- ■

- ■

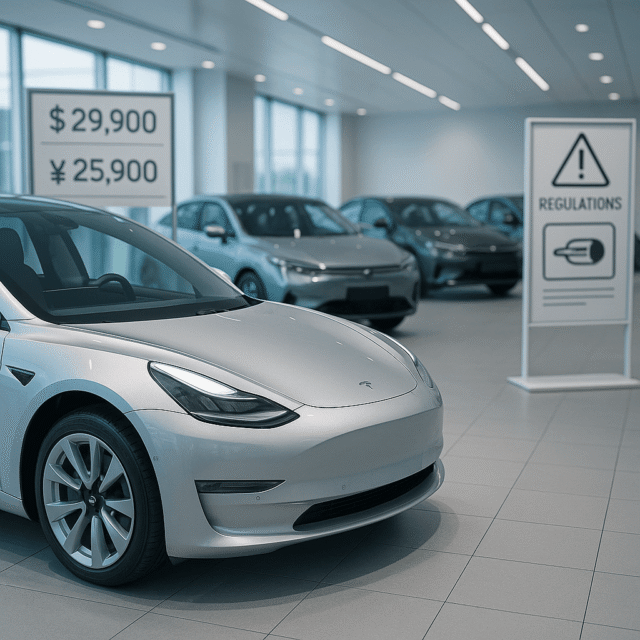

China’s new regulations will ban concealed door handles from Jan 2027, targeting Tesla’s signature flush design after fatal incidents where occupants couldn’t escape burning vehicles

- ■

Tesla’s base Model 3 costs 235,500 yuan ($33,943) – nearly triple BYD’s Seal at 79,800 yuan – forcing aggressive promotions including 0% financing through February

- ■

China’s EV market grew just 1% in January, the fourth straight month of slowing growth after Beijing reinstated a 5% purchase tax

Tesla is holding its ground in China’s brutal EV battlefield, but the fight’s getting tougher. The company shipped 69,129 vehicles from its Shanghai Gigafactory in January, up 9% year-over-year, according to data from the China Passenger Car Association. But the modest bump masks deeper trouble – Tesla’s annual China sales actually fell 4.8% in 2025, making it one of only two manufacturers in Beijing reporting declining numbers. And now there’s a new curveball: China just announced regulations that’ll effectively ban Tesla’s signature flush door handles starting January 2027.

Tesla just posted numbers that tell two very different stories about its China business. The surface looks fine – 69,129 vehicles shipped from Shanghai in January, a 9% bump from the same month last year. But dig deeper and the cracks start showing.

The January delivery figures landed Tesla in third place among Chinese EV manufacturers, miles behind BYD‘s commanding 205,518 units and Geely‘s 124,252, according to China Passenger Car Association data published Wednesday. More concerning is what happened over the full year – Tesla’s China-produced EV sales dropped 4.8% in 2025, making it one of only two manufacturers in Beijing that reported declining annual sales.

The disconnect between January’s modest growth and 2025’s overall decline reveals the fundamental challenge Tesla faces in the world’s largest EV market. Those monthly delivery numbers represent total shipments from the Shanghai Gigafactory to domestic and foreign markets across Europe and Asia-Pacific, not actual Chinese consumer demand. New registrations in Europe rose slightly in January, according to Reuters, suggesting some of that Shanghai production is just flowing overseas.