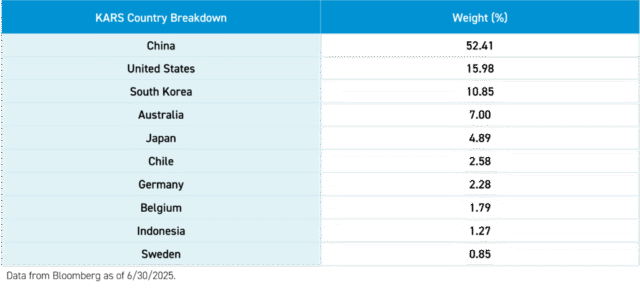

The rapid rise of electric vehicles (EVs) in China is playing an increasingly influential role in the global automotive landscape, capturing the attention of investors, policymakers, and consumers worldwide. At KraneShares, we’ve seen firsthand how innovation in China’s EV sector is powering growth and investment opportunities, which is why we launched the KraneShares Electric Vehicles & Future Mobility Index ETF (Ticker: KARS) in January 2018. KARS is designed to capture global companies that are driving the mobility ecosystem, with a healthy allocation to China’s top companies like battery manufacturer CATL and EV maker BYD.

To gain deeper insight into this dynamic market, Brendan Ahern, CIO at KraneShares, sat down with Phate Zhang, founder of CnEVPost, China’s leading English-language news source on new energy vehicles (NEVs). Their conversation highlighted the driving forces behind the growth of China’s EV industry and the opportunities and challenges on the horizon for those investing in the space.

Q&A with Phate Zhang, Founder of CnEVPost

Q: What’s your background, and can you tell us about CnEVPost?

I graduated from the University of International Business and Economics (UIBE) in Beijing in 2009 with a degree in finance. After graduation, I joined China Daily, writing English news about China’s economy and companies for two years, then moved to Reuters’ Beijing office for another two years. In 2013, I relocated to Shanghai and spent a year in corporate public relations at a state-owned company, but continued working in media, including six years at Wallstreetcn, where I covered the Federal Reserve and other central banks, White House policies, and international markets.

CnEVPost was created by chance: during the National Day holiday in October 2019, I bought a year of cloud services and set up a blog called CnTechPost to share news about China’s tech industry and products in my free time. As China’s EV industry expanded, EV content became a significant part of my posts, leading to the launch of CnEVPost at the end of 2020, focused solely on EV-related news. In April 2021, I left my full-time job to devote myself to these sites, and a few months later, I shut down CnTechPost to concentrate entirely on CnEVPost.

Q: What are the main factors driving China’s rapid EV adoption compared to the US and Europe?

I believe this is mainly due to government support, a well-established supply chain, and automakers quickly responding to consumer demand with products that meet their needs. While there have also been government stimulus policies in the US and Europe, EV adoption hasn’t grown as fast in those regions as in China. I think this is because of a lack of disruptive innovation from local companies, which has slowed local supply chain development and limited consumer options.

Over the past five years, innovation in the EV industry has been almost weekly, if not daily, in China. This includes stronger powertrains, improved designs, faster charging, and more advanced software, making EVs seem like the next generation of cars compared to traditional gas-powered vehicles for many people. Once you’ve driven one and gotten used to the experience, it is sometimes difficult to go back to traditional gas-powered cars.

Only Tesla currently offers such products in Europe and the US. Traditional automakers are moving cautiously and slowly, while Chinese startups are more nimble.

Q: I don’t think BYD’s achievements receive the attention and respect they deserve. What are your thoughts on the company and its founder?

I believe this is normal, as brand building and changes in public perception take time. BYD has been around for just 30 years, and its rise in the NEV sector has only happened in recent years. Before 2021, even in China, BYD was seen as a lower-end brand and not the first choice for car buyers. Only through the launch of numerous competitive new models over the past few years has BYD achieved its current position in China and globally.

Building brand awareness might take even longer in international markets. Established automakers naturally enjoy more trust. Additionally, many people still doubt products from Chinese companies, and shifting this mindset will also take time.

BYD chairman Wang Chuanfu is a leader who has directed the company to accumulate a wealth of technology over the past 30 years and deployed it strategically. The disruptive innovations enabled by these technologies have caught traditional automakers off guard, laying the groundwork for BYD’s rapid rise.

Q: How important are government policies and subsidies in shaping China’s EV market?

I think government policies can be decisive, but they are not enough alone. These subsidies allow consumers to buy EVs that offer a potentially enhanced experience than traditional cars at lower prices. China’s subsidies for the EV industry apply to all brands, including Tesla, Volkswagen, and Ford. Domestic automakers, especially startups, have been quicker to act and respond to shifting consumer preferences, which has helped them quickly gain ground.

Traditional domestic automakers have been slow but are catching up fast, launching new brands and competitive models. Foreign automakers have been caught off guard by the rapid market changes, losing some market share. If they take China’s EV market seriously, they can still succeed. For example, the N7 sedan recently launched by Dongfeng Nissan, led by its local Chinese team, has received good reviews.

Q: With over 100 EV brands in China, how do you see the market consolidating over the next five years, and which companies are most likely to survive?

