At a one-hour press conference revealing the appointment of Kenta Kon as Toyota’s chief executive last week, not one word was said about an existential threat to Japan’s auto industry: electric vehicles.

The replacement of car-loving engineer Koji Sato with the chief financial officer has focused attention on how the world’s largest car manufacturer plans to deal with the rise of EVs in an increasingly turbulent global environment.

Kon, a former secretary of Toyota chair Akio Toyoda who is viewed as a temporary steward, vowed to eliminate “any wasteful penny” to withstand tariffs and rising competition. He said he would create the foundation for “courageous and bold decisions” as digitisation and electrification reshape the industry.

Auto industry executives and analysts said the leadership change signalled Toyota was entering a new era of cost control to build a war chest for the battle against Chinese EV rivals taking market share in Japan, south-east Asia and Europe.

“Toyota has this new obsession with break-even volume. They are reviewing every investment, initiative and project,” said Julie Boote, analyst at Pelham Smithers. “There’s this strange sense of emergency.”

The Japanese company’s wariness of EVs has been vindicated after its push to sell more hybrids helped it extend its reign as the world’s largest carmaker and mitigate $9.5bn of US tariffs.

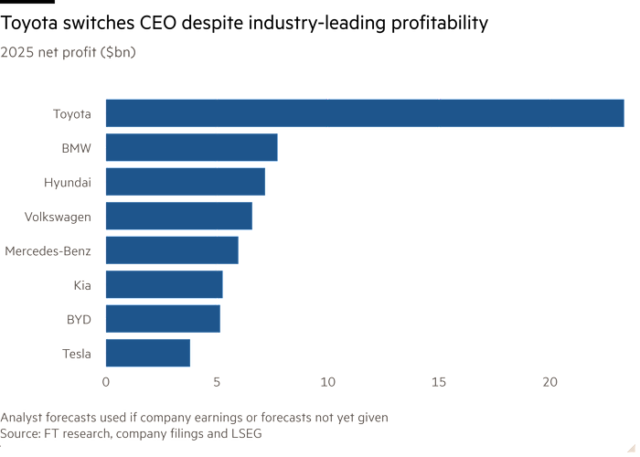

While rival automakers including Stellantis, Honda and General Motors have been forced to reset their EV strategy with heavy writedowns, Toyota sold a record 11.3mn cars in 2025 and is forecast to rake in net profits totalling ¥13.3tn ($85bn) over Sato’s three years in charge.

But in parts of south-east Asia and Europe where EV sales are picking up pace, Toyota is losing market share to BYD and other Chinese brands that are expanding with affordable offerings of both EVs and plug-in hybrids.

In late 2021, Toyota’s then-president Toyoda unveiled targets for 3.5mn EV sales and 30 new electric models by 2030. After taking over in 2023, Sato was tasked with executing that ambition and pledged to sell 1.5mn EVs annually by 2026. Last year, it sold only 200,000 EVs.

Analysts widely expect Toyota to fall short of its targets. A reversal in climate policy in the US and a loosening of the EU’s 2035 petrol ban have also given the carmaker more leeway to focus on cutting costs and sales of hybrids, which are higher margin than EVs.

Toyota has long argued decarbonisation should be a “multi-pathway” mix of hybrids, EVs and hydrogen-powered vehicles instead of a single bet on battery-powered cars, due to power infrastructure and affordability constraints. The company has been directed by regulatory and consumer demand to adapt its line-up.

While Toyota is not expected to change its approach, the question is how aggressively it plans to compete under Kon, who will take over in April. Just days before the announcement of Kon’s promotion, Japanese media reported Toyota plans to lift hybrid output 30 per cent to 6.7mn units by 2028.

“Toyota still cannot understand the future of battery EVs — how many cars will be required and how much of the income will be generated in future by this number, so that’s why the policy is how to control these expenses,” said one person close to the company.

Kon faces other challenges. On Thursday, Toyota Motor was forced to extend its tender offer deadline for the controversial $34bn privatisation of its largest subsidiary Toyota Industries, in a victory for US activist fund Elliott Management’s push to block the deal it claims is undervalued. Kon, who has been a central figure in the deal, will have to work out how to see off Elliott before dealing with post-merger integration.

Erik Wilhelmsson, senior strategic buyer at Swedish truckmaker Volvo, said the next phase for the auto industry was about “capital discipline, productivity and funding multiple technology bets” such as EVs, software and autonomous driving.

“In an environment shaped by tariffs, supply chain volatility and aggressive Chinese EV competitors, cost control is no longer a support function — it’s a strategic enabler,” he said in a LinkedIn post.

Still, 2026 is shaping up to be a key year for Toyota’s EV strategy with 11 model launches planned between last December and September, according to a report from November by Bernstein, ahead of its attempts to commercialise vehicles using longer-range solid-state batteries from 2027 onwards.

“While everyone else is cancelling or postponing EV projects or booking losses, we expect Toyota to further accelerate their EV business this year,” said Bernstein analyst Masahiro Akita.

In the world’s largest auto market, Toyota’s strategy has switched to a “China for China” business model, in which local suppliers are used to bring costs down and research and development functions are based in the country.

“China is the big challenge for Toyota,” said an executive at one of the company’s major suppliers.

It has had some success with its $16,000 bZ3X electric SUV, which is built on local partner GAC’s platform, and sold 70,000 units in China last year.

But Toyota held just 0.8 per cent of EV sales in China in 2025, according to Shanghai-based consultancy Automobility. Sales of its petrol vehicles also dropped 3 per cent year-on-year.

Last year, its market share in Europe and the UK slipped to 7 per cent from 8 per cent due to an influx of new EVs from both Chinese rivals and other companies, including Volkswagen and Hyundai.

“The EV models being offered at the moment seem kind of halfhearted . . . and they are kind of like compliance vehicles,” said auto industry analyst Matthias Schmidt. “If they don’t bring more serious EVs to Europe, we will continue seeing market share dilution going forward.”

Kon will have to balance financial discipline with supporting Toyota’s various technological bets, including on software development, autonomous driving and hybrids.

“Money, profit and numbers are what I’m focused on,” he said. “It’s about being prepared for creating the future, so that the money can be invested.”