Support CleanTechnica’s work through a Substack subscription or on Stripe.

As Zach mentioned yesterday, The Guardian reported data from ACEA showing that Tesla sold 12,130 vehicles in Europe in November, down from 18,430 last year, while the overall market grew slightly. Tesla’s market share shrank from 2.1% to 1.4%. However, while Tesla staggered, BYD’s sales growth accelerated in the EU, EFTA, and UK from 6,568 to 21,133 units in November. That’s up 221% over the year prior, more growth than any other automaker.

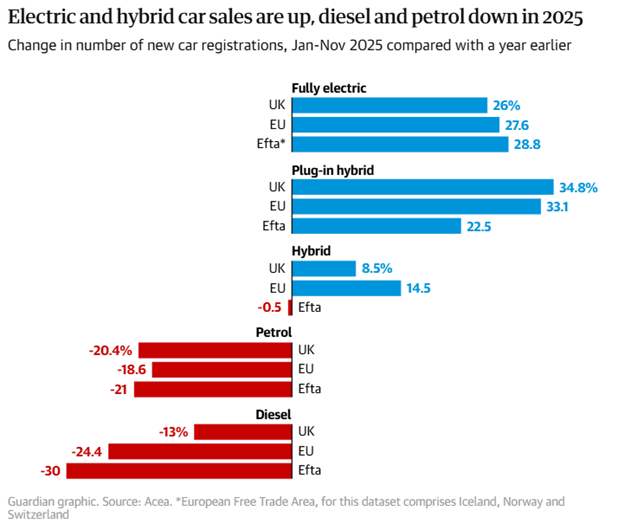

It should be noted that this YoY growth came after the EU implemented supplemental BEV tariffs on top of the 10% base tariff, bringing the total to 27% for BYD. Politicians who thought that the tariffs might stop them are undoubtedly disappointed. BYD indicated that it had padded prices ahead of the tariffs in anticipation of their implementation and that they would not need to raise prices after the tariffs were announced. As such, the tariffs did not slow them down. While protectionism and the threat of protectionism undoubtedly inflate European prices overall, greater certainty lets companies like BYD build out viable business models. Their vehicles are still more than competitive, even when prices are inflated by politicians. However, because the added tariffs do not apply to PHEVs, those models have been growing faster. This is driving faster PHEV growth in 2025.

However, this is just the start. BYD just launched a new PHEV version of the Yuan Up/Atto 2 specifically for Europe’s tariff situation and a PHEV Dolphin model is anticipated soon. Rumors out of the factory in Hungary indicate that production will start soon. That will be followed by Turkey later in the year. They join plants in Uzbekistan and Thailand that also have favorable trade agreements with the EU. Other Chinese automakers are also building capacity outside of China, and EV supply chains are being built up.

Back in China, the cars keep getting more advanced. If the EU market demands, better models are available. BYD’s Chinese competitors are also building better models that could be exported. In addition, recent moves to prevent unfair competition within China are adding transparency and detail to show that every car is being sold for more than what it costs to make. That transparency also makes any claims of “dumping” even more ridiculous. It should be mentioned that protectionists never looked in the mirror to compare to EU subsidies and pricing. Currently, many western automakers lose money on EVs. In addition, China harmonized to global safety standards and then took them a step further, making safety no longer an excuse either.

Overall, protectionists are running out of excuses and paths to keep vehicles from Chinese brands out, better cars from BYD and other competitors, like Leapmotor, NIO, and XPENG. Unless EU legacy industry seeks the most extreme “lawyer” solutions to block competition, EU brands will need to step up their “engineering” solutions to make better vehicles. Increasingly, those solutions may rely on partnerships. Taken together, Europe is poised to get better EVs.

However, the EU recently backtracked on EV targets after significant industry lobbying. The European Parliament also rolled back the Corporate Sustainability Reporting Directive (CSRD), under pressure from industry and the current US administration. That regulation drove many companies to offer EVs as part of their company car programs, which make up the majority of car sales in the EU. That could have a short-term impact on EV sales, particularly for domestic brands that tend to be favored for company cars.

Conversely, automakers like BYD are already better than price parity within China. They are also starting to roll out EVs at price parity in countries like Australia, where tariffs are not prohibitive. For the same price level, the cars are better built, have more advanced tech, and save money during their operation. With an increasing number of paths to market, better EVs that offer better value are coming to Europe. Better products will increasingly drive the market more than the now weakened regulations. Western automakers who think that the regulatory rollback that they lobbied through lets them relax will be faced with a harsh reality.

The flip side of competition is that EU consumers will increasingly be faced with a wealth of great EV options. That will make it hard for Tesla’s stale lineup to stand out. And it will make it harder to differentiate between fundamentally good, affordable EVs. However, having too many good EV options to pick from is a problem that many of us wish we had in the US, as we fall further behind.

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy