In the second week of April, the China EV market was mostly down with several exceptions. Nio was up 95%, Tesla 50%, while Xpeng was down 10%.

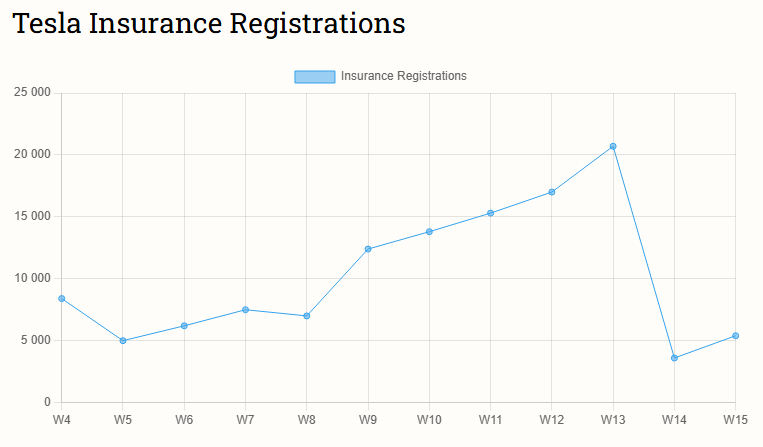

351,000 passenger cars were registered in China, up 3.9% from last week. Of these, 186,000 were electric vehicles, meaning the EV penetration rate was 53%, up 2.9% percentage points from last week.

The weekly sales were published by Li Auto. However, Li Auto ceased publishing them in March after the China Association of Automobile Manufacturers (CAAM) “recommended” that Li Auto, the media and any third parties end it. CAAM says weekly data “undermines the industry order” and “fuels vicious competition.” Since then, Li Auto has published only its own EV registration.

The weekly data are used by consultants, analysts, or investors to see the sales trend and forecast monthly deliveries. They show how many cars were registered for road traffic, which can be later compared with automakers’ self-reported monthly sales, which, unlike registrations, include cars for showrooms, test cars, and other uses.

China-controlled media have followed CAAM’s recommendation to stop publishing weekly figures. CarNewsChina continues to publish weekly insurance registrations, based on China EV DataTracker data.

The numbers are rounded and present new energy vehicle (NEV) sales, the Chinese term for BEVs, PHEVs, and EREVs (range extenders). To be completely precise, it also includes hydrogen vehicles (FCEVs), but their sales are almost non-existent in China.

Week 15 of 2025 (W15) was between April 6 and 13.

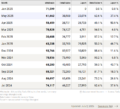

BYD led the registrations with 53,400 units, up 18.4% from 45,100 the previous week. In the first two weeks of April, BYD registered 98,500 vehicles in China.

Li Auto followed with 7,200 registrations, rising 16.1% from 6,200 units a week earlier. In the first two weeks of April, Li Auto registered 13,400 vehicles in China.

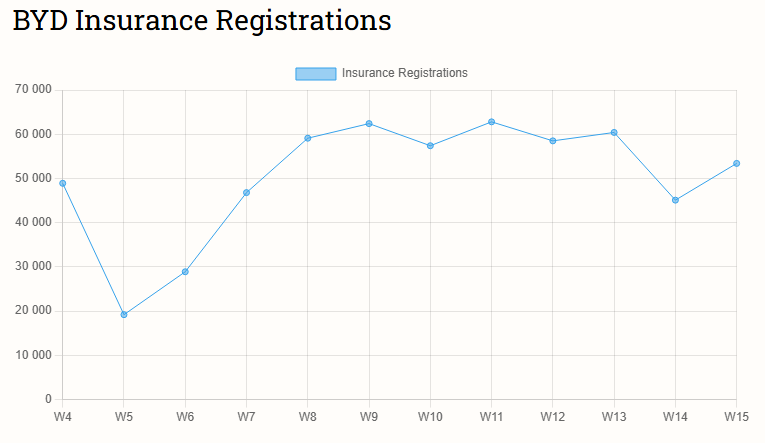

Xpeng saw 6,700 registrations, down 10.7% from 7,500 units the previous week. In the first two weeks of April, Xpeng registered 14,200 vehicles in China.

Leapmotor recorded 6,400 registrations, increasing 18.5% from 5,400 units the week before. In the first two weeks of April, Leapmotor registered 11,800 vehicles in China.

Xiaomi registered 6,300 vehicles, up 23.5% from 5,100 the previous week. In the first two weeks of April, Xiaomi registered 11,400 vehicles in China.

