Unusual US-China link-up may challenge LG’s early lead in American ESS market

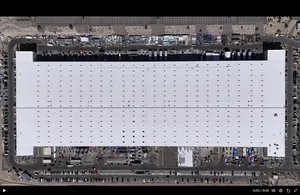

Tesla dropped a bombshell by recently sharing a video clip on X showing drone footage of its lithium iron phosphate (LFP) battery cell manufacturing facility for energy storage systems in the US state of Nevada. The post read, “Nearing completion” of its first-ever LFP cell production site in North America.

While the electric vehicle giant is known for pioneering cylindrical lithium-ion battery cells for cars, Tesla’s venture into LFP cells sends a warning signal to Korean battery manufacturers, as it potentially enables the Chinese battery giant CATL to indirectly enter the US market despite trade barriers against China.

Rare US-China tie-up

According to Bloomberg, Tesla — already using CATL’s LFP cells in its “Megapack” product for utility- and grid-level ESS, manufactured outside the US — will utilize equipment and battery design from CATL at its Nevada facility.

“Tesla’s completion of its LFP cell factory will effectively be equivalent to an indirect entry of CATL into the US market,” said Park Cheol-wan, a car engineering professor at Seojeong University.

“Tesla sources LFP batteries for energy storage and electric vehicles from CATL and BYD, with BYD’s long cells serving Europe and CATL’s prismatic cells targeting Asia and North America,” Park added. “With increased US sanctions on China under the Biden administration, Tesla planned to start local production at its Nevada factory. This strategy has shown unexpected foresight, especially in light of the tariffs imposed during Donald Trump’s presidency.”

Park noted that CATL’s entry through Tesla differs from its “de facto failed attempt” to build a joint battery manufacturing plant with Ford Motor Company, which involved licensing its battery technology. With Tesla having full control over the Nevada factory, CATL can still benefit financially from supplying equipment, thereby deepening its reach into an otherwise “impenetrable” US market.

Fresh threat to LG?

Tesla and CATL’s LFP battery production intensifies pressure on LG Energy Solution, which last month became the first among US-based players to begin mass production of LFP cells for ESS at its Michigan plant.

An LG Energy Solution official noted that the company is now supplying long-cell-based LFP battery pack products to major US energy solution providers, including Terra-Gen and Delta Electronics. The combined annual supply volume to these two firms is projected to reach 12 gigawatt-hours, valued at approximately 3 trillion won ($2.2 billion).

In 2022, LG Energy Solution also entered the ESS system integration sector, moving beyond battery supply to the construction and operation of large-scale ESS in North America.

“Although this move strengthens their market position, we’ll need to wait and see whether they can maintain price competitiveness against Tesla, which is collaborating with the cost-efficient CATL,” Park said.

While Tesla does not disclose its exact market share in the US ESS sector, it is known to be a dominant player in residential ESS and a key supplier for utility-scale storage. In 2024, the combined energy storage capacity of Tesla’s Megapack and Powerwall products soared 114 percent year-on-year to 31.4 gigawatt-hours. The company projects at least 50 percent growth in this segment for 2025.

No clear leader

Industry watchers expect the LFP battery rivalry between LG Energy Solution and Tesla — backed by CATL — to expand into the US electric vehicle market.

“While Tesla has so far only revealed plans for ESS production at its Nevada plant, it seems only a matter of time before it begins manufacturing LFP cells for EVs as well, given that these products use the same battery design,” said a researcher at a major Korean battery company.

Park also noted that Tesla’s local production of LFP cells is likely to spur LG Energy Solution — which is set to begin large-scale LFP battery supplies to Renault Group from its plant in Poland — to explore new partnerships with legacy US automakers such as Ford Motor Company and General Motors.

In the first quarter of this year, GM’s brands — Chevrolet, Cadillac and GMC — ranked second in US EV sales with 31,886 units, following Tesla’s 128,100 units, according to data from Cox Automotive. Ford came in third with 22,500 units sold.

hyejin2@heraldcorp.com