Key Takeaways:

- BYD’s stock price has climbed 30% this year amid its aggressive European expansion.

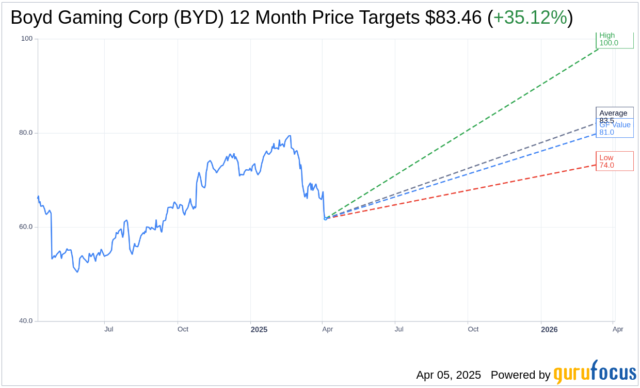

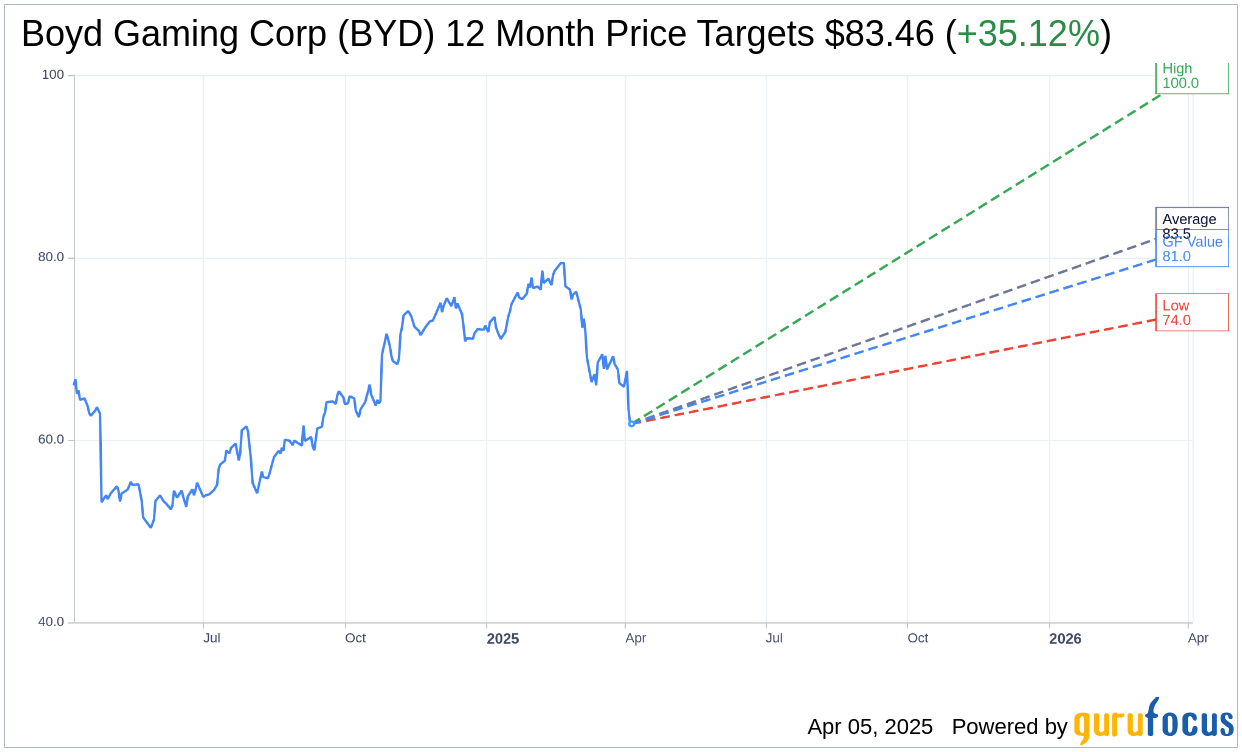

- Analysts anticipate a further 35.12% upside, with a one-year target price of $83.46.

- GuruFocus estimates suggest a 31.2% potential increase based on GF Value.

BYD, a powerhouse in the electric vehicle industry, is making significant strides in Europe. This year alone, the company’s stock price has surged by 30%, capitalizing on its strategic expansion across the continent. Despite facing tariff challenges, BYD remains steadfast in its ambition to more than double its European sales by 2029, leveraging its competitive pricing and cutting-edge technology.

Wall Street Analysts Forecast

Wall Street analysts have high expectations for Boyd Gaming Corp (BYD, Financial), as reflected in their one-year price targets. The average target price stands at $83.46, with predictions ranging from a high of $100.00 to a low of $74.00. This average target price implies a promising upside potential of 35.12% from the current price of $61.77. For a more detailed breakdown of these estimates, visit the Boyd Gaming Corp (BYD) Forecast page.

The consensus from 15 brokerage firms rates Boyd Gaming Corp (BYD, Financial) at an «Outperform» level, with an average recommendation score of 2.2. The rating scale, ranging from 1 (Strong Buy) to 5 (Sell), places BYD favorably in the market landscape.

According to GuruFocus estimates, the GF Value for Boyd Gaming Corp (BYD, Financial) projects a notable upside of 31.2% from the current price of $61.77. This GF Value represents GuruFocus’s fair value estimation, derived from historical trading multiples, past business growth, and future performance forecasts. For more comprehensive analysis, explore the Boyd Gaming Corp (BYD) Summary page.