Etiqueta: Europe

BYD beats Tesla in Europe for second consecutive month

Since BYD, the world's leading Chinese plug-in vehicle brand, decided to land in Europe, Tesla's dominance in the continental electric market is crumbling. We saw it in July... and

BYD (BYDDY) Stock: Falls 5% in September as Japan EV Sales...

BYD (BYDDY) stock fell 5% in September as Japan EV sales disappoint and Berkshire Hathaway exits its 15-year stake, raising investor concerns.

CoreWeave, AstraZeneca, GSK, BYD, Tesla: Trending Stocks

Stocks to watch this morning include CoreWeave (CRWV), the NVIDIA (NVDA)-backed AI cloud scaler, which is rising after some big swings in recent weeks. In the pharmaceutical sector, AstraZeneca (AZN) gains as it announces plans to list in New York, while GSK (GSK) and UCB SA (UCB.BR) are up on appointing a new CEO and positive trial results, respectively. And it's a high-stakes moment for Tesla (TSLA), BYD (1211.HK) and other makers of electric vehicles, amid a global slowdown and as a $7,500 tax credit comes to an end in the US. For more live coverage of markets watch the full episode of Market Sunrise and head to Yahoo Finance.

BYD reaches 100 UK dealership milestone in record time

The Chinese EV firm has officially opened its 100th franchised dealership in the UK, just less than 30 months after its initial UK retail launch in April

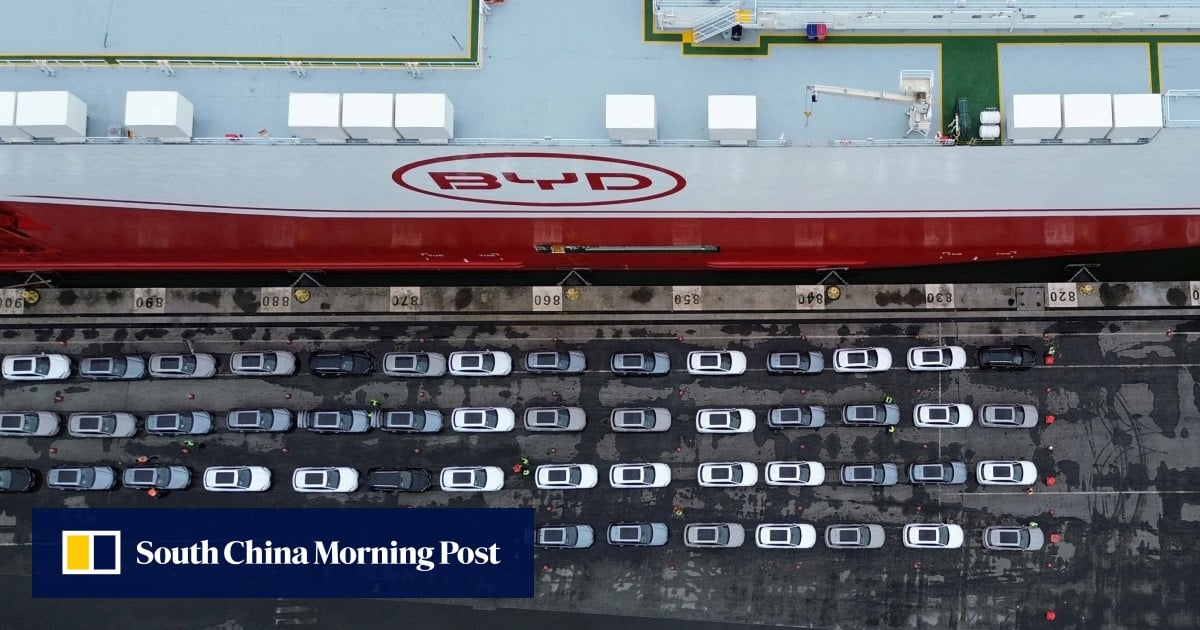

BYD projects exports to account for 20% of 2025 sales

BYD projects to export between 800,000 and 1 million units in 2025, which is about 20% of its total sales.

Chinese EV Giant BYD Targets up to 1 Million Overseas Deliveries...

Chinese EV giant BYD projects 800,000, 1 million overseas deliveries in 2025, fueled by expanded logistics, European factories, and showroom growth.

BYD Has Plans To Introduce China-Developed Cars To Foreign Markets, Expects...

Chinese EV giant BYD Co. Ltd. (OTC: BYDDY) (OTC: BYDDF) expects its overseas sales to make up about 20% of its total deliveries in 2025.

BYD Bets On Exports To Drive Growth — Plans 1M Overseas...

The company is also preparing to start production at its new Hungary plant early next year as part of its broader international expansion.

China’s EV king BYD expects international sales to top 20% this...

In 2024, BYD’s sales outside the mainland accounted for less than 10 per cent of its total of 4.26 million deliveries.

BYD’s 8th car carrier enters service

All eight cargo vessels in BYD's fleet are now operational, with annual transport capacity exceeding one million vehicles.