Etiqueta: Report

India: BYD explores localising additional models amid rising demand

With rising demand putting pressure on its import-led passenger car business in India, BYD is reassessing its current strategy. The company is considering

BYD mulls expanding India operations as orders surge, report says

Strong demand is prompting BYD to reassess ways to deploy more vehicles in India, where dealers currently have hundreds of bookings, according to Bloomberg.

BYD reportedly weighs India expansion as hundreds of car orders pile...

BYD weighs local EV assembly in India to meet surging demand amid import quotas and approvals, as dealers hold hundreds of bookings.

BYD Dominates Mexico’s EV Market With 70% Share

BYD now accounts for about 70% of Mexico’s EV and plug-in hybrid sales, nearly doubling volumes despite new tariffs, BloombergNEF data show

Is It Time To Reconsider BYD (SEHK:1211) After Mixed Returns And...

If you are wondering whether BYD's current share price reflects its true worth, you are not alone, as many investors are asking the same question before making their next move. BYD's shares last closed at HK$98.5, with returns of a 2.2% decline over 7 days, 5.2% over 30 days, a 0.3% decline year to date, 8.7% over 1 year, 27.2% over 3 years, and 24.6% over 5 years, a mixed set of numbers that naturally raises questions about value and risk. Recent headlines around BYD have focused on its...

BYD wants to grow outside of China

Chinese market leader BYD aims to sell 1.3 million vehicles outside China by 2026—about 24 per cent more than the previous year. To meet its 2030 ambitions,

BYD aims for 1.3 million overseas sales in 2026

BYD targets 1.3 million overseas vehicle sales in 2026, representing about 24% growth.

Is It Time To Reassess Boyd Gaming (BYD) After Its Strong...

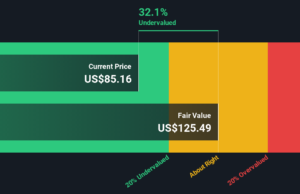

If you are wondering whether Boyd Gaming's share price still offers value after its long run on the market, this article will walk you through what the current numbers might be telling you.

The stock recently closed at US$85.09, with returns of 13.8% over 1 year, 43.3% over 3 years, and 92.8% over 5 years. The shorter term picture shows a 5% decline over 7 days and a 1.3% decline year to date.

Recent attention on Boyd Gaming has been shaped by ongoing discussion around the US gaming and...

Tesla and BYD dominate South Korea’s booming EV market

Tesla and BYD dominated South Korea’s imported EV market in 2025, led by Model Y sales.

The Bull Case For BYD (SEHK:1211) Could Change Following Its Argentina...

Chinese automaker BYD recently marked a milestone in its global expansion by shipping over 5,800 electric and hybrid vehicles to Argentina, taking advantage of the Milei administration’s tariff-free quota for electric vehicles and reduced trade barriers. This move not only extends BYD’s international reach but also underscores how shifting policy frameworks in emerging markets can rapidly reshape global EV competition. Next, we’ll examine how BYD’s push into Argentina under favorable EV...