When it was announced that BYD’s sales had overtaken those of Tesla, there was those who put the blame squarely the erratic behavior of Elon Musk. In reality the Chinese company had been building up to this point for years. Here’s how they did it – and what they’re going to do next

BYD stands for Build Your Dreams, but Beyond Your Dreams might be a better phrase to describe the astonishing success it has enjoyed. In the 20 years since the launch of the BYD F3, the first car produced of its own design, the Chinese manufacturer has risen to become the world’s leading electric vehicle maker in terms of volume, developing proprietary battery technologies that are the envy of its rivals, Tesla included. Its remarkable rise can also be attributed to its skills at vertical integration. Ownership of its supply chain has meant increased profits and greater protection against market instability, when compared with its competitors.

At the recent launch of the Sealion 7, BYD’s executive vice president Stella Li said, “Our goal is to be the global number one automotive brand,” and right now that goal looks eminently within their grasp. In 2024, BYD sold 1.76m battery electric vehicles (BEVs) worldwide, second only to Tesla’s 1.79m. If you take into account plug-in hybrid electric vehicle (PHEV) sales, then BYD sold 4.3m new electric vehicles (NEVs) in total last year, more than twice as many as Tesla, which does not make PHEVs. That lifted the Chinese firm’s share of the global NEV market to 22%, meaning one in five electric vehicles purchased in 2024 was a BYD, leaving Tesla in second place with 10.3% market share, and Chinese rival Wuling in third with 4%. BYD’s diverse range of vehicles has helped it to market leadership. The compact Dolphin hatchback, the Sealion range of compact and midsize SUVs and the Seal sedans are among the firm’s best-selling models. The Yangwang range of luxury cars, launched by BYD in January 2023, includes the U9 supercar; it sold 88 in China in 2024.

However, these numbers are mainly achieved in China, with homeland sales accounting for about 90% of the total. Reports suggest that BYD aims to have 50% of sales achieved overseas by 2030 – an ambitious target even by its own reputation for growth – which it intends to do by increasing its manufacturing capabilities in Europe and South America.

Cutting edge

When former UK prime minister Tony Blair, launched the manifesto that helped Labour win the 1997 general election, he boiled down the party’s three priorities to “education, education, education.” BYD’s astonishing performance might similarly be summarized as “integration, integration, integration”. Depending on whose analysis you read, a BYD car is 75% to 85% in-house parts; other experts say only the windows and tires come from outside suppliers.

The most notable of those parts is the Blade Battery, an LFP unit launched five years ago, which has developed an unparalleled reputation for safety and performance. (See The sharpest in the box) BYD supplies Blade Batteries and associated technologies to over a dozen of its leading competitors, through its FinDreams subsidiary, and has entered into joint ventures to build battery packs and cells outside China, in locations in America, Asia and Europe. The firm also controls the pipeline making its semiconductors, computer chips. These technical innovations, in both software and hardware, have led BYD to the top table of electric vehicle manufacturing. (See Beyond the battery).

