- In recent days, Wells Fargo initiated coverage on Boyd Gaming, assigning it an Equal-Weight rating and spotlighting the company’s best-in-class balance sheet and ongoing share repurchase efforts.

- Wells Fargo also pointed to a lack of near-term growth catalysts while highlighting upcoming development projects in Norfolk, Cadence Crossing, and Par-a-Dice as future performance drivers beginning in 2027.

- We’ll explore how Wells Fargo’s assessment of Boyd’s balance sheet strength and share buybacks could influence the investment narrative.

We’ve found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Advertisement

Boyd Gaming Investment Narrative Recap

To own Boyd Gaming stock, an investor needs to have confidence in the company’s financial strength, capital return strategy, and the long-term growth potential from future development projects. The recent Wells Fargo coverage highlights Boyd’s solid balance sheet and aggressive share buybacks, but does not alter the fact that the biggest short-term risk remains limited earnings catalysts and competitive pressure at key properties. The impact of Wells Fargo’s assessment on near-term catalysts does not appear material, with the main narrative unchanged for now.

Among Boyd’s announcements, the October share buyback stands out as closely tied to the news. Repurchasing 1.9 million shares for US$160 million reinforces Boyd’s approach to returning capital to shareholders even as new project openings are still several years away. Until these projects launch, share repurchase activity may be the most visible driver of shareholder returns.

Contrasting this capital return, investors need to be mindful of competitive pressures at The Orleans and the possibility that…

Read the full narrative on Boyd Gaming (it’s free!)

Boyd Gaming’s outlook anticipates $3.5 billion in revenue and $563.3 million in earnings by 2028. This projection is based on a 4.7% annual decline in revenue and a slight decrease in earnings of $1.2 million from current earnings of $564.5 million.

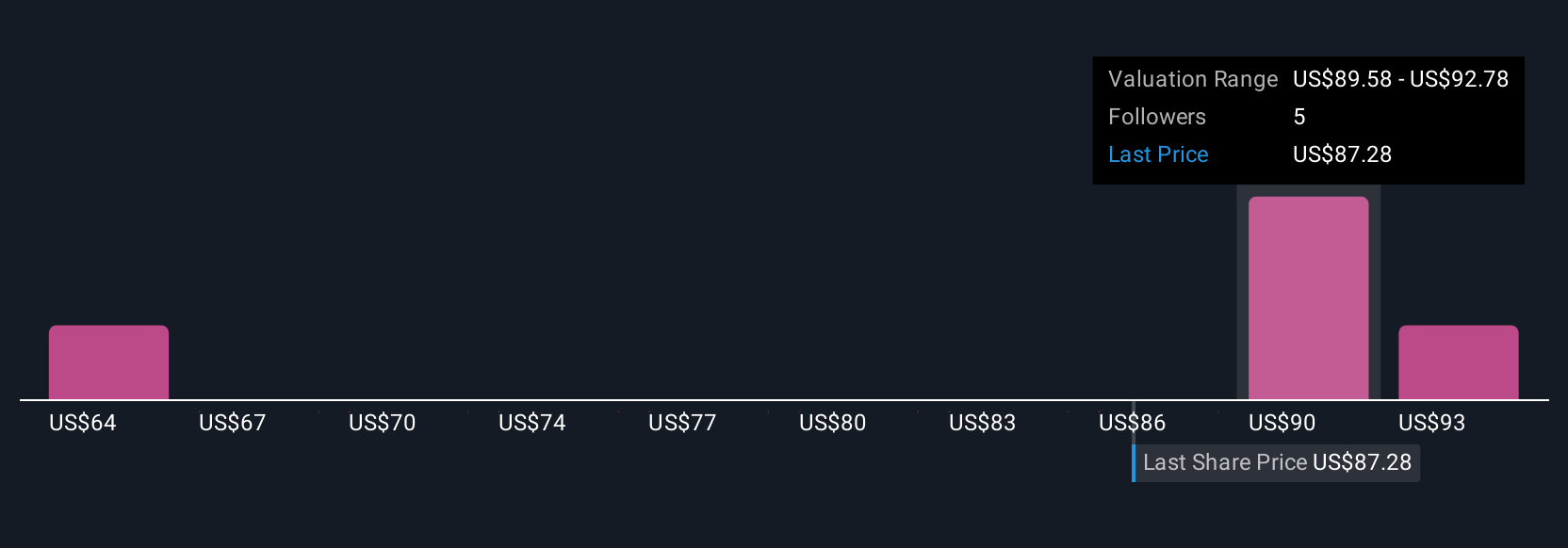

Uncover how Boyd Gaming’s forecasts yield a $92.77 fair value, a 18% upside to its current price.

Exploring Other Perspectives

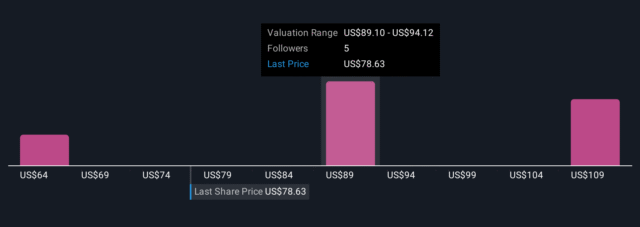

Four fair value estimates from the Simply Wall St Community span from US$64.03 to US$114.18 per share. While community perspectives vary widely, the immediate lack of significant growth drivers could lead to differing expectations about Boyd’s future performance.

Explore 4 other fair value estimates on Boyd Gaming – why the stock might be worth as much as 45% more than the current price!

Build Your Own Boyd Gaming Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Boyd Gaming?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Boyd Gaming might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com