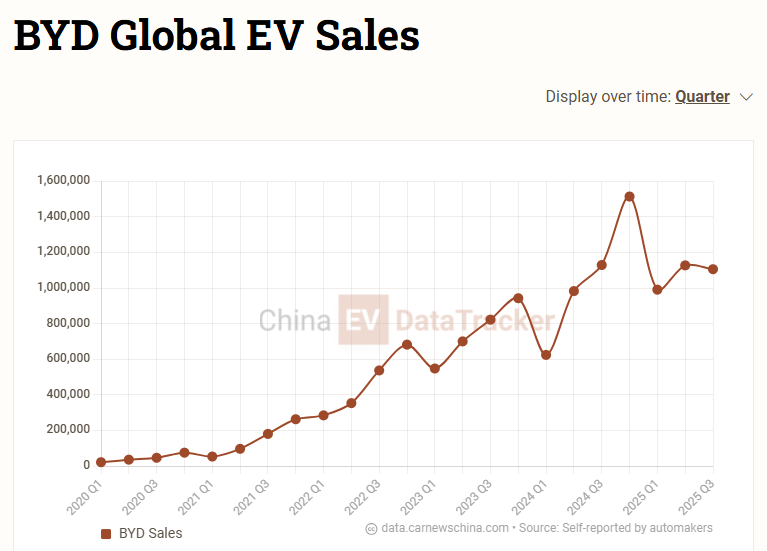

BYD Group sales fell 5.9% to 393,060 units in September, compared to the same month last year. This follows two months of stagnation, during which BYD Group sales remained nearly flat in July and August.

The main driver behind the sales decline is the BYD brand itself, which fell 11.4% to 355,774 units in September, continuing the 3.6% decline in August, according to data monitored by China EV DataTracker.

BYD struggles in its home market in China, where the price war has reached its rock bottom, and most automakers simply can’t go any lower without facing long-term challenges. BYD brand sales have declined by an average of 20% over the last three months in China.

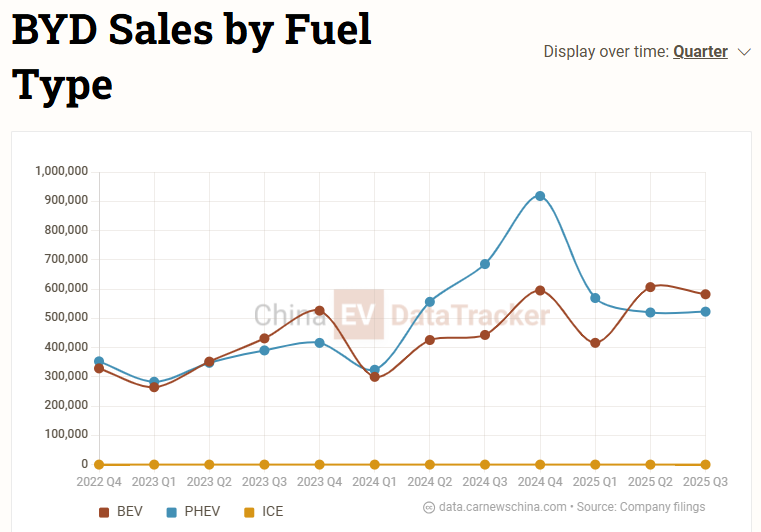

Another critical factor is the drop in BYD’s PHEV (plug-in hybrid vehicle) sales. In September, PHEV sales declined 25.6% to 188,010 units. Their PHEV sales have declined for six consecutive months since April.

What keeps BYD from a sharper fall are three factors: the three new subrands, BEV (battery electric vehicle) sales and overseas sales.

Fang Cheng Bao, BYD’s brand focused on rugged SUVs, grew 345% to 24,121 units, while the premium Denza brand grew 20.5% to 12,407 units, and the supercar brand Yangwang grew 145% to 758 units in September, year-over-year.

BYD also sold 71,256 vehicles outside of China in September, up 115.8% from the same period last year. Earlier this week, BYD completed its massive export fleet, consisting of eight large car carriers with a cumulative annual transport capacity of one million vehicles. The last one, which went into operation earlier this week, was named BYD Jinan.

BYD’s BEV sales grew 24.3% to 205,050 vehicles, year-over-year.

In Q3, BYD Group sold 1,105,591 vehicles globally, down 2.1% from last year, marking the first quarterly decline since 2020. The BYD brand experienced a 4% decline from last year.

Shenzhen-based automaker exported 232,806 units in Q3, representing a 146.4% increase from the same period last year. PHEV sales fell 23.7% to 523,069 units, while all-electric vehicle sales grew 31.4% to 582,522 units.

This comes at a moment when many Chinese EV startups are hitting record-high sales. For example, Leapmotor surpassed 60,000 monthly sales for the first time, doubling its sales from last year. Meanwhile, Nio, Xiaomi, and Xpeng are reaching all-time highs in September.

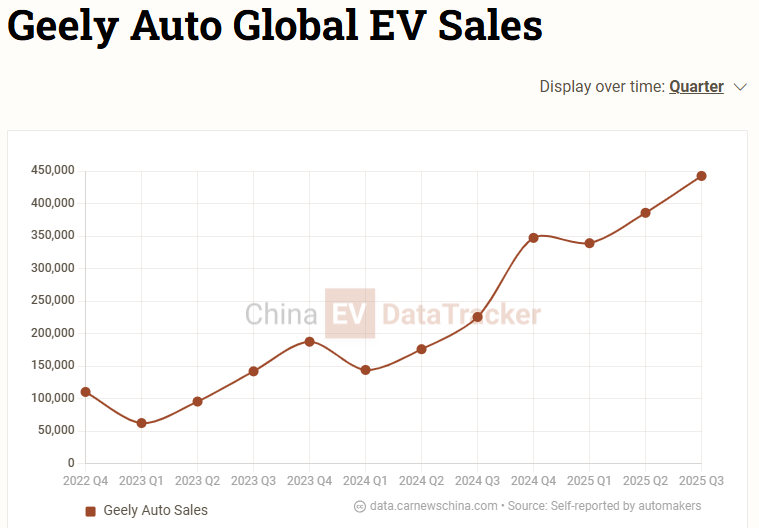

BYD’s biggest competitor, Geely, which is sometimes referred to as the Chinese Volkswagen due to the numerous brands it operates, sold 442,672 electric vehicles (BEV + PHEV) in Q3, representing a 96.2% increase, primarily driven by its Galaxy brand.

Follow us for ev updates