Support CleanTechnica’s work through a Substack subscription or on Stripe.

TOKYO — The 2025 Japan Mobility Show this year felt like a crucial turning point for the Japanese automotive industry. There was a strong presence from BYD, which started in 2023 with the introduction and sales of the BYD Atto 3. The entry of the Chinese carmaker to Japan also marked a dramatic shift in how domestic manufacturers approach electrification — seeing the success of the Chinese brands in their home territory.

While Japanese BEVs, hybrids, and multi-fuel strategies from Toyota remained prominent throughout the exhibition halls, several key pure electric vehicle concepts, one coming into the once impenetrable kei-car territory, became causes of concern.

At this particular show, Japanese automakers may have found themselves squeezed between rising Chinese and Korean competitors eating into their domestic market share and the slow-but-steady electrification demands of international markets. Held at Tokyo Big Sight from October 30 and going into November 9, the biennial event attracted a record 517 companies and organizations, surpassing all previous editions and signaling that the stakes for Japan’s automotive future have never been higher. 2025’s show represented not just a product showcase but a strategic response to existential threats facing the backbone of the Japanese economy.

Graveyard for imports

Loyalty and domestic preference have always been the hallmark of the Japanese market. Interestingly, Japan is a “graveyard for imported vehicles.” Big American cars don’t work here. (So, I am astonished at President Trump’s offer of “beautiful” Ford F-150s to supposedly balance the trade deficit.) Koreans have struggled too. Most of the Korean cars here are parallel imports and diplomatic vehicles (it’s a cultural thing). And Europeans have always maintained a niche market because the luxury car segments are lorded over by Toyota.

Among overseas exhibitors, Chinese electric vehicle giant BYD mounted the most aggressive offensive, displaying an astonishing 13 vehicles in total across its booth, including eight passenger cars and five commercial vehicles. The lineup featured one world premiere and three Japan premieres in the passenger segment, plus one world premiere and one Japan-only model debut in commercial vehicles. Trivia: BYD has been in Japan since 2015, making and distributing buses to the Kyoto Municipal transportation service.

BYD Racco

BYD’s centerpiece was the RACCO, the company’s first pure-electric kei car designed exclusively for the Japanese market. This compact, boxy, four-door electric vehicle represents a direct assault on Japan’s most protected automotive segment, one that accounts for more than a third of all new car sales in the country. The RACCO features BYD’s signature Blade Battery technology utilizing lithium-iron-phosphate chemistry and is designed to meet the strict kei car regulations that govern urban commuting. With an expected range of approximately 180 kilometers (112 miles) on the WLTC cycle for its long-range variant and a remarkable DC fast charging capability of up to 100 kilowatts, the vehicle is scheduled for launch in summer 2026 at an estimated starting price of around ¥2.5 million before government subsidies.

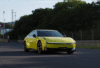

Alongside the RACCO, BYD showcased its plug-in hybrid midsize SUV, the Sealion 6 DM-i, known in China as the Song Plus, making its Japan premiere. The company also introduced the new electric compact SUV ATTO 3, called Yuan Plus in its home market, to Japanese audiences for the first time. Rounding out the premium end of BYD’s display was the high-end Yangwang brand’s U9 supercar, demonstrating the breadth of the Chinese manufacturer’s ambitions. BYD’s aggressive expansion strategy extends beyond product lineup. The company has struck a significant partnership deal with Japanese retail giant Aeon to expand its sales network, targeting approximately 30 outlets nationwide.

A first for Hyundai

Hyundai Motor made its historic first appearance at the Japan Mobility Show, marking a bold push into a market that has proven notoriously difficult for foreign brands. The Korean automaker unveiled the all-new NEXO, an updated hydrogen fuel cell electric vehicle positioned as a compact crossover SUV, for the first time in Japan.

Hyundai’s booth also featured its flagship electric vehicle, the IONIQ 5, alongside the Inster Cross, a variant of the compact crossover city car known in Korea as the Casper. The company displayed a concept version called the Insteroid as well. According to Hyundai officials, the Inster Cross fits Japan’s strong preference for small cars and favorable tax categories for compact vehicles, making it a strategic entry point for the brand.

Kia goes commercial

Kia, operating through Kia PBV Japan, exhibited the PV5 Cargo and PV5 Passenger models, representing the first vehicles in its Platform Beyond Vehicle lineup of electric vans developed on a dedicated electric vehicle platform. These purpose-built commercial vehicles are scheduled for release in the Japanese market next spring, targeting the growing electric commercial vehicle sector there.

The Korean brands face stiff competition in Japan’s nascent electric vehicle market. According to market tracker SNE Research, Nissan led Japan’s EV segment in the first half of 2025 with 11,695 units sold, accounting for approximately 40 percent of total battery electric vehicle sales of 29,857 units. Tesla followed with 5,542 units, Mitsubishi with 4,793 units, and BYD with 1,409 units. Hyundai’s market share in Japan’s EV segment remains in the low single digits, squeezed between entrenched local manufacturers and fast-rising Chinese and American rivals.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy