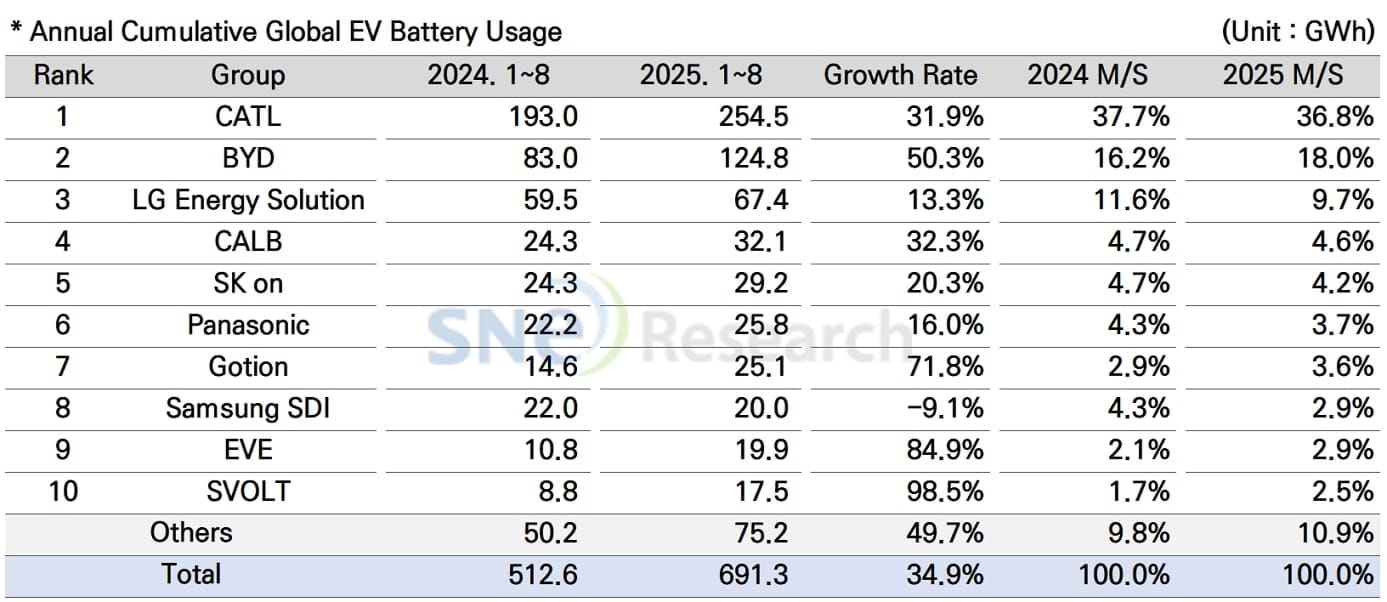

According to the new statistics, the global energy output of batteries for electric and hybrid vehicles from January to August 2025 amounted to 691.3 GWh, representing growth of 34.9 per cent compared to the same period last year. CATL continues to dominate the market for traction batteries, growing by 31.9 per cent to 254.5 GWh. This represents a market share of 37 per cent.

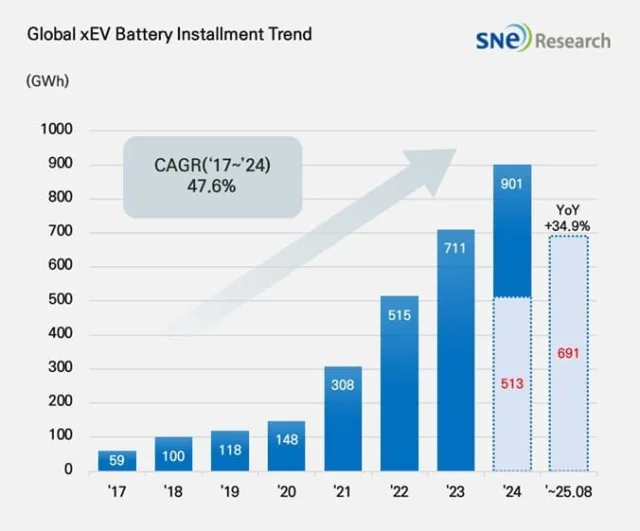

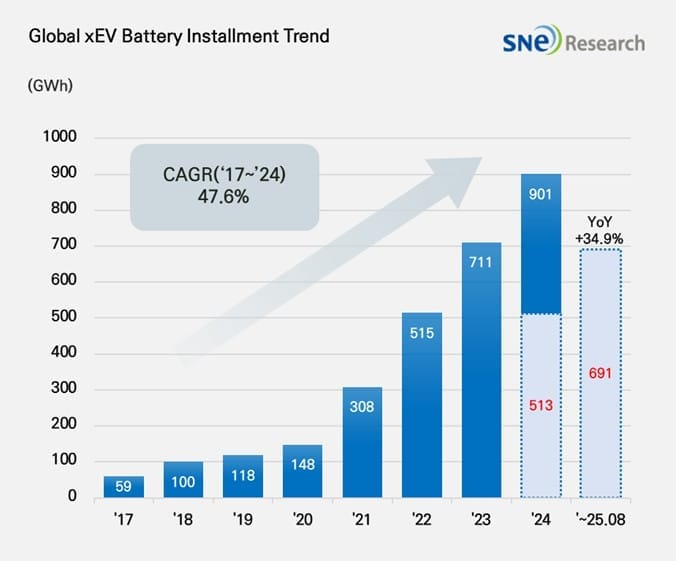

But let’s first take another look at the year-on-year comparison: as SNE Research explains, the total energy output in 2024 amounted to 901 GWh. In the period from January to August under review, analysts recorded 513 GWh last year. As the figure for the current year was already almost 35 per cent higher at 691 GWh in August, the 1,000 GWh mark is likely to be easily exceeded in 2025. The next statistics from the South Korean market researchers will provide more information on this.

