Electric vehicles (EVs) are not a new concept; their existence goes as far back as the 19th century. But modern interest in EVs grew in the 1990s and 2000s, pushed by the need to reduce fossil fuel usage. Traditional petroleum-based fuels were becoming more expensive, and the tremendous environmental damage caused by emissions needed to be mitigated.

In this piece, we look at the rise of EVs and how that led to the self-driving industry’s explosion, which has now set the stage for the era of robotaxis.

Rise of Electric Vehicles

In 1996, the US state of California mandated that automakers sell a small percentage of zero-emission vehicles. Of course, only EVs could meet the standard, and this led to the groundbreaking GM EV1 by General Motors (GM). The project led to the development of many technologies that are now staples in cars. A few of the innovations include the electrohydraulic power steering (which led to electric power steering), heat pump HVAC, low-rolling-resistance tires, inductive charging, and even keyless ignition.

The GM EV1 wasn’t a moneymaker for the company, and the project was eventually shuttered with GM getting backlash for not even letting leaseholders purchase their cars.

It was the Tesla Roadster, released in 2008, that was the catalyst that disrupted the automobile industry. Tesla was among the first to put lithium-ion batteries in cars, and this was the monumental game-changer. These batteries allowed greater energy storage, delivering high power while remaining relatively lightweight. Crucially, they could be charged much faster than older battery types.

In August 2009, GM Vice-Chairman Bob Lutz said:

“All the geniuses here at General Motors kept saying lithium-ion technology is 10 years away, and Toyota agreed with us – and boom, along comes Tesla. So I said, ‘How come some tiny little California startup, run by guys who know nothing about the car business, can do this, and we can’t?’ That was the crowbar that helped break up the log jam.”

Suddenly, it was apparent that there was a potentially huge consumer demand for EVs, and lithium-ion batteries were going to unlock it.

Over the next decade, the launch of the Nissan Leaf in 2011 and the Chevrolet Bolt in 2017 helped establish EVs as “normal” cars attainable for everyone. Tesla continued to rule the industry in luxury and performance with the release of the Model S in 2012, the Model X in 2016, and the Model 3 in 2017. Other notable EVs produced during this time include the Mitsubishi i-MiEV, Renault Kangoo Z.E., Renault Zoe, and the BMW i3.

Chinese Automakers Dominate the Field

Unmentioned until recently are Chinese automakers. Shenzhen-based BYD, China’s biggest carmaker, outsold Tesla last year. With top-selling models like the Qin and Song, BYD is aiming to take the market through an accessible price point.

Furthermore, the company is outproducing Tesla in battery-powered vehicles and plans to expand further. They are currently building a massive 32,000-acre factory that will push production to one million electric cars per year.

The market domination of BYD is still breaking new ground. As of October, it has beaten Tesla in EV sales in the United Kingdom, with seven times as many new BYD cars being registered as Teslas. The UK has long been one of Europe’s largest markets for plug-in cars, and last year Tesla outsold BYD by almost 6-1. The new shift marks the UK as BYD’s largest market outside of China.

It’s not just a lower price point that BYD offers; they are currently on the cusp of leading the industry in terms of technology: ultra-fast charging systems, advanced batteries, and their very own autonomous driving assistant system.

BYD CEO Wang Chuanfu said in the company’s annual report in March: “BYD has become an industry leader in every sector from batteries, electronics to new energy vehicles, breaking the dominance of foreign brands and reshaping the new landscape of the global market.”

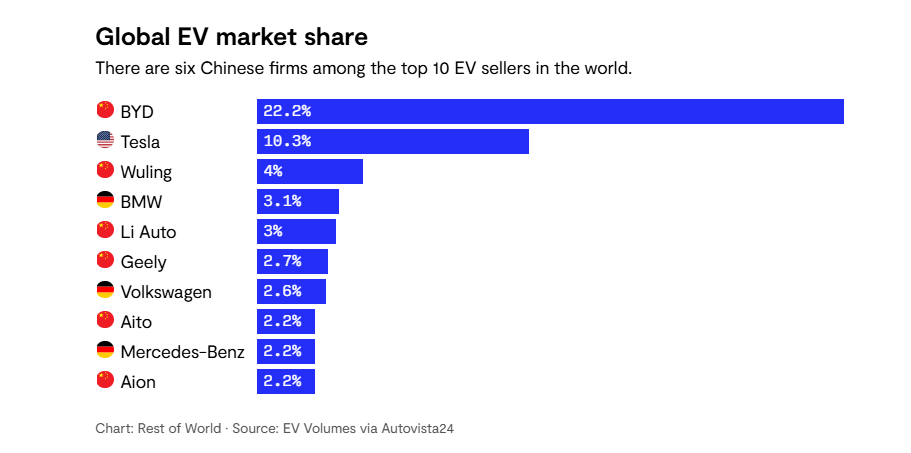

BYD isn’t the only player out of China; six of the world’s top 10 electric-vehicle sellers last year were Chinese and, according to the International Energy Agency, Chinese automakers now control 70% of global EV production.

What Defines Autonomous Vehicles (or Self-Driving Cars)?

