Etiqueta: Battery

BYD Mar 5 tech event: Everything we know so far

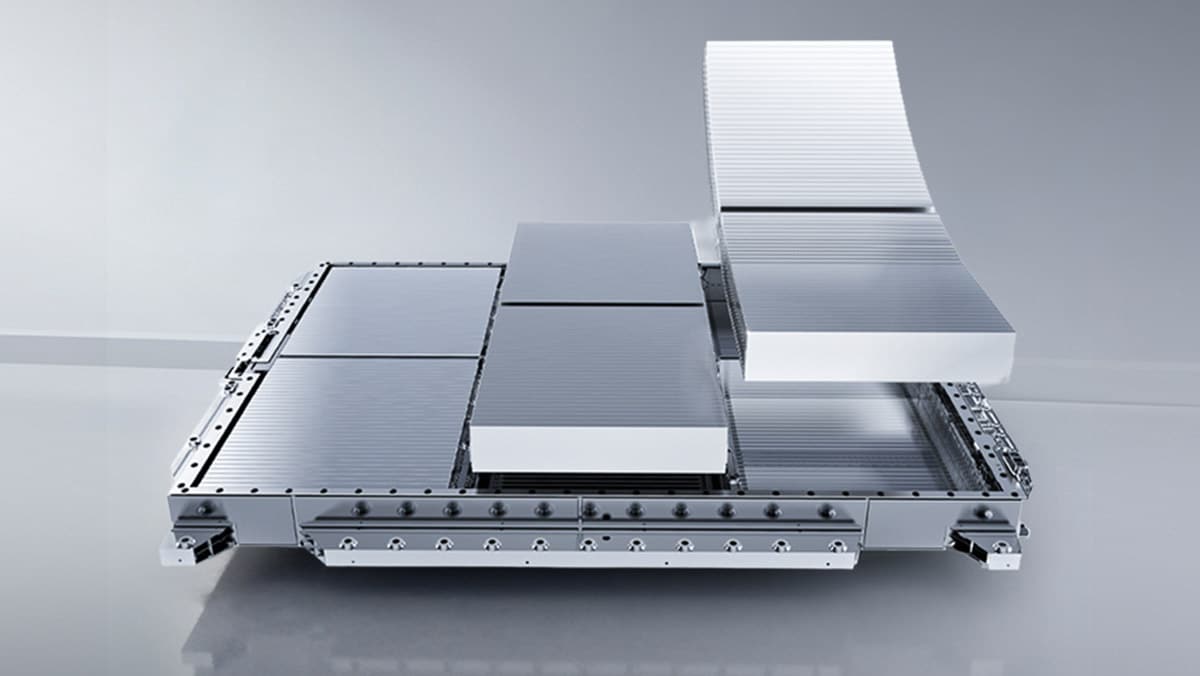

BYD will launch its second-generation blade battery, new flash-charging technology, and multiple models across its main and sub-brands at its March 5 event.

BYD to launch 2nd-gen blade battery and flash-charging tech on Mar...

The Yangwang U7 will be the first to feature the second-generation blade battery, achieving a pure electric range of 1,006 kilometers.

Gasgoo Daily: BYD to roll out Great Tang SUV on Mar....

body { font-size: 16px; line-height: 34px; ...

BYD pulls the cover off its stunning flagship electric SUV for...

With its official debut just days away, BYD revealed the first images of its new flagship electric SUV, the Great...

BYD to roll out Datang SUV, Denza Z9GT, and updated Yangwang...

BYD is attempting to reverse declines with disruptive charging technology and premium models amid six consecutive months of falling sales.

No cap: Nearly 70% of Gen Z would consider Chinese cars...

If Chinese automakers eventually break into the US market, younger Gen Z buyers could be first in line.

The BYD Seal 07 EV official images are here

The new BYD Seal 07 EV is a sleek electric sedan with {{705 km}} range, advanced LiDAR technology, and a single 240 kW motor.

BYD’s luxury brand says it’s just made the world’s longest-range EV,...

Luxury, long-range wagon is scheduled to go on sale in Europe

BYD’s New EV Chargers Are So Fast They’re Arranged Like Gas...

Megawatt flash charging could make range anxiety feel very last decade

Musk Calls BYD’s Worst Sales Decline in Six Years ‘Tough Sledding’

Tesla’s Chief Executive Officer Elon Musk commented on BYD’s sixth consecutive month of sales decline on Monday, calling it “tough sledding.”

![BYD pulls the cover off its stunning flagship electric SUV for the first time [Images] BYD pulls the cover off its stunning flagship electric SUV for the first time [Images]](https://automundochina.com/wp-content/uploads/2026/03/byd-pulls-the-cover-off-its-stunning-flagship-electric-suv-for-the-first-time-images-300x194.webp)