Etiqueta: Sales

BYD Hong Kong shares sink to 5-week low on weak January...

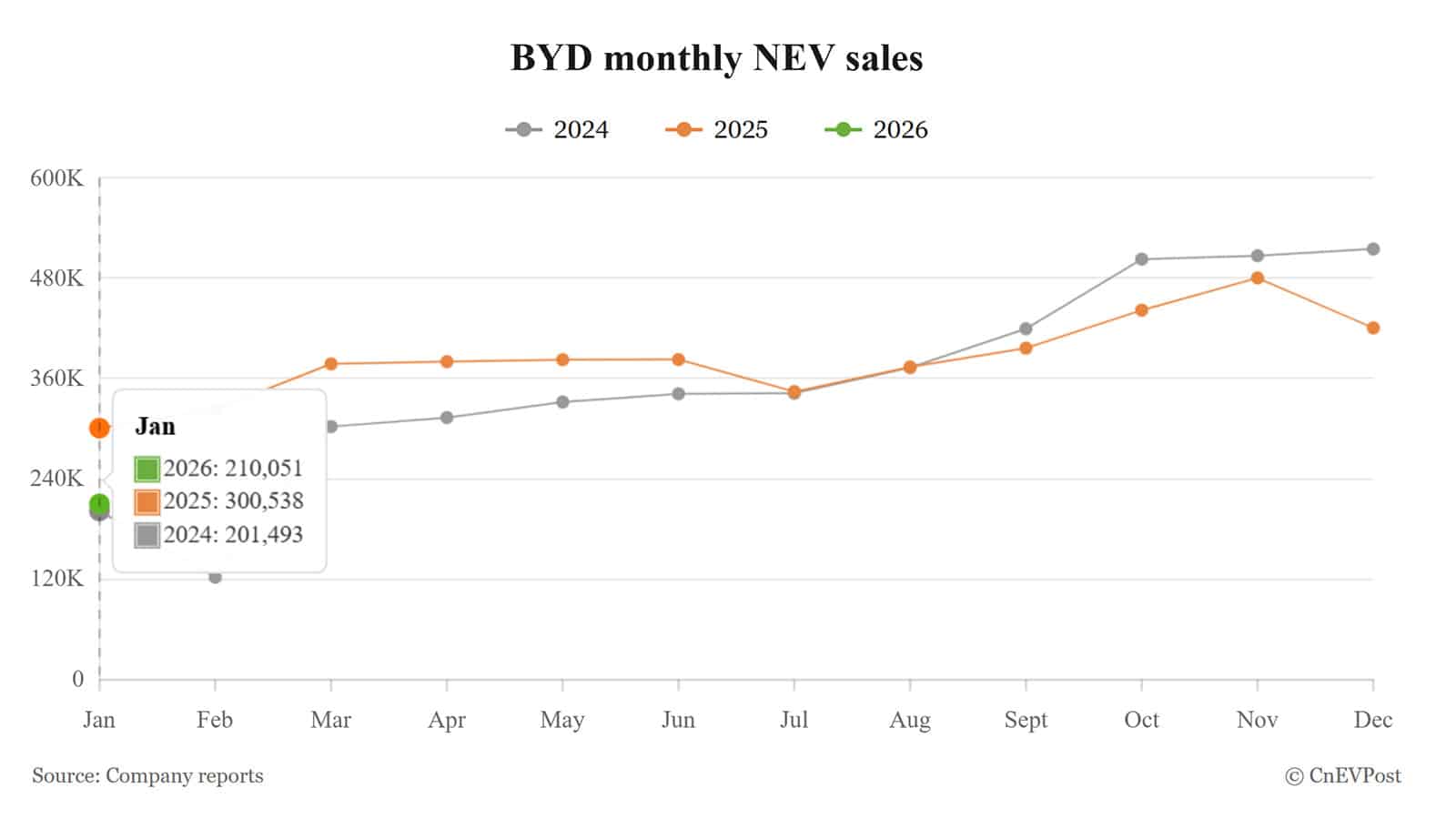

HONG KONG, Feb 2 (Reuters) - Hong Kong shares of BYD Co Ltd fell 5.1% early on Monday after the vehicle maker posted its fifth straight month of decline in monthly sales. The stock fell to HK$92.75, the lowest since December 24. BYD's vehicle sales dropped by 30.1% in January year-on-year as the Chinese electric vehicle maker navigates external uncertainties and tough competition at home. (

BYD sales fall for fifth consecutive month as global volumes slide

The Chinese brand that knocked Tesla off to become the world’s number one electric vehicle maker has posted another month of sliding sales.

BYD vehicle sales slump 30% in January as China demand cools

BYD Co. said sales dropped 30% in January, underscoring the challenges facing the electric vehicle maker’s efforts to boost sales just as a winding back of subsidies hurts demand in China.

BYD sells 210,051 NEVs in Jan, down 30.11% year-on-year

BYD exported 100,482 NEVs in January, a 51.47% increase year-on-year, marking one of the few bright spots.

China’s BYD vehicle sales fall for fifth month in a row

BEIJING/HONG KONG, Feb 1 () - BYD's vehicle sales fell by 30.1% in January from a year earlier, the fifth straight month of decline, as the Chinese electric vehicle maker navigates external uncertainties and stiff competition at home.

Canada & South Korea Discuss Trade Deal As BYD Eyes India

Canada and South Korea are working toward a new trade deal that would bring more auto manufacturing to that country.

Can Budget take a leaf out of China’s BYD story to...

India's EV market is growing, but faces challenges like a two-wheeler sales slowdown and financing issues. From Budget 2026, the industry seeks structural reforms, including GST rationalization, component-level PLI support, and a national charging roadmap, to foster domestic manufacturing and achieve mass adoption.

Vietnam becomes BYD’s next strategic «power battery» in its global playbook

body { font-size: 16px; line-height: 34px; ...

BYD Begins Trial Production at First European Passenger Car Plant

BYD began on Thursday trial production at its first European plant in Hungary, following delays in completing construction of the passenger vehicle factory.

CATL and BYD are betting on a new type of EV...

CATL and BYD are already dominating the EV battery market, accounting for over 50% of global sales last year. With...