CATL and BYD are already dominating the EV battery market, accounting for over 50% of global sales last year. With new tech rolling out in 2026, China’s battery leaders look to stay one step ahead of the competition.

CATL and BYD double down on sodium-ion EV batteries

To combat rising lithium prices, Chinese battery manufacturers are pushing for new types of battery chemistries, including sodium-ion.

CATL unveiled its first sodium-ion battery, “Naxtra,” during its Tech Day event last April, deeming it the world’s first mass-producible sodium-ion battery for commercial vehicles.

Earlier this month, CATL’s chief tech officer, Gao Huan, confirmed the company plans to begin installing the new batteries in passenger vehicles, starting in the second quarter of 2026. The first model to be equipped with CATL’s sodium-ion batteries will be the AION Y Plus.

According to a report from local media outlet Cailian Press, the first passenger vehicles equipped with CATL’s sodium-ion EV batteries are preparing for public winter testing.

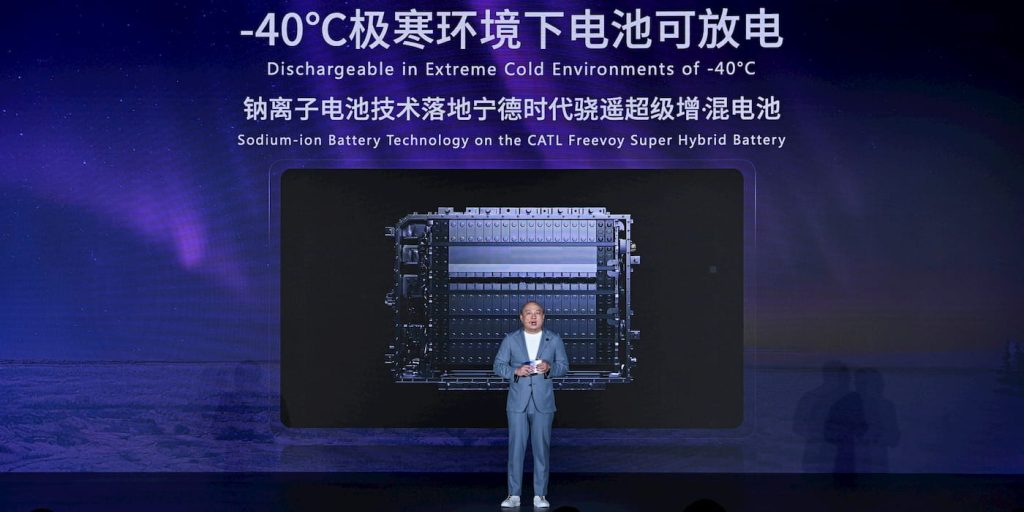

The 45 kWh sodium-ion battery is designed for use in small trucks, vans, and other vehicles. In temperatures as low as -30°C, vehicles equipped with the batteries can still charge and climb hills with a full load.

“We plan to achieve the energy density of sodium batteries to the level of lithium iron phosphate batteries within the next three years, and replace part of the lithium battery market in customized scenarios,” Gao Huan said last week.

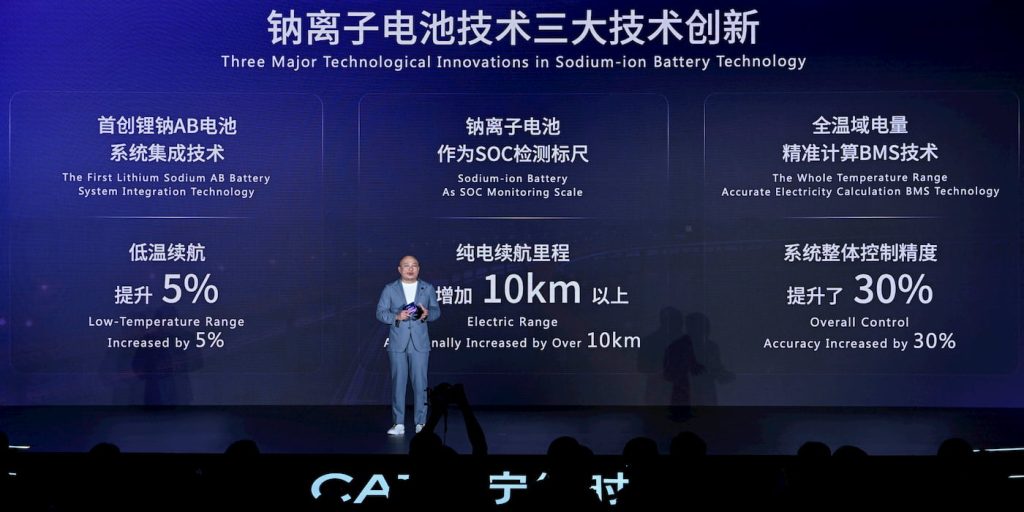

CATL’s tech boss explained that sodium-ion batteries have two key advantages over lithium-ion. First, they perform better in extreme cold, and second, they are safer to use during ultra-fast 5C charging.

The sodium-ion batteries can still be charged at temperatures as low as -30°C (-20°F), CATL said. At -40°C (-40°F), the battery still retained 90% of its usable capacity. In comparison, lithium batteries retain about 80% of their capacity on average.

BYD, on the other hand, began construction on its first sodium-ion battery plant in early 2024. The company invested 10 billion yuan and plans to reach an annual capacity of 30 GWh. Others, including EVE Energy and Ronbay Technology, are also turning to sodium-ion batteries.

Another key reason CATL, BYD, and others are investing in sodium-ion batteries is to mitigate rising lithium prices.

Sodium is much more widely available than lithium, which could potentially help lower costs while preserving raw materials.

Lithium carbonate prices reached 170,000 yuan ($24,500) per ton earlier this year, up significantly from around 50,000 yuan per ton in 2021.

Although sodium-ion batteries currently have lower energy densities, CATL aims to bring them on par with lithium iron phosphate (LFP) within the next three years.

CATL said during its Tech Day event last year that its new cell achieved an energy density of 175 Wh/kg (385 Wh/lb), on par with the higher end of LFP battery cells.

Last year, sodium-ion battery shipments reached 9 GWh, up 150% from 2024. By 2030, that number is expected to surpass 1,000 GWh.

Source: Autohome, Cailan Press