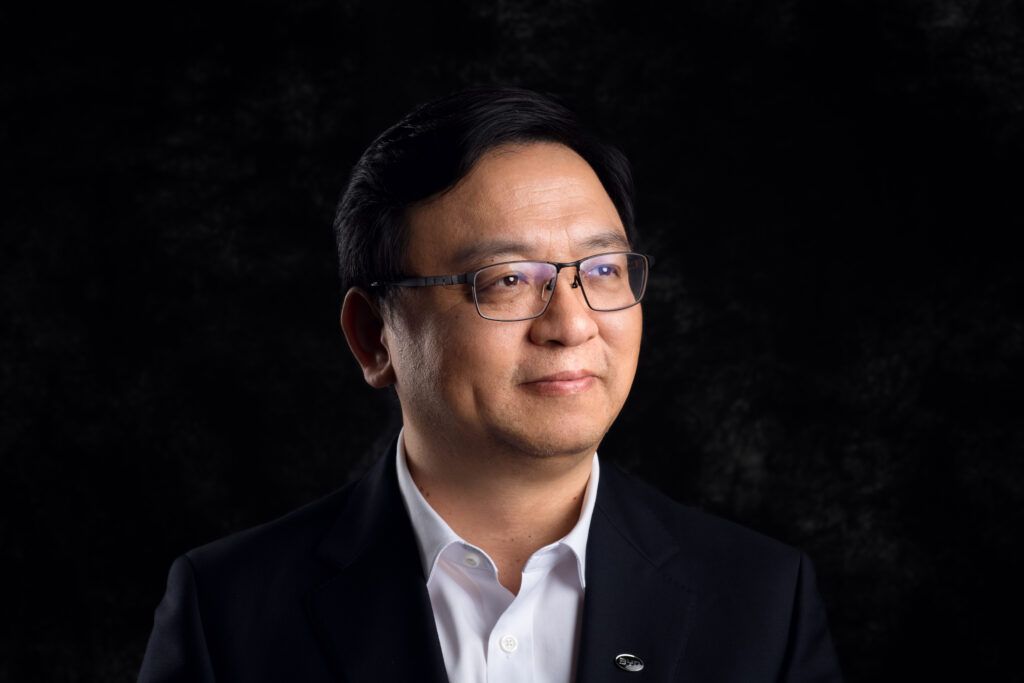

With all these ups come the downs, and the first half of 2025 has been a particularly volatile period for BYD. Its CEO, Wang Chaunfu, who established his firm in 1995 as a maker of batteries; it celebrated its 30th birthday in February as the world’s second largest supplier of mobile phone batteries, along with its success with EVs. Chaunfu’s personal wealth was estimated at $30b (£22.2m). In March, BVD announced megawatt-speed batteries that would enable its cars to add 400km of range with a five-minute charge – about twice as fast as Tesla’s current best. The Han L saloon and Tang L SUV, for now only on sale in China, have this capability.

And yet: BYD and its Chinese rivals, including Geely Group and Leapmotor have been criticized by the Chinese government. At the start of June, the Chinese car industry was attacked for entering into a price war; BYD was not explicitly named, but the inference to the industry’s largest maker was clear. China’s lackluster economy, said the government, is not benefiting from auto makers’ “rat race” to lower price points, which has led to reduced margins (although consumers certainly are enjoying the fallout from the price war). The criticism also suggested that low prices lead to lower quality – both actually and in the minds of potential customers – and that “made in China” may again become a phrase synonymous only with poor-quality goods. However, BYD has excellent levels of exports, its cars are seen as good value, and it has been getting some of its best-ever notices in reviews.

Safety in numbers

In May this year, the last month for which complete records are available, BYD had its best ever monthly sales total, of 376,930. Over the first five months of 2025, BYD has sold 1.74m vehicles, up 34% on the same period in 2024 – and about 200,000 less than the total number of EVs it sold in all of 2024. May was also the month in which BYD sales in Europe overtook Tesla’s – a truly milestone moment, but one which has come with a drop in sales of the American cars.

These are undeniably great numbers, but BYD’s shares dropped 17% in the week to 2 June, amid the criticisms and also reflecting May’s year-on-year growth rate of “only” 14%, its lowest y-o-y performance for nearly six years. (This is one of the classic problems of capitalism: if astonishing business performance levels out to merely highly impressive performance, the numbers on the balance sheet still turn red.) In that week, BYD announced it would make a kei (microcar) EV for the Japanese market, the sort of thing that usually upticks a firm’s share price, but not in this instance.

So, what does this mean for the future of BYD in the global EV market, which the consulting firm EY estimates to be generating $660b in sales by 2030? Industry watchers agree that BYD’s market share will increase – if not quite to the levels the firm is projecting – despite the hurdles it faces in becoming a truly global car maker. Tariffs and trade barriers, not least those set by President Trump, mean that BYD is expanding its manufacturing capabilities, of both batteries and vehicles, in Europe and Latin America. The CEO of JP Morgan Chase, America’s largest bank, recently told a US economic forum that Trumps’ tariffs will not force the Chinese to come to the negotiating table, but to instead build a workaround. “When they have a problem, they put 100,000 engineers on it,” he said. “They’ve been preparing this for years.”

BYD is also upping its efforts with driverless car technology. CEO Chaunfu was not a fan of developing the software along with his batteries and vehicles, but young consumers increasingly want the tech in their cars (a move facilitated say some, by the company’s younger engineers gaining a louder voice. In February, BYD launched God’s Eye, available in all new models since, an advanced assisted driving platform which uses radar, LiDar and lasers. One report suggests remote parking via a mobile app will be rolled out next year.

In dreams

For BYD to truly transform the global EV market, as it plans to, will require more than just its undoubted financial and technological advantages. Vertical integration in China has been facilitated by favorable government conditions (hence the slight telling-off early this year), especially subsidies for and less regulation of Chinese green tech companies. China’s migrant labor force is of course a factor, too. When Amnesty ranked BYD alongside Hyundai and Mitsubishi as having the auto industry’s joint-worst human rights record in November 2024, the usual thing happened in the West when this sort of news breaks: some hand wringing, a small number of boycotts, then business as usual. This kind of thing will be much harder to shake off when building factories and facilities outside of China, where costs will be much higher and government restrictions tighter. The recent announcement that the company has committed to base its European business headquarters in Budapest, Hungary – supported by a new European research and development centre – suggests that this issue is well in hand. “Establishing BYD’s European headquarters in Hungary is a natural progression,” said Chairman Chuanfu. “We aim to deepen integration with local markets, enhance our localisation capabilities and brand influence, and ensure sustainable growth in Europe.”

Navigating tariff barriers will be as important as making a better battery. But BYD knows this, and if it can keep its costs down to make EVs that consumers cannot ignore due to their price point and performance, then their remarkable success story will continue to be written. No one is better placed than BYD to become the number one EV maker in the world.

The sharpest in the box

At the heart of everything BYD does is its battery tech; hardly surprising given the company’s origins as a sole battery maker. The Blade Battery, launched in March 2020, has won plaudits for its safety and performance. The thin blade-like cells that give the battery its name are arranged to give maximum battery power in a given space: they’re the most physically efficient batteries on the market. Having an array of cells does away with the need for traditional pack housing and this cell-to-body integration adds to the battery system’s performance.

The cathode material is lithium iron-phosphate (LFP), which BYD claims is safer and more durable than batteries using lithium-ion – claims backed up by third-party observers and analysis. (there have been some reports of BYD vehicles catching fire; the company does not acknowledge any). The Blade Battery performed particularly well on the Nail Penetration Test, with no smoke or fire and only a relatively small and safe rise in battery surface temperature.

With the announcement of the ultra-rapid charge of 400km in five minutes, BYD is laying down a marker for the industry but also making a rod for its own back. New charging stations capable of such speeds need to be built; 4,000 “flash-charging” stations across China have been promised. Can such a network be built in other countries? It’s the sort of thing that will require cooperation and understanding, at a time when global trade is short of both. But with BYD already supplying major rivals with battery tech, the Blade Battery, and any potential successor unit, is at the forefront of electric vehicle power storage.

Beyond the battery

At the 2021 Shanghai Motor Show, BYD unveiled e-platform 3.0, the core component system for all its electric vehicles. It’s a modular approach to EV manufacture that only a company with the vertical integration of BYD can realistically rely on: “we make and own almost all the parts, so we can standardize our vehicles to a large extent”. With highly integrated architecture, encompassing battery, motor and electronic controls, other facets of the EV are then left open to greater customization. It’s the sort of thing that BYD might license to other firms in the future.

BYD’s PHEV innovations are also much admired. Its DMi super-hybrid system uses a Blade Battery alongside a high-speed, dual motor oil-cooled powertrain with dual controllers, and only uses the engine for assistance. If the battery is fully charged, then the vehicle becomes fully electric. With a full tank alongside a full battery, a combined range of up to 699 miles is claimed for the BYD Seal U DM-i SUV, alongside a not-inconsequential 78 miles electric-only.