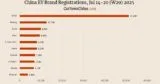

In the first whole week of August, the Chinese EV market was mainly down, with several exceptions. Onvo was down 13%, Xpeng was down 13% and BYD was down 10%, while Tesla was up 22%, compared with the week before. The first week of the month is usually weak as automakers recover from the end-of-month sales push.

Nio Group registered 6,100 vehicles, down 23.1% from 7,930 the week before. The Nio brand, together with the Firefly sub-brand, registered 2,900 units, the breakdown is not yet available and will be updated later.

The weekly brand’s EV sales were published by Li Auto. However, Li Auto ceased publishing them in March 2025 after the China Association of Automobile Manufacturers (CAAM) “recommended” that Li Auto, media and any third parties end it. CAAM says weekly data “undermines the industry order” and “fuels vicious competition.” Since then, Li Auto has published only its own weekly EV registration.

The weekly data are used by consultants, analysts, or investors to see the sales trend and forecast monthly deliveries. They show how many cars were registered for road traffic, which can be later compared with automakers’ self-reported monthly sales, which, unlike registrations, include cars for showrooms, test cars, and other uses.

Most of China’s media have followed CAAM’s recommendation to stop publishing weekly figures. CarNewsChina continues to publish weekly insurance registrations, based on China EV DataTracker data.

The numbers are rounded and present the brand’s new energy vehicle (NEV) sales in China, the government term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

Week 32 of 2025 (W32) was between August 4 and August 10. W32 of 2024, used for year-over-year comparison, was between August 5 and 11.

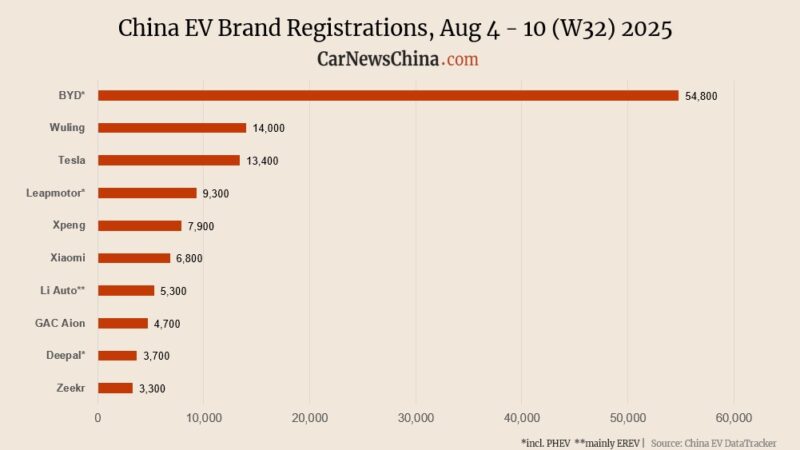

BYD brand registered 54,800 vehicles, down 10.1% from 60,930 the previous week. Year-on-year, this marks a 22.4% decline from 70,600.

Fang Cheng Bao registered 3,000 vehicles, down 12.5% from 3,430 the previous week. Year-on-year, this is up 98.7% from 1,510.

Denza registered 1,700 vehicles, down 27.7% from 2,350 the previous week. Year-on-year, this is down 22.7% from 2,200.

Wuling registered 14,000 vehicles. Year-on-year, this is up 41.4% from 9,900.

Tesla registered 13,400 vehicles, up 21.6% from 11,020 the previous week. Year-on-year, this is a slight decline of 0.7% from 13,500.

Leapmotor registered 9,300 vehicles, down 8.7% from 10,181 the previous week. Year-on-year, this is an increase of 97.9% from 4,700.

Xpeng registered 7,900 vehicles, down 12.9% from 9,071 the previous week. Year-on-year, this is up 229.2% from 2,400.

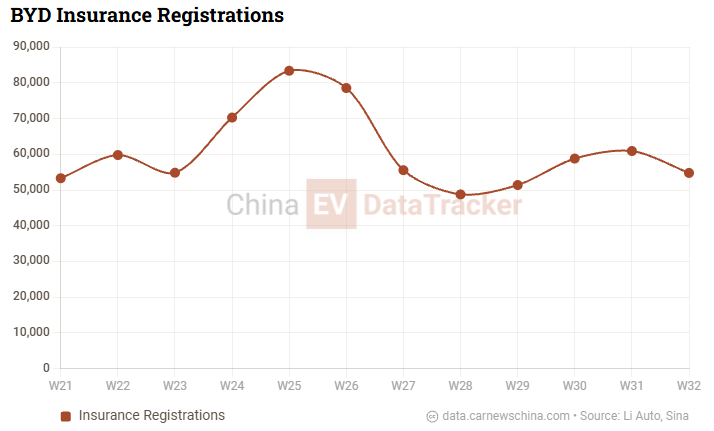

Xiaomi registered 6,800 vehicles, down 10.3% from 7,577 the previous week. Year-on-year, this is up 74.4% from 3,900.

Li Auto registered 5,300 vehicles, down 3.2% from 5,476 the previous week. Year-on-year, this marks a 58.6% drop from 12,800.

Deepal registered 3,700 vehicles, down 6.3% from 3,947 the previous week. Year-on-year, this is up 32.1% from 2,800.

Zeekr registered 3,300 vehicles, up 13.5% from 2,908 the previous week. Year-on-year, the number is unchanged.

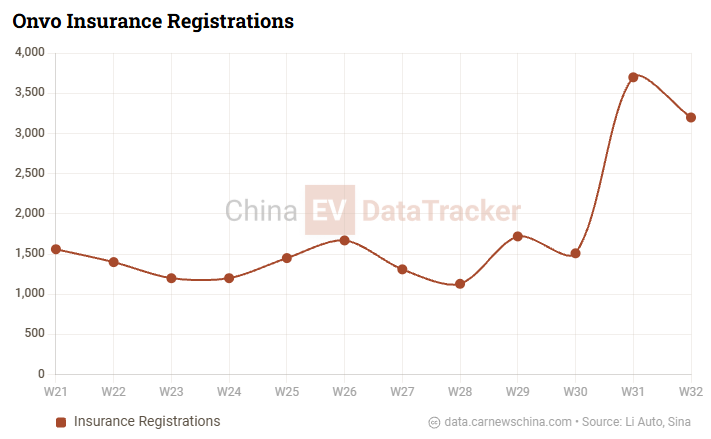

Onvo registered 3,200 vehicles, down 13.5% from 3,700 the previous week.

Avatr registered 1,800 vehicles, down 2.7% from 1,850 the previous week.

Recommended for you

China EV registrations in week 31: Nio 3,450, Onvo 3,700, Xpeng 9,071, Tesla 11,000, BYD 60,930

China EV registrations in week 30: Nio 3,200, Xpeng 8,400, Tesla 10,650, BYD 58,810

China EV registrations in week 29: Nio 2,500, Xiaomi 7,200, Tesla 9,900, BYD 51,400

Follow us for ev updates