Where is Tesla’s Semi now?

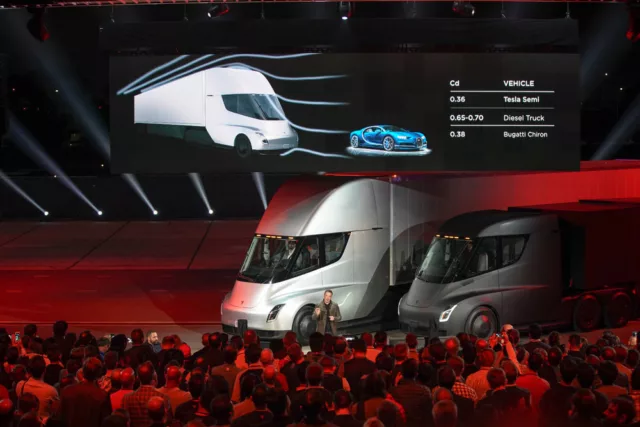

In 2017, it was the future. Every truck maker aspired to create its own sleek behemoth with self-driving capabilities, 500 miles hauling distance, and space warping acceleration. It promised to be the next chapter in long-haul freight.

Since the 2017 concept truck and the 2022 production run, there are an estimated 140 Tesla Semis operating in the US only. The first delivery was to PepsiCo on December 1, 2022, turned over from Gigafactory Nevada.

Since then, there are no reports of Semis being produced or delivered. There were reports of ongoing technological developments of the commercial vehicle, but nothing beyond that. Since Tesla does not have a PR department — CleanTechnica sent some questions to them nonetheless — writing this article to get their side depended entirely on whatever information is available online or in current documentation.

It’s a Semi, so it’s not complete. Yet.

Let’s face it. In the grand narrative of EVs, Tesla steals the spotlight. And in the EV truck space, it used to hog headlines. But as Tesla seemed to wrestle with production complexities and battery constraints, and manufacturing of the futuristic Semi stalled, other companies, especially ones in China, quietly took a closer look at their diesel trucks and decisively pulled ahead in electrifying their heavy-duty fleets, deploying tens of thousands of electric trucks onto roads worldwide.

As of mid-2025, Tesla expects the “first builds of the high-volume Semi design” to begin in late 2025, with a ramp-up into early 2026, aiming for a lofty goal of 50,000 units annually. This limited rollout comes even as the Semi has demonstrated impressive efficiency and driver satisfaction in early pilot programs, with PepsiCo’s fleet logging nearly 680,000 zero-emission miles by late last year. The chasm between initial hype and current reality has left a void that global competitors have eagerly filled.

Tesla’s lost opportunity isn’t just about sales numbers; it’s about setting the standard and establishing market leadership in a segment that desperately needs high-volume, reliable electric solutions.

The Chinese assault

China’s full-frontal assault on diesel was originally simply conversions of existing truck engines replaced with motors or motors hooked up directly to the differentials. Then there was battery type and location — usually top of the axles.

These days, their e-trucks are designed from ground up to accommodate load balancing, battery swapping, use of multiple motors, and even transmissions. Manufacturers are plenty. BYD, China National Truck Company (CNTC), Dongfeng Motor Corporation, Foton Motor, XCMG, SANY, FAW, Shacman, Sinotruck, Yutong, and Zoomlion are leading the charge.

Collectively, just these 12 truck makers own a significant 61% of the zero-emission heavy truck market globally — that’s about 120,000 units worldwide. Eighty percent of the global total is 96,000 — that’s the number of Semi-sized electric trucks sold in China. The remaining 24,000 is distributed to the rest of the world.

According to chinatrucks.org, total commercial vehicle sales reached 3.87 million units, lower than the projected 4 million, in 2024, while the heavy-duty truck market dropped from an expected 1 million units to 900,000. This was largely because two big truck makers — Dayun Heavy Truck and SAIC Hongyan — encountered financial troubles and filed for restructuring.

Development by sheer scale

BYD produces electric trucks, including refuse trucks and cargo vehicles, with extensive international sales and proven battery technology. This is the only Chinese EV maker in the US creating buses, trucks, airport transporters, and heavy equipment using labor from the United Auto Workers (UAW) and materials sourced locally.

Dongfeng Motor Corporation and Foton Motor offer electric trucks across light to heavy segments, focusing on urban logistics and construction. Their vehicles are equipped with modern lithium-ion batteries and telematics systems, with many models already in commercial use.

SANY has a wide range of electric trucks, from heavy-duty mining dump trucks with payloads up to 70 tons to urban construction vehicles. Their electric trucks feature advanced battery technologies, fast charging, battery swapping, and intelligent fleet management. They have successfully deployed electric trucks in India’s mining sector and at the Barrick Kibali Gold Mine in the Democratic Republic of Congo.

Sinotruk and Zoomlion are also active in developing electric commercial vehicles, supporting China’s push toward electrification in heavy transport.

According to the International Council on Clean Transportation (ICCT), for the full year 2024, battery electric heavy trucks alone accounted for a remarkable 13% sales share of all heavy-duty trucks in China, a figure that surged to 20.9% in December 2024. The heavy truck sales total last year in China was just above 900,000 units.

The success of e-trucks in China is not only coming from demand. It stems from a confluence of factors, including robust government incentives, a macroeconomic stimulus package, and more favorable battery costs. These contribute significantly to lower base prices than Western counterparts.

Crucially, Chinese electric trucks are deployed across a diverse range of applications beyond long-haul, excelling in urban logistics, port operations, mining, and construction, where typical ranges often average around 320 kilometers (approximately 200 miles), proving perfectly adequate for predictable, shorter routes.

A critical differentiator for the Chinese market is the widespread adoption of battery swapping technology, with nearly 40% of electric heavy-duty trucks utilizing this method, allowing for a “refuel” in under 5 minutes, directly addressing range anxiety and minimizing downtime. This pragmatic focus on operational efficiency has accelerated deployment. Analysts now predict that EVs will outsell combustion heavy-duty trucks in China by as early as 2028, with new electric truck sales potentially exceeding 190,000 units in 2025.

Coming Part Two: e-trucks in the European Union

Sign up for CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Whether you have solar power or not, please complete our latest solar power survey.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy