Han Woo-duk

The author is a senior reporter of the China Lab.

The cost is compelling — around 30 million won ($20,570) for an electric vehicle (EV). That’s the price point of BYD’s latest models now available for order. Consumers are intrigued by the affordability, and the domestic automotive industry is on edge. The Chinese “deflation offensive” has now set its sights on Korea’s car market. Some are arguing for higher tariff walls to shield the local industry.

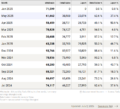

This is not an isolated phenomenon. In 2022 alone, there were 160 international trade disputes involving Chinese products, according to the South China Morning Post. That’s more than double the figure from the previous year, with cases largely focused on steel and electric vehicles. The disputes span 28 countries, from the United States and the European Union to India, Thailand, Peru and Pakistan. China’s deflation exports have become a global “public enemy.”

China defends its position, claiming its trade practices are legitimate and the result of corporate innovation. It argues that government support for nascent industries is common worldwide. While not entirely inaccurate, this justification fails to address the fundamental issue: China’s economic and industrial structure inherently generates deflation.

China’s manufacturing boom has unfolded in three distinct waves. The first, in the 1990s, was led by the home appliance industry, fueled by rising demand for white goods. The second wave followed China’s 2001 accession to the World Trade Organization, concentrating on construction-related sectors like steel, cement and petrochemicals. The third wave began with the 2015 “Made in China 2025” initiative, targeting new energy industries such as EVs, batteries and solar power.

Local governments have played a significant role in driving this boom. They focused less on what neighboring provinces or cities were producing and more on seizing opportunities they deemed profitable. By providing land to companies and funneling bank loans, they created jobs, increased tax revenues and boosted their chances of advancing in the central political hierarchy.

However, China’s weak domestic demand remains a critical problem. In advanced economies, consumer spending accounts for 70-80 percent of GDP. In China, the figure is only about 55 percent, reflecting an economic structure where wealth is disproportionately concentrated in the state and corporations. Despite being the world’s second-largest economy, China lacks a domestic market commensurate with its global standing. Consequently, excess capacity builds up, forcing companies to seek consumers overseas.

When Chinese products flood foreign ports, they inevitably disrupt local industries, as seen in steel, petrochemicals and solar energy. Now, the ripple effects are reaching Korea’s auto market. It seems Korean consumers may have to absorb the imbalance in China’s supply and demand — evidenced by BYD’s sales efforts in Seoul.

Translated using generative AI and edited by Korea JoongAng Daily staff.