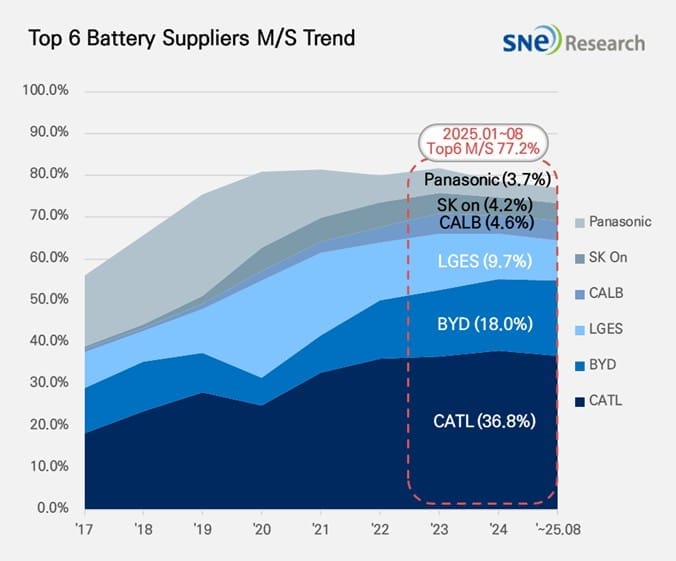

The trend of Chinese manufacturers securing ever larger market shares continues. CATL has achieved a market share of 36.8 per cent so far this year, followed by BYD with 18 per cent (124.8 GWh, +50 per cent YoY). LG Energy Solution follows with a 9.7 per cent market share (67.4 GWh, +13 per cent YoY), CALB and SK On with 4.6 and 4.2 per cent market share respectively, and Panasonic with 3.7 per cent. The study focuses in particular on these six companies (top 6). For the sake of completeness, however, it should be mentioned that they are followed by the quartet of Gotion High-Tech, Samsung SDI, Eve Energy and Svolt.

So while the three Chinese manufacturers in the top 6 alone dominate 59.4 per cent of the market, South Korean manufacturers continue to lose influence: LG Energy Solution, SK On and Samsung SDI (not represented in the top 6) had a cumulative market share of 16.8 per cent from January to August 2025, which corresponds to a decline of 3.8 percentage points compared to the same period last year. However, only Samsung SDI recorded a decline in sales (20 GWh, -9.1%), while LGES and SK On (29.2 GWh, +20% YoY) grew, albeit well below the overall market.

SNE Research also provides a ranking of the top six battery suppliers, showing which car manufacturers are their largest customers. CATL supplies national OEMs such as Zeekr, Aito, Li Auto and Xiaomi, as well as international brands including Tesla, BMW, Mercedes-Benz and Volkswagen.

BYD is known for its strong vertical integration of the value chain for its batteries and cars, which allows it to leverage price advantages. ‘The company consolidated its presence not only in the Chinese domestic market, but also in the global market. BYD recorded remarkable growth in the European market in particular,’ write the analysts at SNE Research. In the first half of this year, the use of BYD batteries in Europe stood at 8.6 GWh, an increase of 263 per cent compared to the previous year.

LG Energy Solution’s batteries are mainly purchased by Tesla, Chevrolet, Kia and Volkswagen. Tesla’s sharp decline in sales this year had a significant impact on LGES: “Due to a slowdown in sales of Tesla models, to which LG Energy Solution’s batteries are installed, the usage of LGES’ batteries by Tesla saw a 15.8% YoY decrease.” This was offset by strong sales of the Kia EV 3 on the global market and increased sales of the Chevrolet Equinox, Blazer and Silverado EV.

The report does not provide any details about CALB. Hyundai Motor Group, Mercedes-Benz, Ford and Volkswagen are named as the main customers for SK On. Strong sales of the Hyundai Ioniq 5 and Kia EV 6, the VW ID.4 and ID.7, and the Ford Explorer EV helped SK On achieve moderate growth despite declining sales of the Ford F-150 Lighting.

Panasonic mainly supplies Tesla and has accelerated the restructuring of its supply chain in response to the recent tightening of US tariffs on Chinese batteries and raw materials: “To be specific, Panasonic is working on lowering its dependency on the Chinese materials, expanding the procurement of local materials, and securing new material sources in order to increase the stability in battery production. These efforts are expected to lay a significant foundation for recovery in the usage of batteries made by Panasonic and maintaining its market share in the North American market,” according to the experts’ assessment.

This article was first published by Cora Werwitzke for electrive’s German edition