors should stay the course but would be wise to prepare for a few bumpy quarters. The U.S. market will work through a pull-forward in demand as the $7,500 federal tax credit on EVs expires at the end of September, and the Chinese market continues to be combative with no end in sight.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.