China’s electric vehicle (EV) industry entered 2026 with momentum—and mounting pressure. At home, a fierce price war cut margins to the bone. Abroad, Chinese automakers pushed harder than ever, flooding global markets with low-cost EVs and hybrids. The result was a historic export surge that is now reshaping trade flows, competitive dynamics, and the global auto hierarchy.

A Record Export Surge Signals a Strategic Shift

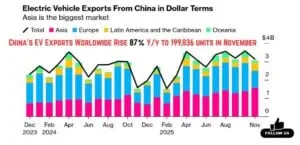

Bloomberg reported that China’s EV exports jumped 87% year-over-year to nearly 200,000 units in November, according to customs data. This was not a one-off spike. It reflected a deliberate pivot away from an overcrowded domestic market toward overseas growth.

Automakers faced brutal competition at home. Discounts deepened. Profitability shrank. As a result, exports became a lifeline. For many companies, overseas markets now serve as the main buffer against falling domestic sales.

This export push also revealed a sharp understanding of global trade rules. Chinese brands did not simply ship more cars. They shipped the right cars to the right places.

Mexico Emerges as an Unexpected Gateway

Mexico became the biggest surprise in China’s export map. Bloomberg further revealed that, in November alone, the country imported 19,344 Chinese electric vehicles. It marked a staggering 2,300% surge year-over-year, making it the top destination for Chinese EV exports that month

This growth reflected strategic timing. While the United States imposed a 100% tariff on Chinese EVs, Mexico maintained looser trade barriers. That made it an attractive entry point into North America’s broader automotive ecosystem.

Thus, Chinese manufacturers used Mexico not only as a sales market but also as a potential production and logistics hub. In a fragmented global trade environment, flexibility became a competitive advantage.

Europe’s Tariffs Fail to Stop Chinese Brands

Europe also remained a critical battleground. Despite new tariffs, Chinese carmakers captured a record 12.8% share of Europe’s EV market in November, the highest level ever recorded.

The European Union imposed extra duties ranging from 17% to over 35% on Chinese battery-electric vehicles after a subsidy investigation. In theory, the move aimed to shield European automakers from low-cost imports. In practice, it created a loophole.

Plug-in Hybrids Become the Trojan Horse

The tariffs targeted only fully electric vehicles. Plug-in hybrids faced just the standard 10% import duty. And Chinese brands reacted fast.

Chinese automakers shifted aggressively into plug-in hybrids. Exports of these vehicles to Europe soared, rising sixfold year-over-year at one point in 2025.

In hybrid categories, Chinese brands achieved a market share of over 13% across the EU, EFTA countries, and the UK. They also surpassed Korean automakers for the first time, marking a significant shift in the competitive landscape.

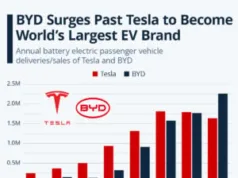

BYD led the charge. Its European registrations more than tripled year-over-year, nearly matching Tesla’s monthly sales. The BYD Seal U quickly became one of Europe’s top-selling plug-in hybrids. SAIC Motor’s MG brand also expanded rapidly, delivering hundreds of thousands of vehicles across the region.

European demand itself remained strong. EV registrations across the continent rose sharply, proving that growth was not coming at the expense of market expansion—but from intensified competition.

China Overtakes Japan in Global Auto Sales

The export boom contributed to a broader milestone. As per industry reports, in 2025, Chinese automakers are projected to sell around 27 million vehicles globally, surpassing Japan for the first time in over two decades.

This shift marks a historic turning point. Just three years earlier, Japan outsold China by millions of vehicles. Now, Chinese brands dominate growth charts, powered by EVs and plug-in hybrids that account for the majority of new passenger vehicle sales at home.

BYD and Geely both climbed into the global top ten automakers, signaling China’s arrival as a full-spectrum automotive superpower.

Pressure Builds Across Asia, Europe, and Emerging Markets

Chinese exports surged across Southeast Asia, Latin America, and Africa. In Thailand, long dominated by Japanese brands, market share erosion accelerated. In Latin America and Africa, Chinese vehicles gained ground as affordability and rapid rollout trumped brand loyalty.

Japanese automakers felt the strain. Profits declined. Capacity utilization weakened. The challenge went beyond tariffs—it cut to the heart of competitiveness in the EV era.

Export Growth Masks Domestic Weakness

While exports surged, cracks widened at home. BYD, China’s largest EV maker, recorded declining domestic sales for three straight months in late 2025.

To stay competitive, the company slashed prices across its lineup. Some models saw cuts of more than 30%. Entry-level EVs fell to prices once considered impossible, intensifying what industry analysts describe as “involution”—destructive competition that destroys value without creating new demand.

Exports helped offset these losses. In November alone, BYD shipped a record number of vehicles overseas, underlining how critical foreign markets have become to China’s EV giants.

The EV giant also began shipping production equipment to its new plant in Hungary in late 2025. Trial production is expected in early 2026, with mass manufacturing planned shortly after. The facility will initially focus on compact models designed for European buyers.

This move allows Chinese brands to sidestep import duties while embedding themselves deeper into regional supply chains. It also raises the stakes for European manufacturers already struggling with cost pressures and slower innovation cycles.

As tariffs pushed Chinese automakers to think beyond exports, local production emerged as the next phase of their global strategy.

The Bigger Picture: Trade, Technology, and Power

China’s EV export surge tells a larger story. Price wars at home forced companies to become leaner, faster, and more aggressive globally. Tariffs reshaped product strategies but failed to stop expansion. Plug-in hybrids, local factories, and emerging markets became tools of adaptation.

As 2026 unfolds, the global auto industry faces a new reality. China no longer competes only on volume. It competes on speed, strategy, and scale. And for rivals, the pressure is only beginning.