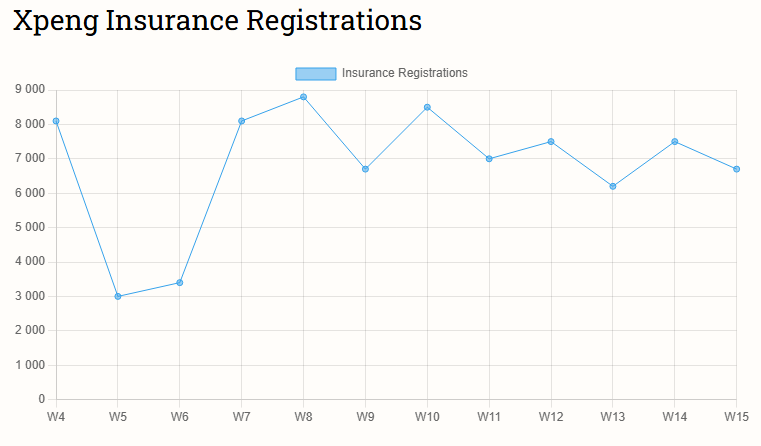

Tesla had 5,400 registrations, a 50.0% rise from 3,600 units the previous week. In the first two weeks of April, Tesla registered 9,000 vehicles in China.

Deepal posted 4,340 registrations, up 5.9% from 4,100 units the week before. In the first two weeks of April, Deepal registered 8,440 vehicles in China.

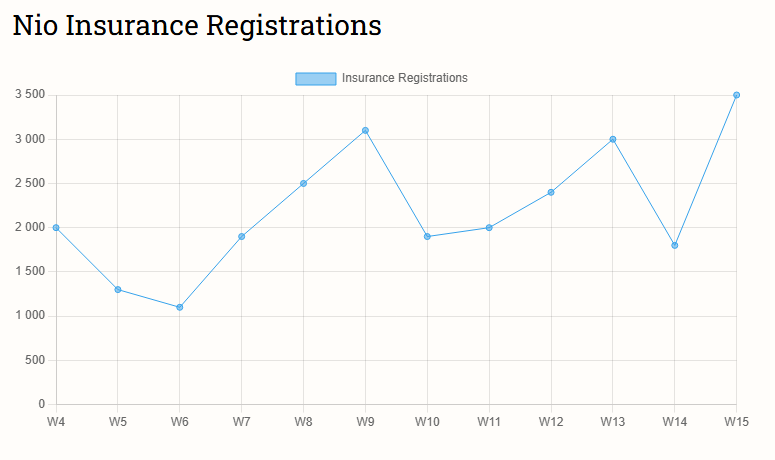

Nio saw a strong rebound with 3,500 registrations, up 94.4% from 1,800 units the previous week. In the first two weeks of April, Nio registered 5,300 vehicles in China.

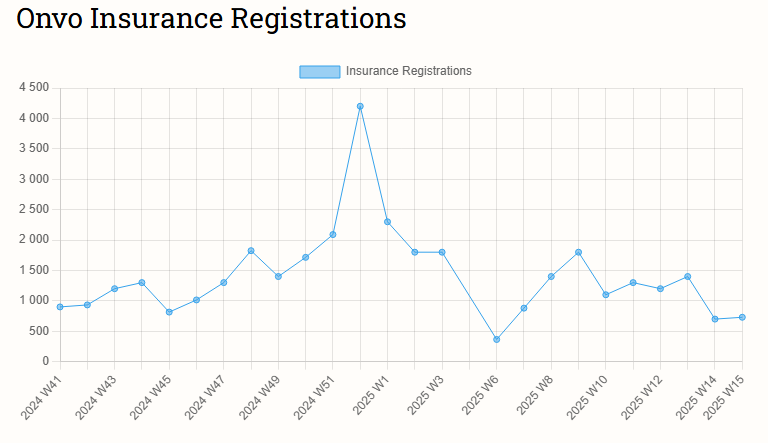

Nio’s brand Onvo had 730 registrations, rising 4.3% from 700 the previous week. In the first two weeks of April, Onvo registered 1,430 vehicles in China.

Aito registered 3,200 vehicles, down 33.3% from 4,800 units the previous week. In the first two weeks of April, Aito registered 8,000 vehicles in China.

Denza recorded 3,000 registrations, increasing 15.4% from 2,600 units a week earlier. In the first two weeks of April, Denza registered 5,600 vehicles in China.

Zeekr posted 2,300 registrations, a decline of 14.8% from 2,700 units the previous week. In the first two weeks of April, Zeekr registered 5,000 vehicles in China.

Avatr registered 1,500 vehicles, up 15.4% from 1,300 units the week before. In the first two weeks of April, Avatr registered 2,800 vehicles in China.

Recommended for you

China EV registrations in week 14: Nio 1,800, Tesla 3,600, Xpeng 7,500, BYD 45,100

China EV registrations in week 13: Nio 3,000, Xpeng 6,200, Tesla 20,700, BYD 60,400

China EV registrations in week 12: Nio 2,400, Xpeng 7,500, Tesla 17,000, BYD 58,500

Follow us for ev updates