Etiqueta: Weekly

BYD to launch 2026 Qin L and Qin Plus PHEVs with...

BYD will launch the 2026 Qin L DM-i and Qin Plus DM-i in China on January 8.

BYD’s BEV Sales Grew 28% In 2025, But Dropped 8% In...

Support CleanTechnica's work through a Substack subscription or on Stripe. It’s a mixed result for BYD at the end of the year. The big headline is that the company passed up Tesla in annual BEV (fully electric vehicle) sales. Overall, the company’s BEV sales grew 28% in 2025. However, that ... [continued]

Look Out For Your Chips, The Seagull Is Coming!

BYD has launched yet another BEV into to the Australian market, undercutting and out teching the petrol driven competition.

BYD & Tesla Combine for 30% of Cumulative BEV Sales Globally

Support CleanTechnica's work through a Substack subscription or on Stripe. Following up on the article I wrote a few days ago about BYD having 20% of cumulative plugin vehicle sales globally and Tesla having 12% of cumulative plugin vehicle sales, I wanted to figure out the same kind of figures ... [continued]

Sunday China Drive | Geely Galaxy Starshine 6 PHEV challenges BYD...

Starshine 6 competes with BYD Qin Plus, delivering a spacious interior and practical rear seating for families.

BYD’s at 20% Share of Cumulative Plugin Vehicle Sales!

Support CleanTechnica's work through a Substack subscription or on Stripe. We’ve been logging a handful of big EV statistics lately, but one nearly snuck under our noses. It’s an amazing one, and it also brings us back to a years-long rivalry. But I’ll wait until the end to circle back ... [continued]

BYD wins defamation lawsuit over online false claims, Chinese court orders...

A Chinese court awarded BYD 2 million yuan (279,000 USD) after ruling online accounts spread false information.

BYD Reaches 15 Million Plugin Vehicles In Crazy Time

Support CleanTechnica's work through a Substack subscription or on Stripe. In November 2024, BYD reached cumulative production of 10 million plugin vehicles (or “new energy vehicles” as they are called in China). Just 13 months later, in December 2025, the company reached 15 million. That’s stunning growth. From 10 million ... [continued]

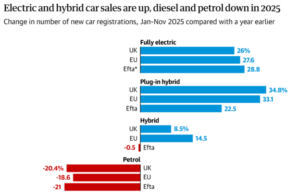

BYD Rises in Europe as Tesla Falls, More Than Tripling Sales

As Zach mentioned yesterday, the Guardian reported data from ACEA showing that Tesla sold 12,130 vehicles in Europe in November, down from 18,430 last year, while the overall market grew slightly. Tesla’s market share shrank from 2.1% to 1.4%. However, while Tesla staggered, BYD’s sales growth accelerated in the EU, EFTA and UK from 6,568 to 21,133 units in November over the year prior. Up 221%. More growth than any other automaker.It should be noted that this YoY growth came after the EU implemented supplemental BEV tariffs on top of the 10% base tariff, bringing the total to 27% for BYD. Politicians who thought that the tariffs might stop them are undoubtedly disappointed. BYD indicated that they had padded prices ahead of the tariffs in anticipation of their implementation and that they would not need to raise prices after the tariffs were announced. As such, the tariffs did not slow them down. While protectionism and the threat of protectionism undoubtedly inflate European prices overall, greater certainty lets companies like BYD build out viable business models. Their vehicles are still more than competitive, even when prices are inflated by politicians. However, because the added tariffs do not apply to PHEVs, those models have been growing faster. This is driving faster PHEV growth in 2025.

BYD launched PHEV engine oil for its DM-i hybrid system, in...

As of the end of November, BYD’s global cumulative sales of new energy vehicles is 14.7 million units.