Find winning stocks in any market cycle. Join 7 million investors using Simply Wall St’s investing ideas for FREE.

BYD (SEHK:1211) has drawn fresh attention after shipping more than 5,800 electric and hybrid vehicles to Argentina, a move enabled by the country’s new tariff free quota for imported electric cars.

See our latest analysis for BYD.

Investors have been weighing this export push alongside a mixed price pattern, with a 5.65% 1 month share price return but a 4.67% decline over 3 months, while the 1 year total shareholder return of 8.62% and 3 year total shareholder return of 35.38% point to momentum built over a longer horizon.

If this kind of global EV expansion has your attention, it might be a good moment to look across the sector and see how other auto manufacturers are shaping up.

With BYD trading at HK$99.05 and screens flagging a potential intrinsic and analyst target discount, the key question is whether that gap reflects undervaluation or whether the market is already baking in future growth.

BYD shares closed at HK$99.05, and a P/E of 21x suggests the market is paying a relatively rich price for each unit of current earnings compared with peers.

The P/E multiple compares the market price per share with earnings per share, so for an automaker like BYD it often reflects how investors view the quality and durability of those earnings. A higher P/E can signal that the market expects stronger profit growth or sees the earnings stream as more resilient than that of other companies in the same space.

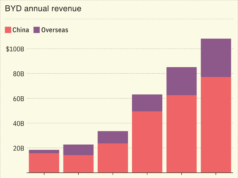

For BYD, earnings have grown 13.1% over the past year and are forecast to grow 16.33% per year going forward, with revenue forecast growth of 10.8% per year. That growth outlook is higher than the wider Hong Kong market for both earnings and revenue, which can help explain why the current P/E sits well above the peer average and above an estimated fair P/E level that our work suggests the market could eventually move closer to.

Against that, BYD’s P/E of 21x stands sharply above the peer average of 8.7x and the Asian auto industry average of 18.6x, and also exceeds an estimated fair P/E of 13.9x. This places the stock in a clearly more expensive bracket than many regional competitors on current earnings.

Explore the SWS fair ratio for BYD

Result: Price-to-Earnings of 21x (OVERVALUED)

However, there are still risks that could challenge that optimism, including pressure on auto margins and any slowdown in annual revenue or net income growth.

While the 21x P/E makes BYD look expensive against peers and an estimated fair ratio of 13.9x, our DCF model points in the opposite direction. At HK$99.05, the shares are trading about 27% below an estimated future cash flow value of HK$135.74, which suggests a possible mismatch between earnings based pricing and cash flow expectations.

That gap raises a simple question for you: are today’s earnings multiples too cautious about what BYD can generate in cash flows over time, or is the DCF model being too generous about the future?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BYD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

If you look at these numbers and reach a different conclusion, or simply prefer to test your own assumptions against the data, you can build a custom view in just a few minutes using Do it your way.

A great starting point for your BYD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

If BYD has sharpened your thinking, this is your cue to keep going and line up a few more opportunities before the market moves without you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include 1211.HK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com