Etiqueta: US

BYD Electric Car Prices In Ethiopia: A Comprehensive Guide

BYD Electric Car Prices in Ethiopia: A Comprehensive Guide Hey there, car enthusiasts! Are you guys in Ethiopia buzzing about electric vehicles? Well, you’re...

BYD revealed Linghui M9 MPV official images for the ride-hailing market

The Linghui M9 is designed based on the BYD Xia DM-i.

BYD adds to China’s expanding automotive footprint in Pakistan

The world’s largest EV maker is expected to begin assembly in Pakistan in the third or fourth quarter, according to the partner firm.

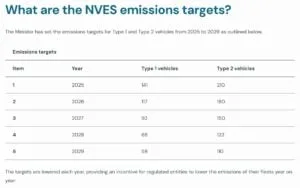

BYD Banks 6.2M Carbon Credits Potentially Worth US$217M Under Australia’s EV...

BYD earns 6.2 million carbon credits under Australia’s vehicle efficiency rules, boosting its EV compliance edge.

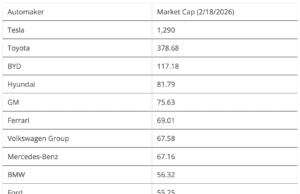

Tesla Market Cap More Than Market Cap of Toyota, BYD, GM,...

Support CleanTechnica's work through a Substack subscription or on Stripe. Or support our Kickstarter campaign! I just caught up on comments under an article I wrote several days ago, “Is Tesla Really In Trouble This Time?” There were many great comments from readers, but a few jumped out at me ... [continued]

Ford CEO Floats Bold China JV Plan To Trump Team

Ford CEO proposes joint venture framework with Chinese automakers to manufacture vehicles in the US, amidst shift in auto industry.

Electric Vehicle Battery Technology Research Report 2026: A $156.95 Billion Market...

The Electric Vehicle Battery Technology Market, valued at USD 98.65 billion in 2025, is set to reach USD 156.95 billion by 2031, growing at a CAGR of 8.05%. Key trends include the rise of sodium-ion batteries, known for their cost efficiency and safety, and the expansion of gigafactories worldwide, driven by technological scaling and logistical needs. The market is propelled by rapid EV adoption, government mandates, and increased urbanization. Dominated by Asian manufacturers, the market sees s

Dachser deploys BYD electric trucks

Dachser, a logistics provider operating across Europe that has long used electric trucks, has deployed two electric trucks from Chinese manufacturer BYD for

BYD to launch Sealion 06 PHEV with 175 kW motor, 220...

BYD Sealion 06 sold over 100,000 units in three months and PHEV variant will receive 220 km EV range and ADAS upgrade.

Alibaba Leads Tech Slide After Pentagon Briefly Shows Blacklist

Alibaba Group Holding Ltd. led a Chinese tech-share selloff after the Pentagon added some of the country’s biggest names to a list of companies aiding the military — only to withdraw that roster minutes later without explanation.