- Boyd Gaming (NYSE:BYD) is set to report its quarterly earnings this Thursday after market hours, following a previous quarter where it exceeded both revenue and earnings expectations.

- While last quarter saw revenue growth and a positive earnings surprise, analysts now anticipate a year-on-year revenue decline, putting additional focus on the company’s upcoming report.

- With investors watching whether Boyd Gaming can repeat its past outperformance, we’ll explore how these shifting expectations may reshape its investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Advertisement

Boyd Gaming Investment Narrative Recap

For shareholders in Boyd Gaming, the core belief centers on the company’s ability to grow through property expansions, enhanced amenities, and digital gaming partnerships, even as market cycles shift. While last quarter’s strong earnings narrowed focus on short-term momentum, the upcoming report, building on previous outperformance, is now overshadowed by analyst consensus projecting a 10% year-on-year revenue decline. This expected downturn becomes the most important short-term catalyst, yet it does not substantially alter the biggest risk, which remains competitive pressures affecting property-level performance, especially at The Orleans.

Among recent announcements, Boyd Gaming’s expanded partnership with Fanatics Betting and Gaming in Missouri stands out for its connection to digital growth initiatives. This collaboration follows the continued strength of Boyd Interactive and reflects ongoing efforts to diversify revenue beyond core casino operations. It offers a timely counter to traditional competitive risks, positioning the company for potential resilience as its underlying business mix evolves.

In contrast, weather-related disruptions in key regions are a risk investors should be aware of, particularly as…

Read the full narrative on Boyd Gaming (it’s free!)

Boyd Gaming’s outlook anticipates $3.5 billion in revenue and $563.3 million in earnings by 2028. This is based on a projected annual revenue decline rate of 4.7% and a slight decrease in earnings of $1.2 million from current earnings of $564.5 million.

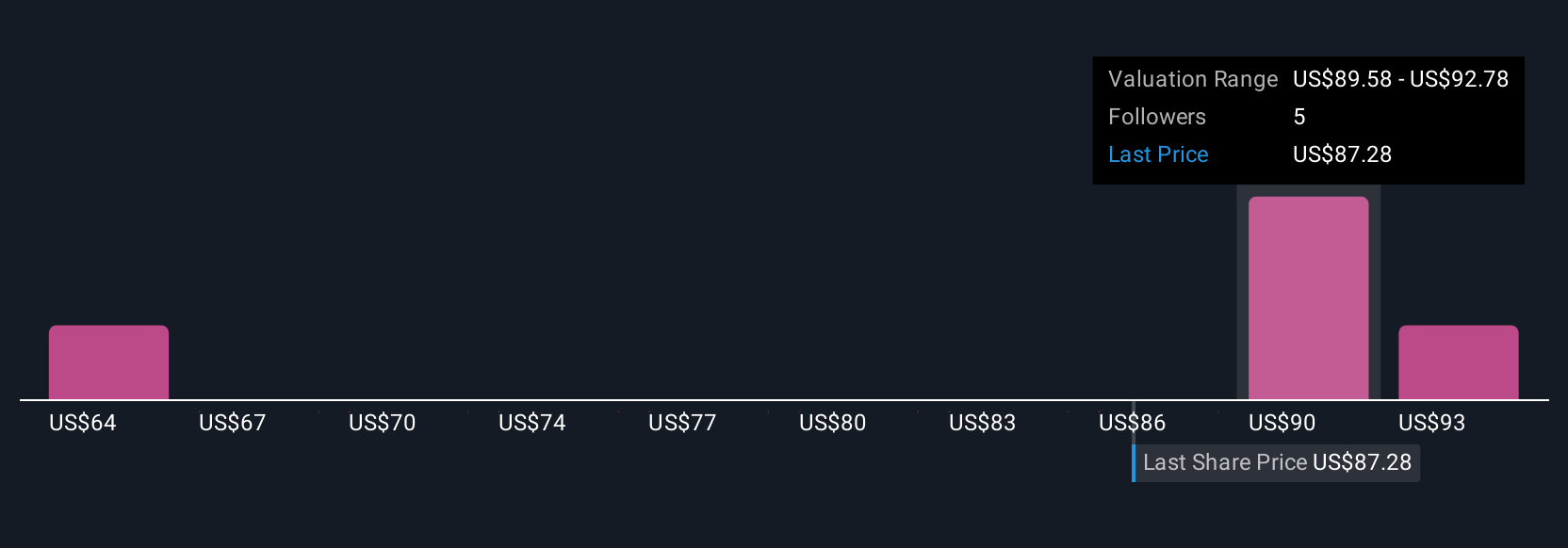

Uncover how Boyd Gaming’s forecasts yield a $91.46 fair value, a 10% upside to its current price.

Exploring Other Perspectives

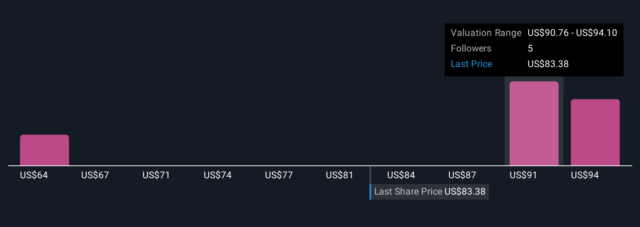

Four opinions from the Simply Wall St Community put Boyd Gaming’s fair value between US$64.03 and US$97.44. Amid this broad range, several market participants remain focused on near-term pressures from expectations of lower revenue and the implications for financial stability, consider exploring these different forecasts to inform your own view.

Explore 4 other fair value estimates on Boyd Gaming – why the stock might be worth 23% less than the current price!

Build Your Own Boyd Gaming Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Boyd Gaming might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com