The progress of autonomous vehicles can be understood using the scale defined by the Society of Automotive Engineers (SAE). This framework divides advanced driver-assistance systems (ADAS) into 5 levels, with 0 indicating no automation and five indicating fully autonomous. Levels 1, 2, 3, and 4 are roughly defined as hands-on/shared control, hands-off, eyes off, and mind off, respectively.

The roots of autonomous vehicles can be traced to the last century. The invention of cruise control in 1948 was possibly the first form of ADAS. Later in the 1990s, the United States’ Defense Advanced Research Projects Agency (DARPA) invested heavily in automated highway systems, which, of course, included research and development of automated driving.

In 2009, Google started working on the Google Self-Driving Car Project under its Google X lab. The initial years of research and development involved extensive testing and collaboration with Google’s Street View team (from Google Maps), which played a pivotal role in the project. By 2015, Google had completed the first entirely autonomous trip on a public road. Estimates say Google spent $1.1 billion on the project from its initiation until 2015.

In 2016, the project spun out of Google into its own company under Alphabet, Waymo.

Tesla, which had already made waves in the electric vehicle market, announced their own ADAS in 2014, branded Tesla Autopilot. Over the past decade, Tesla’s billionaire CEO, Elon Musk, has repeatedly claimed that the company will achieve fully autonomous driving (Level 5) within 1 to 3 years. However, that is yet to come true. In fact, as of 2025, Tesla’s Autopilot only qualifies for Level 2 automation. It provides autosteer and traffic cruise control, with an optional subscription called Full Self-Driving (FSD) unlocking additional features such as semi-autonomous navigation, self-parking, lane change assistance, and reactions to traffic signals and stop signs.

Bureaucratic and technical choices have left Tesla behind Waymo in the progress of automation, as Waymo is already operating level 4 robotaxis in multiple US cities.

Waymo, unlike Tesla, is not bothered with personal self-driving for now. It’s going after the trillion-dollar robotaxi market, and at the moment, it is comfortably far ahead of any competition in the US. The western industry has been a bloodbath over the past decade, causing several companies like Uber and General Motors to drop from the robotaxi race. But a storm has been brewing in the Chinese industry, taking over both personal self-driving cars and robotaxis.

China’s Autonomous Vehicles Adoption Surges

China currently has more self-driving car players than any other country in the world. By 2030, the China Society of Automotive Engineers says a fifth of all new cars being sold will be fully autonomous. Major companies like BYD, Baidu, Huawei, Xiaomi, Alibaba, XPeng are all in the race. This growth is strongly supported by Beijing’s national policies that position AVs as a strategic industry, offering R&D subsidies, fast-tracking permits, building urban roads better suited for self-driving cars, and upgrading the country’s network infrastructure.

“In China, I can drive to remote mountains at 15,000-feet elevation and still have [a signal],” says Bill Russo, chief executive of a Shanghai-based strategy firm called Automobility. “Whereas in Reno, Nevada, where I am right now, there are still many places where I can drive and completely lose connectivity.”

Related Articles

Here is a list of articles selected by our Editorial Board that have gained significant interest from the public:

Robust infrastructure support, however, does not mean that regulators are ignoring safety standards. A fatal accident earlier this year involving a Xiaomi SU7 led regulators to pause issuing Level 3 permits until further safety rules for ADAS are finalized. But Beijing is not letting the industry fall behind; the government’s message is clear: move fast, but be careful. They hope to approve the country’s first Level 3 car in 2026.

A 2023 report by PwC found that only 30-40% of German and US consumers felt comfortable with Level 4 automated cars, while the number goes to 85% in China; and, as automakers like BYD continue to rollout ADAS software for free across their entire line-up, more than 60% of new cars sold in China this year will have Level 2 systems.

The Robotaxi Industry: Chinese Companies Target Global Expansion

It’s clear that self-driving technology has already taken hold in China. But as Chinese automakers expand globally — and bring their robotaxis with them — the economic and environmental impact they will have on cities is yet to be observed.

Currently, the biggest Chinese robotaxi players are Baidu’s Apollo Go, Pony.ai, and WeRide. The country’s dominance in battery and EV production plays a prominent role in accelerating the local robotaxi industry, as companies benefit from cheaper components, stronger supply chains, and top talent.

“Our American peers started the development earlier,” said James Peng, chief executive officer at Pony AI. “But we are certainly catching up really fast. We have certain benefits.”

Local expansion is no longer the only goal. Unlike their US counterparts, Chinese companies are focusing on the global market. Pony.ai and WeRide are collaborating with local ride-hailing companies in Singapore to launch the first robotaxi operations in Southeast Asia, with Apollo Go planning a launch in both Singapore and Malaysia.

However, sunny weather, robust road infrastructure, and welcoming policies are positioning the Middle East as the center of the robotaxi rollout. Apollo Go, Pony.ai, and WeRide have all dipped their toes into the region, starting with Saudi Arabia and the United Arab Emirates.

For European countries, particularly large markets of Germany and the UK, the question remains whether they will develop their own, wait for US companies to expand, or collaborate with Chinese companies.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: WeRide robotaxi. Featured Photo Credit: WeRide.