tsla

Tesla’s bullish breakout reflects a potent mix of leadership confidence, technological progress, and robust sales growth.

•

Last updated: Monday, October 27, 2025

Quick overview

- Tesla’s stock rebounded 5% to $458.80 after easing trade tensions and optimism for an upcoming product unveiling.

- The company’s third-quarter earnings showed a 12% revenue increase to $28.10 billion, despite a drop in net income due to lower EV prices.

- Tesla’s Shanghai Gigafactory produced nearly 40% of total sales, with strong demand in China despite competition from local brands.

- Elon Musk’s recent $1 billion insider purchase boosted investor confidence, highlighting faith in Tesla’s long-term potential and innovation.

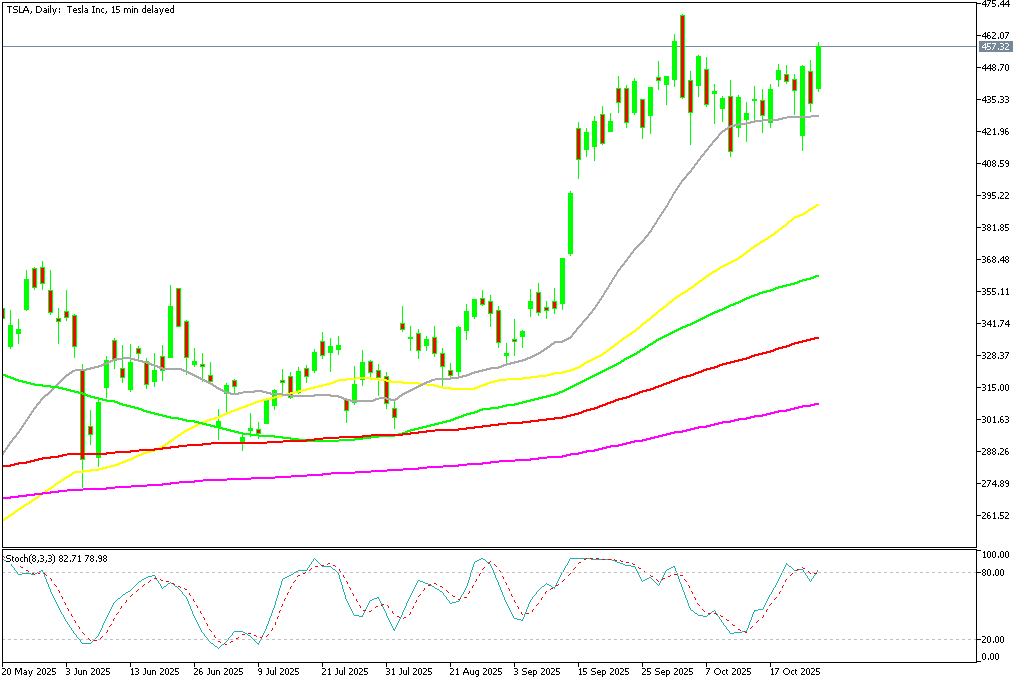

Live TSLA Chart

[[TSLA-graph]]

Tesla’s bullish breakout reflects a potent mix of leadership confidence, technological progress, and robust sales growth.

Tesla Regains Momentum After Brief Pullback

Tesla (NASDAQ: TSLA) climbed 5% on Monday to $458.80, regaining bullish traction after last week’s dip. The rebound followed easing trade tensions between the U.S. and China, as both sides signaled efforts to prevent further economic disruption. Optimism also grew ahead of a potential product unveiling at Tesla’s rumored October 7 event.

TSLA Chart Daily – Climbing Back Above the 20 SMA

Earnings Recovery Sparks Renewed Optimism

Tesla’s third-quarter earnings reignited investor interest. Revenue rose 12% year-over-year to $28.10 billion, surpassing estimates, though EPS came in slightly below expectations at $0.50 versus $0.54 forecast.

Despite a 37% drop in net income to $1.37 billion—driven by lower EV prices and rising R&D costs for AI—Tesla achieved record deliveries and solid energy growth, signaling robust underlying demand.

China Operations: The Heart of Tesla’s Expansion

Tesla’s Shanghai Gigafactory continues to anchor global operations, producing nearly 40% of total sales. In the first half of 2025, China sales surged past 263,000 units, showcasing enduring strength despite fierce domestic competition from BYD and XPeng.

August data highlighted the contrast: Chinese deliveries rose 22.6% month-over-month, while European sales dropped sharply. Tesla’s strategy remains centered on China as a key profit driver amid global demand shifts.

Energy Storage Segment: A Silent Profit Engine

While EV sales dominate headlines, Tesla’s energy business quietly reached record highs. Deployments hit 12.5 GWh in Q3 2025—its best quarter ever—driven by Megapack and Powerwall demand. This segment now boasts the highest margins in Tesla’s portfolio, reinforcing diversification beyond autos.

Model Y Standard: Europe’s Cost-Conscious Power Play

The 2026 Model Y Standard, built in Germany, targets budget-sensitive European buyers. By streamlining select features while retaining Tesla’s core tech, the model offers an attractive entry point at €39,990 amid tightening EV subsidies.

This strategy supports Tesla’s broader goal to defend market share as European competition intensifies.

Musk’s Billion-Dollar Buy Reignites Confidence

Elon Musk’s $1 billion insider purchase—his first in nearly five years—acted as a bullish catalyst, pushing TSLA shares 4% higher and lifting confidence among institutional investors. The buy was widely seen as a strong show of faith in Tesla’s long-term potential and future innovation cycle.

Innovation Drive: FSD and Robotaxi Expansion

Tesla’s next-generation Full Self-Driving (FSD) system will offer 10x the processing power of current hardware, marking a leap in AI capability. Simultaneously, its Austin-based robotaxi network expanded from 20 to 170 square miles, signaling progress toward large-scale autonomous mobility.

Deepening Roots in China’s Tech Ecosystem

To strengthen its position in China, Tesla is embedding popular domestic software directly into its vehicles—integrating Baidu Maps, WeChat, Doubao, and DeepSeek Chat.

This localization approach enhances user experience while positioning Tesla as a culturally adaptive global automaker ready to compete with local EV giants.

Conclusion: Tesla’s combination of strong fundamentals, strategic localization, and CEO confidence has reignited bullish sentiment. With record deliveries, expanding AI capabilities, and deepening Chinese partnerships, the automaker’s long-term trajectory remains upward—suggesting more highs could lie ahead if global conditions remain favorable.