Tech company Oracle (ORCL) said on Sunday that it planned to raise $45bn (£32.8bn) to $50bn in 2026 to fund the expansion of its cloud infrastructure business.

The company said that it planned to achieve this funding target using a combination of debt and equity financing.

Stocks: Create your watchlist and portfolio

«Oracle is raising money in order to build additional capacity to meet the contracted demand from our largest Oracle Cloud Infrastructure customers, including AMD (AMD), Meta (META), Nvidia (NVDA), OpenAI, TikTok, xAI and others,» it said in a statement, according to a Reuters report.

Oracle (ORCL) shares hovered just below the flatline in pre-market trading on Monday morning and are trading 3.4% in the red over one year.

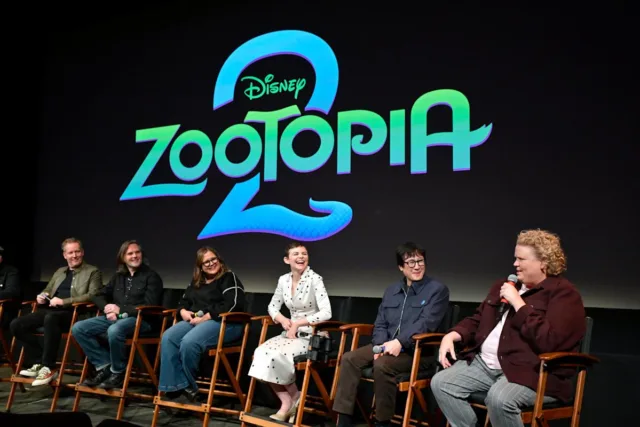

Media and entertainment giant Disney (DIS) was in focus on Monday morning, following a Bloomberg report that it was close to picking theme-park division chairman Josh D’Amaro as the company’s next CEO.

Read more: Commodities price slump drags markets lower

According to the Bloomberg report, Disney’s (DIS) board is aligning on promoting D’Amaro into the role and will vote on naming a new CEO in the coming week, citing people familiar with the matter. D’Amaro would take over from Bob Iger, who returned as CEO in 2022, having served in the role from 2005 to 2020.

Disney (DIS) had not responded to Yahoo Finance UK’s request for comment at the time of writing.

The company is set to report its fiscal first quarter earnings later in the day on Monday. Disney (DIS) shares hovered just below the flatline in pre-market trading on Monday morning and are 0.6% in the red over one year.

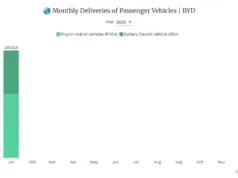

In Asia, shares in Hong Kong-listed electric vehicle (EV) company BYD slid 7.3% on Monday, after reporting a drop in sales in January.

BYD (1211.HK) said on Sunday that it had sold 210,051 vehicles in January, which was 30.1% lower than 300,538 it sold in the same period last year.

The company sold 83,249 battery electric vehicles last month, which was 33.6% lower than January last year and it delivered 122,269 plug-in hybrid EVs, down 28.5%.

Pharmaceuticals giant AstraZeneca (AZN.L) will begin trading its ordinary shares on New York Stock Exchange (NYSE) on Monday for the first time.

AstraZeneca (AZN.L), which is listed on the UK’s FTSE 100 (^FTSE) and Sweden’s OMX Stockholm 30 (^OMX), previously had American depositary shares (ADS) listed on the Nasdaq (^IXIC).

Michel Demaré, chair of AstraZeneca, said: «This will allow even more investors to participate in AstraZeneca’s future. Our harmonised listing across New York, London and Stockholm reflects strong shareholder support for our growth strategy and positions AstraZeneca to deliver more innovative medicines to more patients around the world.»

AstraZeneca’s (AZN.L) London-listed shares were up 1% on Monday morning.

On the London market, gold producer Endeavour Mining (EDV.L) was the biggest faller on the FTSE 100 (^FTSE), with shares slumping 7.2% at the time of writing.

The fall in Endeavour (EDV.L) shares was driven by a drop in gold (GC=F) prices, as well as other metals, adding to losses from Friday’s session, when US president Donald Trump named Kevin Warsh as his nomination for the new Federal Reserve chairman.

Read more: Stocks to watch this week: Alphabet, Amazon, Palantir, Novo Nordisk and Shell

Wealth Club chief investment strategist Susannah Streeter said: «The shock unravelling of prices demonstrates just how concerned investors had been about perceived attacks on the independence of the Federal Reserve.»

«There had been concerns that a Trump cheerleader would be installed at the central bank, which could lead to politically led decision-making, and risks of runaway inflation,» she said. «But now financial industry heavyweight Kevin Warsh has been anointed as successor, with deep Fed experience, he’s not expected to be a pushover and that’s sparked this big reversal of safe-haven positions.»

Read more:

Download the Yahoo Finance app, available for Apple and Android.