- Roland Berger Automotive Disruption Radar: China in pole position, dominating on electric vehicle (EV) preference (95%), EV market share (25%) and development speed

- Germany in seventh place: EV preference drops from 55% to 45%, but the nation is strong in autonomous driving, patent activity and exports

- Regions are diverging on software, standards and customer expectations – OEMs need differing strategies

Munich, September 2025: The global automotive industry has reached an inflection point. As the new edition of Roland Berger’s Automotive Disruption Radar (ADR 14) shows, China is increasingly pulling into the lead on technology, placing top among the countries surveyed. By contrast, European nations and especially the US are coming under pressure. Germany held its position in the leading group, ranking seventh, mainly thanks to advances in autonomous driving, constant patent activity and its export-oriented OEMs. The study, for which Roland Berger experts analyzed the performance of 22 automotive nations across 26 industry indicators and surveyed more than 22,000 car owners, also reveals that regional ecosystems are increasingly diverging: There are rapidly growing differences between markets on aspects like technology standards, regulation and customer preferences – especially between China and the rest of the world. Though complete decoupling is unlikely, this development means automakers must adopt different approaches for different target regions.

«The automotive industry’s transformation is in full swing, but it is not happening at the same pace worldwide,» says Wolfgang Bernhart, Partner at Roland Berger. «China is rapidly pulling away from other regions and is now dominant in all key areas of the automotive industry – from EV market share to charging infrastructure to AI-powered driver assistance systems. Not only that: Chinese automakers’ development cycles are 24 to 40 months long, whereas European OEMs take 48 to 60 months to develop a new vehicle. Europe is falling behind.»

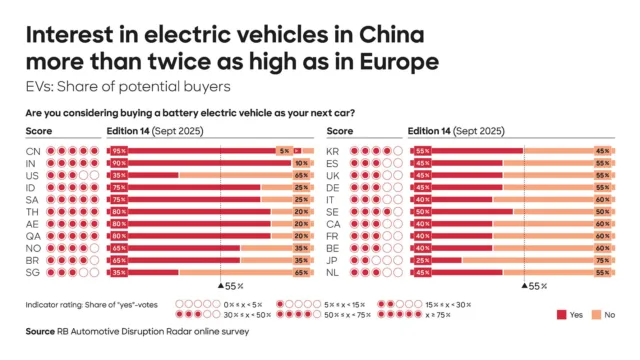

EV market share in China is more than twice as high as in Europe

China has therefore pulled well ahead of the pack in the ADR 14 ranking. With top scores in technology and infrastructure indicators, the nation has reinforced its leading position in the now key areas of electrified and automated mobility. Consumers are also very interested in the latest electric vehicles – 95% express a willingness to buy an EV as their next vehicle – and OEMs are offering extensive EV portfolios and a well-developed charging infrastructure. The share of electric vehicles in new car sales in China has thus risen from 22% to 25% since the last edition of the ADR, whereas Europe’s EV share has stagnated at 12%. In Germany, the share of people who are considering buying a battery electric vehicle as their next car has fallen from 55% in 2021 (ADR 9) to 45% in this edition of the ADR.

Making up the rest of the leading pack behind China are South Korea, the Netherlands, Norway, Sweden and Singapore. Germany follows close behind in seventh place, scoring points despite declining EV sales figures thanks to its efficient and rapid type-approval processes for autonomous driving functions, continued strong patent activity and a globally renowned, export-oriented OEM sector. However, consumer interest in shared mobility in the country has declined, and there remains a notable reluctance among both consumers and providers to engage with innovative offerings such as digital sales channels for vehicle purchases.

The important US car market slipped to 14th place, partly due to declining consumer interest in new technologies and concepts such as shared mobility. This is coupled with the nation’s increasing isolation caused by political uncertainty, alongside slowing innovation momentum in the mobility sector. In addition, more people are moving back towards private vehicle ownership in the US, a trend that is also evident in other mature markets such as Germany, Japan and China.

Regional differentiation poses a challenge for OEMs

In this edition of the ADR, the Roland Berger experts took a particular look at the growing divergence between automotive markets globally: «We are seeing different regions increasingly taking different paths, particularly in terms of software, standards and development speed, but also when it comes to customer expectations,» says Stefan Riederle, Partner at Roland Berger. Although he considers a complete decoupling of vehicle architectures very unlikely, not least for commercial reasons, Riederle recommends that automakers should keep a close eye on developments and integrate them in their plans: «OEMs’ future will depend on their ability to combine strategic alliances, software expertise and adaptation to the way markets are diverging. Going forward, automakers will need to work with at least two systems: one for China and one for the rest of the world.»

More information: www.automotive-disruption-radar.com