BYD (SEHK:1211) shares have shown some fluctuation lately, with their price closing at HK$97.9. Investors have been tracking performance over the past month, which has seen shares decline by 11%. Year-to-date returns remain positive at 14%.

See our latest analysis for BYD.

While BYD’s share price has recently pulled back, the stock’s multi-year performance paints a more robust picture, with a 14% share price gain year to date and an impressive 67% total shareholder return over five years. This signals that, despite some short-term volatility, long-term momentum and growth potential remain strong in the eyes of most investors.

If recent moves in the auto sector have you rethinking your watchlist, it might be the perfect time to discover See the full list for free.

That leaves investors facing a key question: Is BYD’s current share price reflecting genuine undervaluation, or has the market already priced in all its future growth prospects, leaving little room for upside?

Advertisement

Price-to-Earnings of 21.3x: Is it justified?

BYD is currently trading at a price-to-earnings (P/E) ratio of 21.3x, which sets a premium compared to its industry peers. With the last close at HK$97.9, this ratio implies investors are paying more for each unit of BYD’s earnings relative to both the Asian Auto sector average and its closest competitors.

The price-to-earnings ratio helps investors gauge how much they are paying now for expected future profits. For a leading automaker like BYD, this multiple can reflect strong growth expectations, brand position, or sector momentum.

However, BYD’s 21.3x P/E is noticeably higher than the Asian Auto industry average of 18.9x and the peer average of just 9.1x. It also sits above the fair price-to-earnings ratio estimate of 17.2x. This means the market may be optimistic about BYD’s profit outlook, but some of this enthusiasm could already be embedded in the current share price. If broader market trends shift, this premium might not hold.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 21.3x (OVERVALUED)

However, if sector sentiment weakens or BYD’s earnings growth slows, the premium valuation could face pressure and lead to a share price pullback.

Find out about the key risks to this BYD narrative.

Another View: SWS DCF Model Suggests Undervaluation

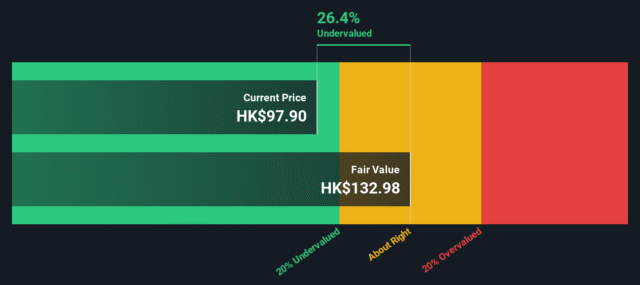

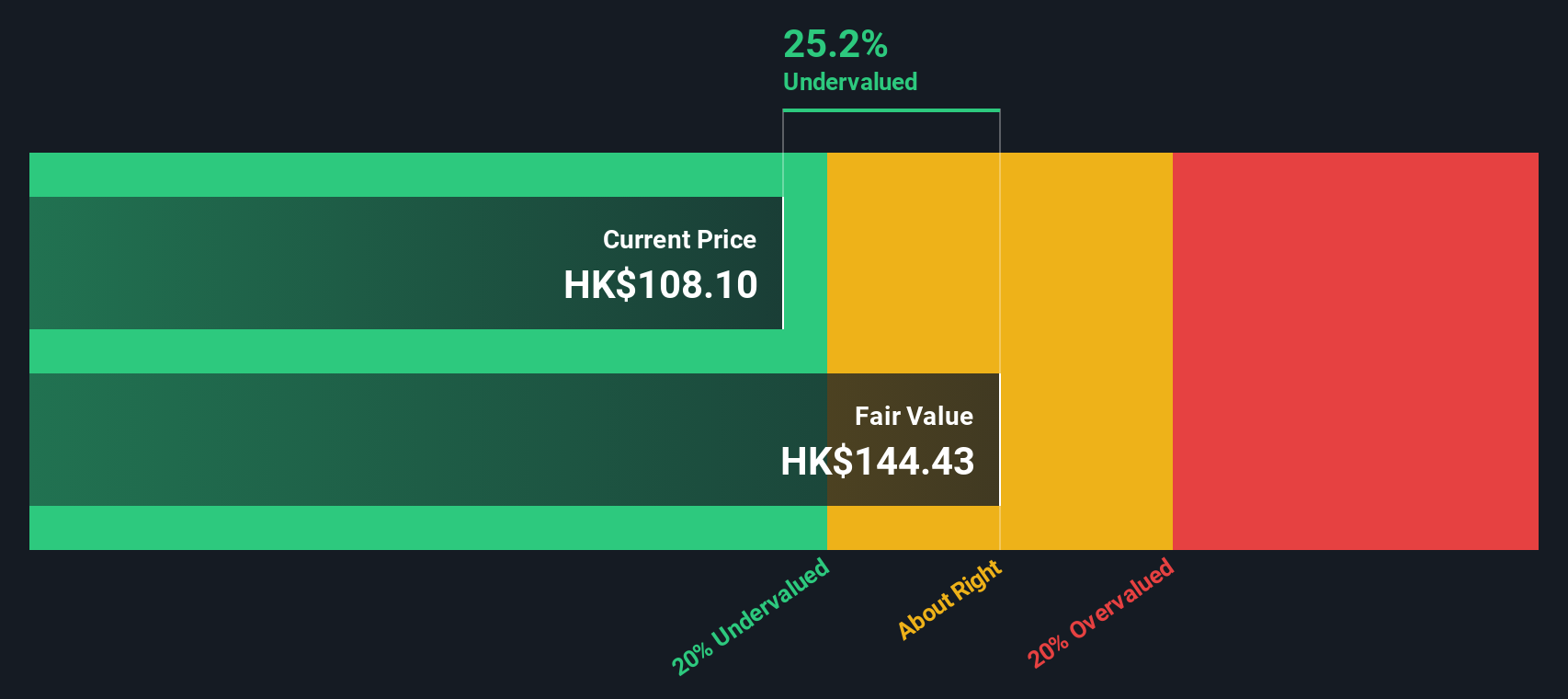

While BYD appears overvalued based on its current price-to-earnings ratio, our DCF model tells a different story. According to this method, the stock is trading about 26% below its estimated fair value. Could the market be overlooking BYD’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own BYD Narrative

If you find yourself wanting to dig deeper or reach your own conclusions, it’s easy to review the numbers and shape your own perspective in just a few minutes. Do it your way

A great starting point for your BYD research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by when other investors are uncovering tomorrow’s leaders today. Use these smart shortcuts to stay ahead of the crowd:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com