China’s All-Solid-State Battery Collaborative Innovation Platform (CASIP) held its 2026 annual closed‑door meeting in Beijing, convening government officials, industry leaders, research institutes, and academic experts to review the current state of all‑solid‑state battery technology and chart priorities for the year ahead. The meeting focused on research progress, shared strategic assessments, common technological challenges, and coordinated paths toward broader industrial application, reports Sina.

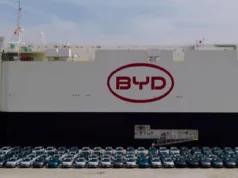

The first phase of the meeting was chaired by Ouyang Minggao, academician of the Chinese Academy of Sciences and platform chairman. Technical reports were presented by representatives from major automakers, including BYD, Chery, FAW, Dongfeng, Changan, GAC Aion, and Weilan New Energy, spanning multiple levels of the value chain from materials and cell design to system integration and vehicle application. Experts analysed common scientific and engineering issues, including electrode stability, interface reactions, manufacturing processes, and system‑level performance.

In the second phase, Lian Yubo, academician of the Chinese Academy of Engineering and chief scientist at BYD, led keynote addresses from senior figures including Miao Wei, former Minister of the Ministry of Industry and Information Technology; Chen Liquan, academician of the Chinese Academy of Engineering; and Wang Jianhua, president of the China Association for Industry‑Academia‑Research Cooperation. Miao noted that 2026 marks both the start of China’s 15th Five‑Year Plan and the platform’s second anniversary, and underlined that coordinated innovation in solid‑state batteries is significant for the high‑quality development of the new energy vehicle sector.

Presentations at the meeting reiterated that while solid‑state batteries have progressed beyond early laboratory research into collaborative development across materials, cells, and system integration, key scientific and industrial challenges remain unresolved, including consistent high performance in full cells, manufacturing process robustness, and cost‑effective scale‑up. Platform experts identified that high-energy materials, such as sulfide solid electrolytes, still require breakthroughs in interface stability and cell manufacturability before commercialisation can proceed more rapidly.

Outside the closed session, Chinese industry progress indicates that various firms are targeting demonstrative or prototype implementations of solid‑state batteries in the 2026-2027 timeframe. Geely has confirmed plans to complete its first full all‑solid‑state battery pack and begin vehicle‑level validation testing in 2026, moving beyond laboratory cells toward integrated vehicle applications.

Other reported developments suggest that multiple automakers and battery developers are pursuing competitive technical targets. For example, some companies are developing cells with energy densities of 350-400 Wh/kg or higher, which industry analysts say could support vehicle ranges above 1,000 kilometres if successfully integrated into vehicle systems. Chery has previously displayed solid‑state battery modules with cell energy-density targets up to 600 Wh/kg, and plans to pilotise in 2026, with broader deployment targeted for 2027.

National industry observers note that 2026 is widely seen as a stepping‑stone year in China’s broader solid‑state battery strategy, with expectations that vehicle testing and small‑batch applications may begin during this period, and that wider commercial deployment could follow in the late 2020s once manufacturing processes and supply chain collaboration mature.

The platform meeting concluded by reaffirming the need for deep collaboration across government, academia, research institutes, and industry, and by advocating coordinated progress on core materials, manufacturing technologies, intelligent R&D platforms, and supply‑chain integration to support China’s next stages of solid‑state battery development.

Follow us for ev updates