Major electric vehicle (EV) makers mostly saw increases in insurance registrations in China last week, as month-end typically brings higher delivery volumes.

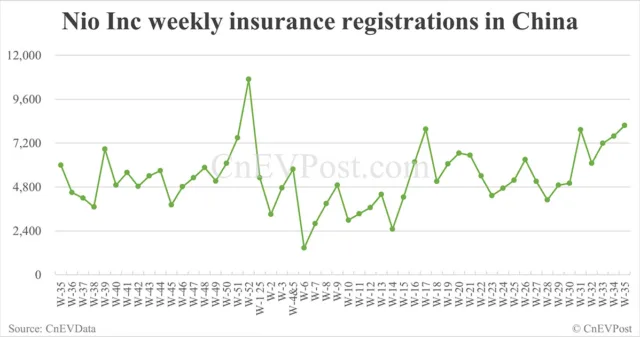

During the week of August 25-31 –week 35 of 2025, Nio Inc (NYSE: NIO) had 8,163 vehicle insurance registrations in China, a 7.82 percent increase from the previous week’s 7,571 units, according to figures shared today on Weibo by multiple automotive industry observers.

The Nio main brand had 2,986 insurance registrations last week, a 15.56 percent increase from the previous week’s 2,584.

Its sub-brand Onvo had 3,673 insurance registrations last week, a 10.50 percent decrease from the previous week’s 4,104 units.

The Firefly sub-brand saw a record 1,504 insurance registrations last week, a 70.33 percent increase from the previous week’s 883 units.

Nio Inc delivered a record 31,305 vehicles in August, including 10,525 units under the Nio main brand, 16,434 units under Onvo, and 4,346 units under Firefly, according to data released yesterday.

Tesla (NASDAQ: TSLA) recorded 12,500 insurance registrations in China last week, a 21.36 percent increase from the previous week’s 10,300.

Tesla’s August sales figures in China are not yet available. Its July retail sales in China totaled 40,617 units, down 12.14 percent from 46,227 units in the same period last year and down 33.94 percent from 61,484 units in June, according to data compiled by CnEVPost.

Xpeng (NYSE: XPEV) recorded 8,400 insurance registrations last week, a 2.44 percent increase from the previous week’s 8,200 units.

It delivered a record 37,709 vehicles in August, up 168.66 percent year-on-year and up 2.70 percent month-on-month.

Li Auto (NASDAQ: LI) had 8,400 insurance registrations last week, a 10.53 percent increase from the previous week’s 7,600 units.

The company delivered 28,529 vehicles in August, down 40.72 percent year-on-year –marking its third consecutive month of significant year-on-year decline — and down 7.17 percent from July.

BYD (HKG: 1211, OTCMKTS: BYDDY) brand vehicles recorded 69,400 insurance registrations last week, a 1.70 percent decrease from the previous week’s 70,600.

The company sold 373,626 new energy vehicles (NEVs) in August, marking a 0.15 percent year-on-year increase and an 8.52 percent rise from July. This represents the second consecutive month BYD’s NEV sales growth has remained below 1 percent.

Xiaomi (HKG: 1810, OTCMKTS: XIACY) saw a record 11,900 insurance registrations last week, a 45.12 percent increase from the previous week’s 8,200 units.

Xiaomi EV deliveries remained above 30,000 units in August, it announced yesterday without specifying exact figures.

Zeekr (NYSE: ZK) brand insurance registrations totaled 3,400 units last week, down 5.56 percent from 3,600 units the previous week.

Zeekr Group delivered 44,843 vehicles in August, marking a 10.61 percent year-on-year increase and a 1.47 percent rise from July.

The Zeekr brand delivered 17,626 vehicles in August, down 2.16 percent year-on-year but up 3.82 percent month-on-month.

Lynk & Co delivered 27,217 vehicles in August, up 20.81 percent year-on-year and flat from July’s 27,216 units.

Leapmotor (HKG: 9863) recorded 13,900 insurance registrations last week, a 14.88 percent increase from the previous week’s 12,100.

The company delivered 57,066 vehicles in August, marking its fourth consecutive month of record-high deliveries.

This marks Leapmotor’s second monthly delivery exceeding 50,000 units, an 88.31 percent year-on-year increase and a 13.84 percent rise from July.

Aito — the brand jointly developed by Huawei and Seres Group — recorded 10,800 insurance registrations last week, a 10.20 percent increase from the previous week’s 9,800 units.

($1 = RMB 7.1824)