Etiqueta: BYD

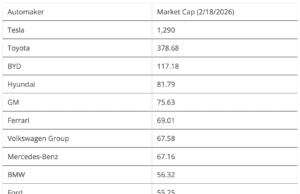

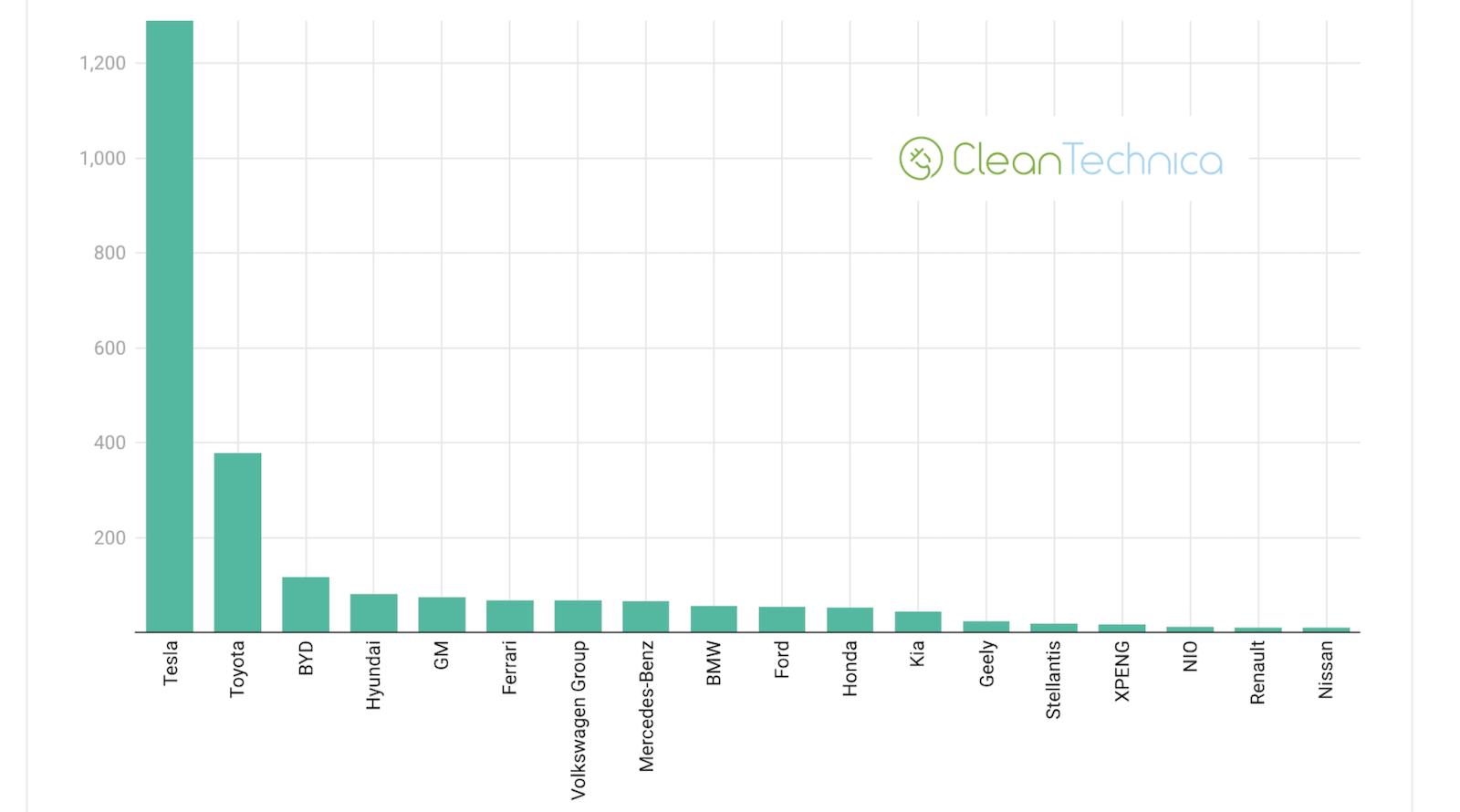

Tesla Market Cap More Than Market Cap of Toyota, BYD, GM,...

Support CleanTechnica's work through a Substack subscription or on Stripe. Or support our Kickstarter campaign! I just caught up on comments under an article I wrote several days ago, “Is Tesla Really In Trouble This Time?” There were many great comments from readers, but a few jumped out at me ... [continued]

DLL to provide leasing and loan solutions for BYD electric buses...

DLL and BYD Europe have signed a partnership agreement under which DLL will provide financing solutions for BYD electric buses

BYD’s first electric kei car is almost here, and it already...

The Racco, BYD’s first electric kei car, will go on sale this summer, but it’s already generating hype. BYD declared...

BYD uses aggressive discounts in bid to make Germany its leading...

BYD is using heavy discounting to boost sales as it seeks to pass MG as the topselling Chinese brand in Europe's biggest market.

BYD’s $26K EV SUV Promises 441 Miles of Range – and...

BYD's $26,000 Song Ultra EV delivers 441-mile range and Tesla-level tech, challenging premium SUV pricing with advanced driver assistance features.

BYD unveils Linghui e9 EV official image for ride-hailing market, up...

The Linghui e9 features 60.5 kWh and 64.315 kWh Blade battery packs, correspond to cruising range of 535 km and 605 km, respectively.

The post BYD unveils Linghui e9 EV official image for ride-hailing market, up to 605 km range appeared first on CarNewsChina.com.

Ford CEO Floats Bold China JV Plan To Trump Team

Ford CEO proposes joint venture framework with Chinese automakers to manufacture vehicles in the US, amidst shift in auto industry.

BYD Reveals Interior of Japan-Exclusive Kei Car Ahead of Summer Launch

Chinese giant BYD revealed the first interior images of its Japan-exclusive Racco kei car, ahead of the model’s launch scheduled for this Summer.

BYD Europe to boost commercial vehicle business via financier DLL

BYD Europe is partnering with financial services provider DLL to offer European customers a wider range of financing solutions for its electric trucks and