When it comes to getting electric vehicles (EV) exposure, the most recognized name within domestic borders is certainly Tesla. However, BYD Company is a name that more investors should be familiar with, and one of the top ETFs with exposure to BYD is the Amplify Lithium & Battery Technology ETF (BATT). With the fund up over 50% year-to-date, BYD is one of the names that could drive further gains for BATT.

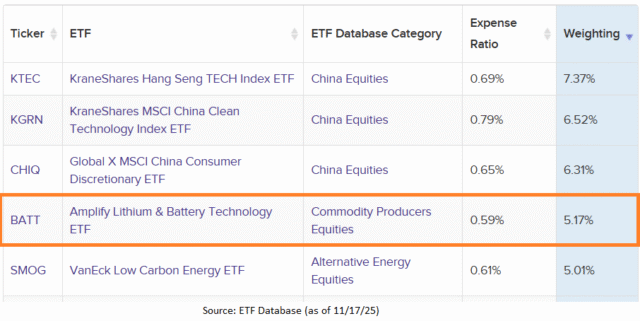

BATT currently has just over a 5% allocation to BYD, which is higher versus a comparative ETF like the Global X Lithium & Battery Tech ETF (LIT) (it has a 3.5% allocation as of November 14). Those looking for heavier exposure will have to enter ETFs that focus on Chinese equities like the KraneShares MSCI China Clean Technology Index ETF (KGRN) or KraneShares Hang Seng TECH ETF (KTEC). BATT keeps investors within the lithium-focused space while also gaining exposure to companies like BYD that can offer global benefits.

Global Market Penetration

BYD currently doesn’t offer EVs for sale in the U.S., which explains Tesla’s market dominance domestically. BYD also focuses on a different market segment, opting to provide affordable EVs that are suitable for most budgets. This allows BYD to penetrate global markets such as South America, where affordability of EVs can be an issue for the mass population in emerging market economies.

“In China, the rapid electrification of small cars has been underpinned by their unrivalled affordability,” the International Energy Agency (IEA) said. “In 2024, nearly all small battery electric car models in China were priced lower than the average small ICE (internal combustion engine) car, and the average purchase price was about half that of the average small ICE car.”

As data from SNE Research noted, that global market penetration is helping to make BYD the top player in the EV space. Through August 2025, it had double the deliveries of other top EV automakers, like its Chinese EV peer Geely. It had more than double those of Tesla.

Humble Leadership

Perhaps investors may have not yet heard of BYD for another reason. The company isn’t led by an enigmatic CEO who can be a lightning rod for news headlines. The CEO of BYD, Wang Chuanfu, is reportedly quite the opposite.

“Wang is reported to be a quiet man with modest habits,” an EL Pais report said. “He travels in economy class on commercial flights whenever his schedule allows; he carries his own suitcase and prefers to go unnoticed in public.”

Wang, the youngest of eight siblings, came from humble upbringings before founding BYD in 1995 by borrowing $30,000 from a family member. That initial grub stake in BYD is now worth over $100 billion. According to EV Magazine, Chuanfu’s leadership is characterized by a “hands-on approach, deep technical knowledge and relentless pursuit of excellence.” Investors who screen companies with qualitative measures like strong management may also align well with BYD.

“This guy is a combination of Thomas Edison and Jack Welch… I’ve never seen anything like it,” said Charlie Munger, legendary value investor and former Berkshire Hathaway vice chairman. Berkshire Hathaway invested about $230 million for about a 10% stake in BYD back in 2008 before fully exiting its position this year. CNBC noted that shares of BYD increased 4300% during Berkshire’s time of ownership.

A Growth Opportunity in Lithium

BATT tracks the EQM Lithium & Battery Technology Index, giving investors global reach to bring additional diversification to a portfolio. That allows the fund to give U.S. investors access to companies like BYD with the potential for further upside. As of September 30, about 50% of the country allocation is split between China and the U.S. Close to 60% of the fund is primarily concentrated in large-cap companies.

Overall, BATT’s investment objective is to capture future growth from three sub-sectors: battery storage solutions, battery metals & materials, and EVs. The fund provides an ideal alternative to a portfolio seeking a growth component outside of the typical AI-fueled large-cap names. In fact, BATT can complement a portfolio that’s already exposed to the AI theme. After all, that theme will require copious amounts of electricity to power its infrastructure such as data centers.

vettafi.com is owned by VettaFi LLC (“VettaFi”). VettaFi is the index provider for BATT, for which it receives an index licensing fee. However, BATT is not issued, sponsored, endorsed, or sold by VettaFi. VettaFi has no obligation or liability in connection with the issuance, administration, marketing, or trading of BATT.

For more news, information, and analysis visit the Thematic Investing Content Hub.