The European Automobile Manufacturers’ Association (ACEA) is asking the European Union to lower its car CO₂ reduction targets when legislation is reviewed later this year.

‘Green’ observers warn that the changes, which would mean not obliging manufacturers to lower CO2 by as much as in present targets, would harm not only the environment but also Europe’s competitiveness.

The ACEA wants vehicles running on so-called carbon-neutral fuels such as biofuels or e-fuels to be counted as emitting zero grams of CO₂ per kilometre. These fuels do emit CO2 during combustion, but this emission is said to be offset by an equivalent amount of CO2 being removed from the atmosphere during the production process.

The non-profit organisation Transport & Environment (T&E) reacted by saying this “loophole” would cut the share of electric vehicle (EV) sales by 25 per cent in 2035, as manufacturers “could continue selling large volumes of highly polluting combustion engine cars”.

T&E director Lucien Mathieu said in a press statement today that would “completely undermine the investment certainty needed for Europe to catch up in the EV race”.

“Turning the EU’s most important automotive regulation into Swiss cheese will not restore the industry’s competitiveness,” he said.

He argued that such a move would further strengthen the advantage held by Chinese carmakers, rather than helping European EV producers.

This comes amid repeated warnings from the European automotive industry that the market is becoming increasingly “difficult”, resulting in factories shutting or moving abroad.

Only a handful of European countries manufacture electric vehicles and they began much later than China, which remains the world’s EV production hub, accounting for more than 70 per cent of global output in 2024, according to the 2025 outlook by the International Energy Agency.

The EU produced around 1.8 million battery electric vehicles (BEVs) in 2024, with Germany leading production. Output is rising thanks to European policies supporting decarbonisation and attracting investment, although growth varies, with some manufacturers and countries experiencing stagnation.

Efforts to curb air and urban pollution gained traction rapidly in China due to its numerous mega-cities of over 20 million inhabitants and government incentives aimed at boosting domestic manufacturers.

Over time, Chinese producers developed expertise and know-how that is increasingly hard to match.

While the EU promotes EV adoption at home, most of the vehicles sold are of Chinese origin. Even when Chinese firms such as BYD set up plants in EU member states, only part of the production is local, with the main benefits still flowing back to China. Chinese foreign direct investment in the European EV sector has risen every year since 2019.

Beyond production, consumption also matters and countries need to adapt their parking, charging and road systems accordingly.

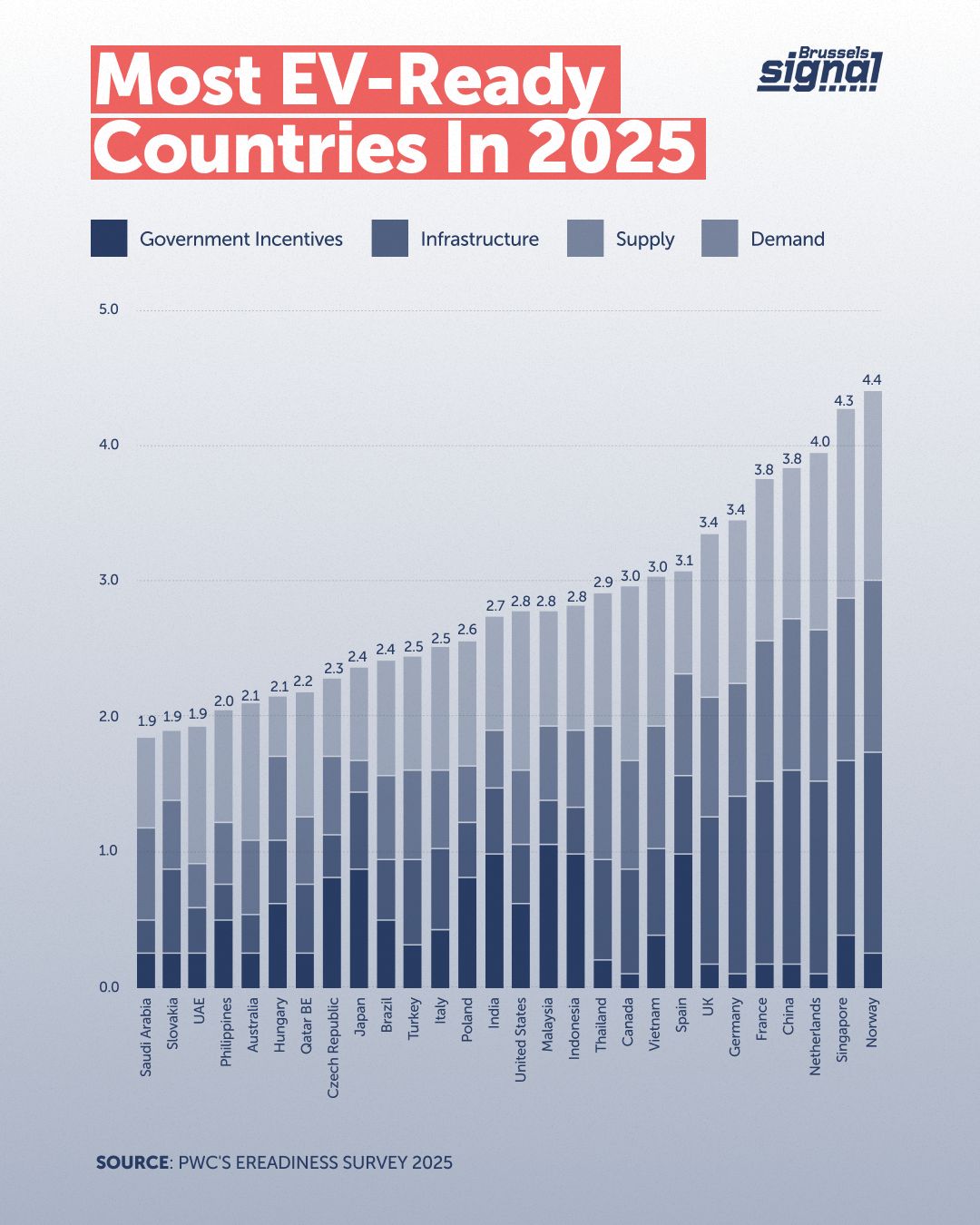

Only three EU nations – the Netherlands, France and Germany – feature among the world’s 10 most EV-ready countries, according to a PwC report published yesterday. The Netherlands ranks second, ahead of China, while Norway takes the top spot.

Policy analyst Varg Folkman, of the European Policy Centre in Brussels, originally from Norway, told Brussels Signal:”There have been a lot of purchasing subsidies for EVs in Norway and, in general, perks for those who go electric. For instance, you have been exempt from some fees, allowed to drive in bus lanes and take certain ferries for free.

“The same goes for charging infrastructure, which has been heavily incentivised and supported by the state in various ways, alongside rising demand as more electric cars hit the road,” he added.

Financial incentives and infrastructure play a key role: PwC’s survey found that 63 per cent of buyers cite cost savings as their main motivation, 44 per cent appreciate being able to charge at home, and 21.7 per cent at the workplace. However, state incentives account for just 10 per ent, and regulation for under 5 per cent. Status and social influence together make up less than 8 per cent.

The European car industry, still struggling to catch up in the EV race, is also focusing on alternatives to reduce pollution such as developing low-carbon fuels and adopting technologies that cut CO₂ emissions during production.

ACEA’s proposal to scrap the 2027 “utility factor” for plug-in hybrids would, according to T&E, reduce electric car sales by 10 per cent. The group is also asking for credits for CO₂ reductions in manufacturing and certain technologies, which T&E says would cut EV sales by a further 6 per cent.

“Together, the loopholes demanded by ACEA mean carmakers would only need to achieve a 52 per cent EV market share by 2035,” the non-profit warns.

As European consumers increasingly buy Chinese EVs, the political debate is now whether to make European models more affordable – through subsidies, tax cuts, bonuses or investment in R&D – or to impose higher import duties on Chinese vehicles.

Few European EVs are priced below €30,000; the average remains above €50,000, while Chinese brands offer models for around €15,000.

In October 2024, the EU introduced tariffs ranging from 7.8 per cent to 35.3 per cent, in addition to the standard 10 per cent import duty, bringing the total to as much as 45.3 per cent. These measures followed an anti-subsidy investigation that found Chinese EV manufacturers benefited from substantial state support, giving them an unfair advantage.

China has criticised the decision and lodged a complaint with the World Trade Organisation (WTO).