- Earlier this month, Boyd Group Services Inc. completed a private placement of CAD 275 million in senior unsecured notes due 2033 at a 5.75% interest rate and expanded its revolving credit facilities to USD 575 million, with the potential to increase to USD 875 million.

- This significant boost in available capital enables the company to fund future initiatives, providing increased flexibility for growth and operational execution.

- We’ll explore how Boyd Group’s expanded debt facilities and enhanced liquidity may impact its investment narrative and long-term growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Advertisement

Boyd Group Services Investment Narrative Recap

To be a shareholder in Boyd Group Services, you need to believe in the company’s ability to capture market share and expand service volumes through acquisition and new shop openings, all while managing cost pressures and operating complexity. The recent increase in available capital, through the CAD 275 million unsecured notes and expanded credit facilities, could enhance Boyd’s ability to pursue growth, but does not materially alter the most important short-term catalyst, volume recovery in accident/repair claims, or address the biggest risk of margin pressure from higher costs and ongoing wage inflation.

Among the recent announcements, Boyd’s Q2 2025 earnings release stands out as most relevant. Sales remained largely flat year-over-year, while net income decreased, demonstrating ongoing margin challenges and the impact of elevated costs, factors that could be influenced by how Boyd leverages its new capital resources in the face of heightened financial commitments.

By contrast, what remains crucial for investors to watch is how Boyd handles higher debt levels amid uncertain repair claim volumes and persistent cost escalation…

Read the full narrative on Boyd Group Services (it’s free!)

Boyd Group Services is projected to achieve $4.1 billion in revenue and $273.2 million in earnings by 2028. This outlook rests on a 10.4% annual revenue growth rate and an increase in earnings of $265.1 million from the current $8.1 million.

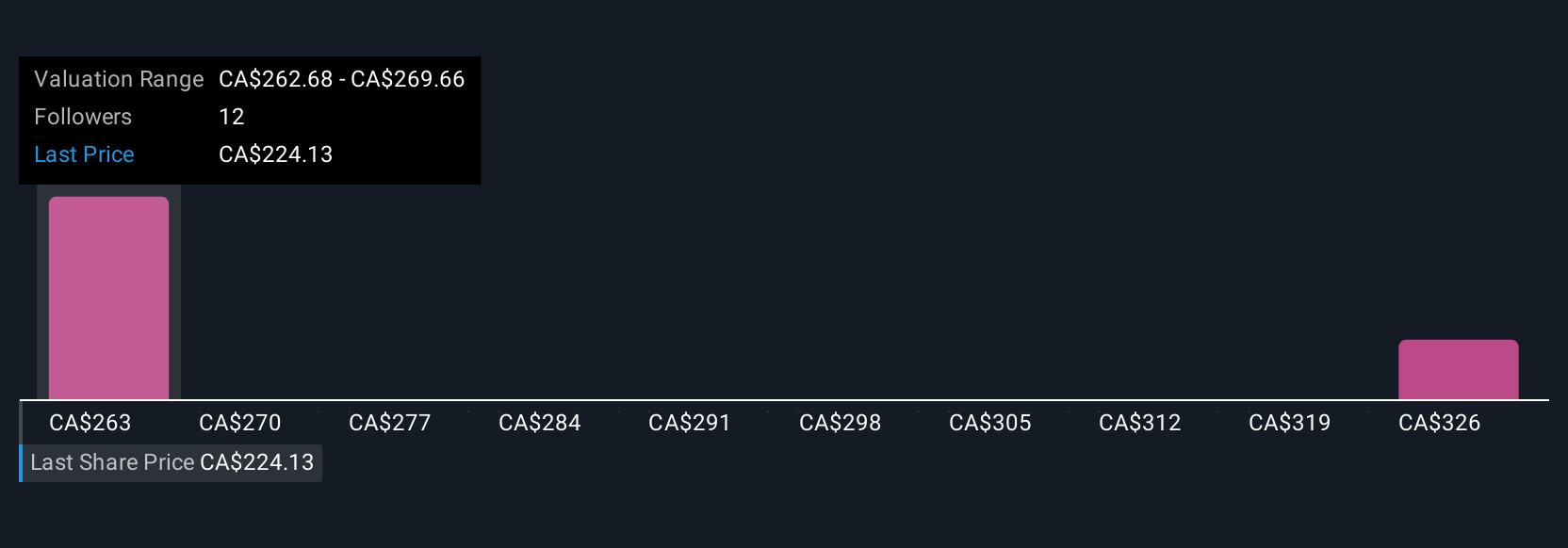

Uncover how Boyd Group Services’ forecasts yield a CA$262.68 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from CA$262.68 to CA$332.48, with two unique perspectives included. While participants see value opportunities, the company’s ability to maintain or improve margins as financing costs rise remains a key factor for future performance.

Explore 2 other fair value estimates on Boyd Group Services – why the stock might be worth just CA$262.68!

Build Your Own Boyd Group Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Boyd Group Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com