Etiqueta: Exceed

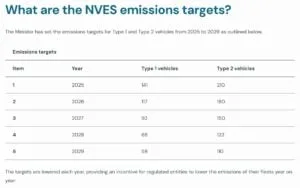

BYD Banks 6.2M Carbon Credits Potentially Worth US$217M Under Australia’s EV...

BYD earns 6.2 million carbon credits under Australia’s vehicle efficiency rules, boosting its EV compliance edge.

BYD releases official images of Song Ultra EV amid ramped-up marketing...

The Song Ultra EV measures 4,850 mm in length and boasts a CLTC range of up to 710 km.

BYD sues US government over tariffs, seeks refunds

Chinese automaker BYD Co (HKG:1211, LSE:0HKY, OTCQX:BYDDY) has filed a lawsuit against the US government challenging tariffs imposed under President Donald...

BYD aims to sell 50,000 cars in Germany this year

One year behind schedule, Chinese manufacturer BYD aims to exceed 50,000 new registrations in Germany this year. This would be more than double the 23,306

Why BYD Has Surpassed Tesla: The Real Inflection Point for Electric...

BYD’s surpassing of Tesla in global battery electric vehicle (BEV) sales in 2025 marks a pivotal shift in the global new energy vehicle landscape. This milestone reflects not only divergent market strategies, but also differences in the stage of EV adoption across price segments.

BYD teases Song Ultra EV as new addition to popular Song...

The Song Ultra EV will be BYD's Dynasty lineup's first B-class pure electric SUV.

Tesla Continues Its Decline, BYD Surges Ahead As Electric Vehicles Exceed...

Electrified vehicles accounted for a bigger market share of the European auto sector than their gasoline counterparts. Gasoline Registrations Drop Gasoline registrations fell in the market towards the end of the year by 18.7% in 2025 in the EU, according to data released by the European Automobile Manufacturers' Association (ACEA) on Tuesday. The market share for Gas-powered vehicles fell to 26.6% from 33.3% a year earlier. Don't Miss: Missed Nvidia and Tesla RAD Intel Could Be the Next AI Powe

BYD boosts EV battery warranty to 155,000 miles

Owners of BYD cars will get an extended eight-year EV battery warranty, now valid for 155,000 miles – and existing owners can benefit, too.

BYD extends warranty of Blade Battery in Europe to eight years...

BYD has strengthened its commitment to its customers in Europe by extending the warranty of its Blade Batteries to eight years or 250,000km

BYD extends Blade Battery warranty to 250,000km

BYD has extended its Blade Battery warranty to eight years or 250,000km for customers in Europe, up from 150,000km previously