Etiqueta: Industry

Is It Time To Reassess Boyd Gaming (BYD) After Recent Share...

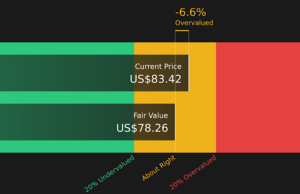

If you are wondering whether Boyd Gaming stock still offers value at its current level, you are not alone. Many investors are asking the same question right now. The share price last closed at US$83.23, with a 3.4% decline over 7 days, a 1.5% decline over 30 days, a 3.4% decline year to date, and gains of 10.2% over 1 year, 30.3% over 3 years and 43.6% over 5 years. Recent coverage around Boyd Gaming has focused on how the company fits into the broader US consumer services and casino space,...

China promises the “holy grail” of electric vehicles in 2026: an...

Exeed claims its 2026 solid state EV will top 1,500 km of range and handle minus 30 C without losing performance.

Xiaomi’s racing ambitions accelerate with leaked Vision GT concept

Ahead of the 2026 MWC opening, a mysterious high-performance concept car from Xiaomi was spotted in Spain.

BMW to unveil China-tailored Neue Klasse at Beijing Auto Show

BMW AG Chairman Oliver Zipse said the automaker will debut its first Neue Klasse model designed spec

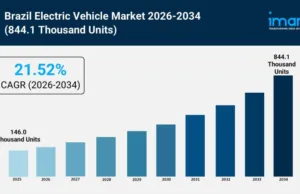

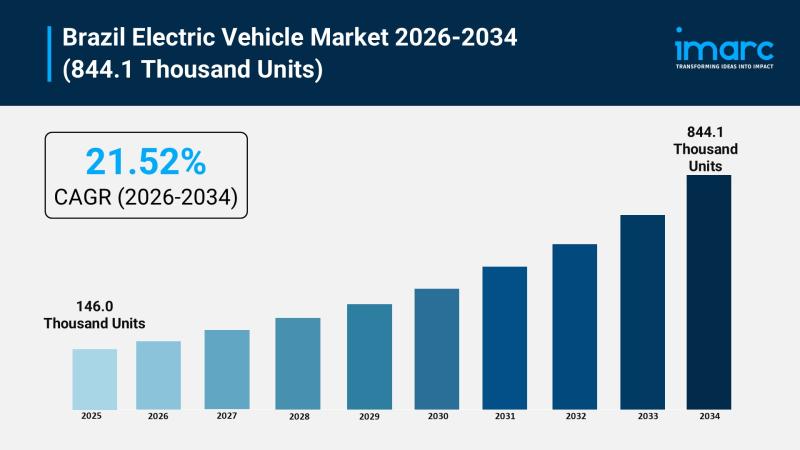

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD...

The Brazil electric vehicle EV market is currently witnessing an unprecedented surge having reached a volume of 146 0 Thousand Units in 2025 Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global ...

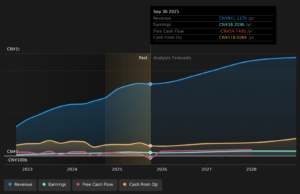

BYD Mexico Plant Bid Reshapes Global Production And Sales Mix

BYD (SEHK:1211) is reported to be in the final bidding round for a Nissan–Mercedes-Benz manufacturing plant in Mexico, which could give it established production capacity in North America and Latin America.

The potential acquisition comes as BYD expands international sales, with particular traction reported in European and ASEAN auto markets.

These developments highlight BYD's push to build out overseas production and distribution options beyond its existing Chinese manufacturing base.

BYD...

What drives BYD’s growth as Tesla struggles in Europe

Once a dominant force and symbol of the region’s transition to electric mobility, Tesla has experienced several months of declining registration...

BYD starts rollout of 1MW charging network

BYD is launching a massive network of 1-megawatt "flash charging" stations that can add {{400 km}} of range to an electric car in only five minutes.

Tesla’s European Sales Drop 17% in January, 13th Straight Monthly Decline

Analysis of Tesla's 13th consecutive month of declining European sales, contrasted with BYD's surge and the competitive shift towards affordable Chinese EVs.

Canada just went ‘anti-tariff’ on Chinese EVs — and what BYD...

Canada is easing tariffs on up to 49,000 Chinese vehicles a year, and a look at major markets gives us a good idea of what BYD will be bringing.