I believe that about half of these EV brands, many of which are nearly unknown, may disappear in the next five years. Still, the well-known brands are likely to remain relatively safe. Currently, most industry experts recognize only about 50 to 60 EV brands. These brands should be fairly secure. It wouldn’t be surprising if many lesser-known brands vanished in the fierce competition ahead.

The companies that will survive are those with strong brand recognition, unique positioning, and their own technologies.

Q: How intense is the price war among Chinese EV makers, and how does it affect profitability and innovation?

Unlike previous years, this year’s price competition in China’s EV market is more subtle. Few companies have directly cut prices to join a price war, except for BYD and a few others in late May.

Our observation is that EV manufacturers have been updating products frequently this year to improve user experience and lower prices, which boosts sales. Leapmotor and Xpeng are prime examples, as both have refreshed many models this year, leading to significant growth.

In terms of profit, lowering prices through product updates is more sustainable than outright price cuts on existing models, though price reductions still hurt profits. At the same time, this pushes automakers to ramp up innovation, as they must meet increasingly selective consumer preferences.

Q: Reuters published an excellent article on how Chinese EV makers are adapting differently from other automakers. Is this mainly due to China’s manufacturing expertise, or are there other factors?

Yes, that’s a great article. Aside from leveraging China’s manufacturing supply chain, I see the quick actions by Chinese automakers and their pursuit of success. I believe international car companies also want to do the same, but face more constraints. Currently, Chinese automakers tend to be smaller, which gives them more room for innovation. This may be the dilemma of innovators.

Q: EV gets a lot of attention, though the correct term should be NEV, which includes EV and hybrids. When I met with BYD last year, they discussed their hybrid tech at length. Do you have any thoughts on EV versus hybrids in China?

China’s city-level licensing restrictions complicate this topic. For instance, Shanghai has been providing free license plates for years to buyers of battery EVs (BEVs) and plug-in hybrid EVs (PHEVs), while buyers of traditional internal combustion engine cars need to pay about RMB 90,000 in an auction for a license plate. Starting in 2023, Shanghai no longer offers free plates for PHEVs.

Beijing enforces stricter rules, treating PHEVs the same as gasoline cars. Buyers of BEVs must also secure license plate quotas in advance, often taking years to do so. Guangzhou and Shenzhen have different policies.

These policies have made BEVs more popular in China’s big cities. Lower-cost hybrid models are still more common outside these areas due to lower income levels and less developed charging infrastructure. Overall, the share of BEVs in NEV sales has been steadily falling, from over 80% in early 2021 to about 60% now, according to data from the China Passenger Car Association (CPCA).

I believe that unless China’s policies change significantly, PHEVs (including extended range EVs known as EREVs) will continue to grow, mainly driven by demand from second and third-tier cities and less developed regions.

Q: What are the main risks and opportunities for investors eyeing China’s NEV sector over the next five years?

While I don’t offer investment advice, I can share some personal insights. For the NEV industry and all others, the key for investors is to focus on incremental changes rather than just the current state of the industry.

When evaluating a specific company, investors should ask if it can keep growing at its current pace, whether there are risks they haven’t seen, and if new businesses or market shifts could unexpectedly impact performance—up or down.

Additionally, international macroeconomic and geopolitical factors, especially Federal Reserve policies, require close attention. Having spent six years focused on global macroeconomics and market reporting, I believe liquidity in international markets often heavily influences the valuation of Chinese assets.

Conclusion

Chinese automakers and battery suppliers have emerged as influential players in automotive technology, manufacturing scale, and cost competitiveness. Their rapid expansion, driven by aggressive export strategies, pioneering R&D, and investments in overseas production, has contributed to the transition to clean transportation far beyond China’s borders. As international competition intensifies, China’s advancements are likely to dictate how the global auto industry pivots to a more sustainable and innovative future.

The KraneShares Electric Vehicles & Future Mobility Index ETF (Ticker: KARS) provides investors with access to many companies in China’s dynamic EV sector and to other global companies engaged in the production of EVs and/or their components.

This material contains the speakers’ opinions and third-party projections. It is provided for informational purposes only and should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the fund. While the discussion may highlight potential opportunities in a particular sector or strategy, investors should also consider the inherent risks associated with any investment—including economic, regulatory, market, and geopolitical uncertainties—that may affect performance and outcomes. A balanced evaluation of both risks and potential rewards is essential when considering any investment.

For KARS standard performance, top 10 holdings, risks, and other fund information, please click here.

Definitions:

BEVs (Battery Electric Vehicles): vehicles powered entirely by electricity stored in rechargeable batteries, with no internal combustion engine or gasoline use; they rely solely on electric motors for propulsion and are charged by plugging into the electric grid.

PHEVs (Plug-in Hybrid Electric Vehicles): vehicles that combine an internal combustion engine with an electric motor and a battery that can be recharged by plugging into an external power source; they can be driven short distances using only electricity, after which the gasoline engine takes over to extend range.

EREVs (Extended Range Electric Vehicles): vehicles powered primarily by electricity from a battery and an electric motor, similar to BEVs. However, unlike BEVs, EREVs include a small internal combustion engine (ICE) that acts only as a generator to recharge the battery when it is low, not to drive the wheels directly. This configuration is sometimes called a “series hybrid” because the engine’s only function is to generate electricity, not to provide mechanical propulsion.