LUXUO examines China’s electric-vehicle market at a critical juncture, where slowing domestic demand, fierce local competition and ambitious global expansion are redefining the industry. From BYD overtaking Tesla to the struggles of legacy automakers, the market is in flux — offering both challenges and opportunities for brands and consumers alike.

A Market at Its Inflection Point

China’s electric-vehicle (EV) story is no longer one of steady growth. The sector is undergoing a strategic pivot as it deals with weakening domestic demand, reduced government incentives and increased margin pressure. China’s EV sector — once a forerunner of unstoppable expansion — is now facing a more disputed reality in 2026.

Earlier policy frameworks positioned EVs at the centre of China’s industrial aspirations. That has changed: Beijing has omitted EVs from the latest five-year plan’s list of priority industries, signalling the end of the period of unfettered backing.

Bloomberg has highlighted growing investor concerns, citing profit issues and disappointing results among EV producers. Meanwhile, exports have emerged as a key growth driver. Overseas shipments of Chinese automobiles — which will be mainly electrified in 2025 — climbed even as domestic sales slowed at the end of the year, forcing makers to hunt for demand elsewhere. Xpeng’s aggressive 2026 ambitions reflect deliberate adaptability rather than naive hope. Xpeng’s intention to sell up to 600,000 vehicles reflects a desire to diversify products and explore new technologies.

However, not all tales are positive. Commentators such as The Atlantic have described the market as “imploding” in places, citing significant discounts and waning customer enthusiasm.

BYD and the Global EV Crown

China’s EV story is not only domestic; it is global. In 2025, BYD eclipsed Tesla as the world’s largest seller of EVs, a milestone that reflects volume growth, affordability and vertical integration. The Shenzhen-based manufacturer has control over crucial components — particularly batteries — which allows it to manage costs and supply chain risk more effectively than Tesla. BYD’s development into Europe, Latin America and Southeast Asia highlights how Chinese EV brands may leverage local scale to achieve international dominance. As Stella Li — BYD’s executive vice president — points out, the emphasis is “on products people can actually afford and use every day.”

VW Slips to Third Place in China

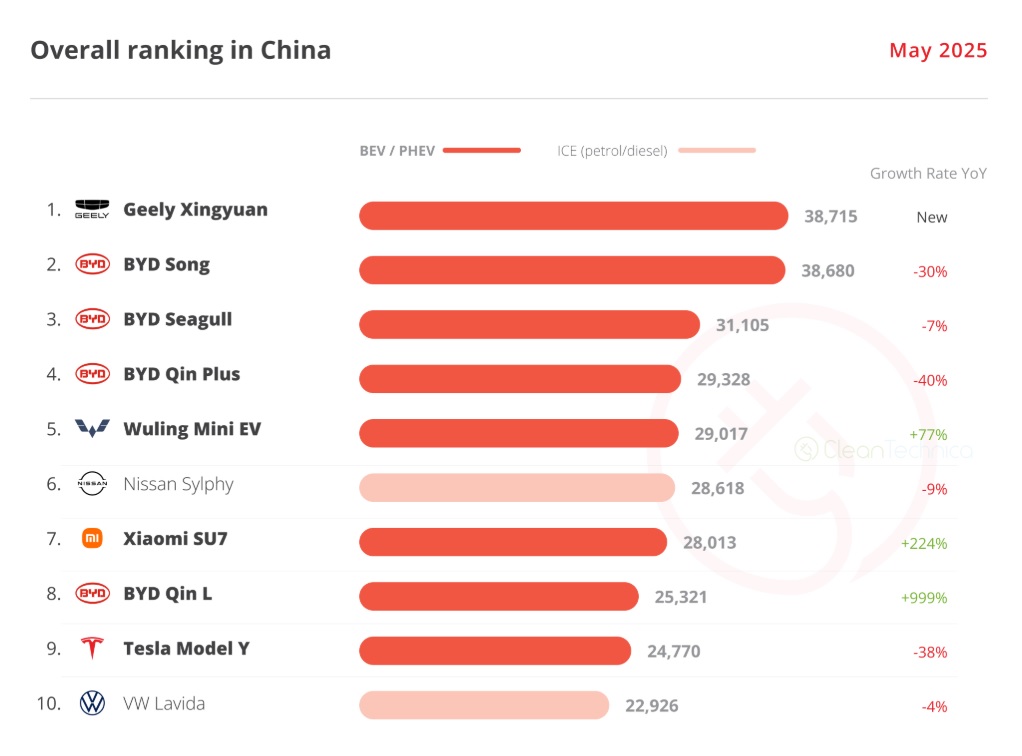

Volkswagen — China’s long-time market leader — fell to third position in 2025, trailed only behind BYD and Geely, with fourth-quarter sales down 17.4 percent. VW and BYD both lost market share due to heavy competition from Chinese competitors, notably in the budget sector. VW intends to launch China-specific EVs and expand exports, but regaining domestic market share remains a major issue for CEO Oliver Blume.

Spaniard’s Love for BYD

Spain’s EV market is expanding, but Chinese automaker BYD — not local brands — is the primary beneficiary. BYD’s market share topped 10 percent in July 2025, outperforming Tesla — thanks to almost 100 dealers and inexpensive EV and plug-in vehicles. Legacy European automakers — such as Seat — are losing position in this change.

In fact, 2024 was a difficult year for German automakers in China, with Porsche sales falling 28 percent and Volkswagen, BMW, and Mercedes-Benz all losing ground to local competitors. Weak domestic demand and lower-cost Chinese competitors have pushed employment layoffs and capacity reductions, indicating that the German auto industry will continue to face pressure.

Tesla’s Stance

Tesla concedes increased competition as BYD overtakes global EV sales, threatening its market dominance in China, Europe and other key markets. In response, Tesla is modifying its price, expanding its car lineup and expediting the development of additional models, all while focusing on software, autonomy and energy integration as differentiators. To regain traction, CEO Elon Musk focuses on AI innovation, manufacturing efficiency and global production scale. In addition, the corporation is extending its foreign reach and considering strategic partnerships to defend its leadership in key sectors against quickly developing Chinese competitors.

The Domestic Demand Challenge

The most immediate pressure point is a drop in domestic consumption. After several years of intensive government incentives (subsidies, tax breaks and buying assistance), these mechanisms are fading. According to a recent South China Morning Post research, sluggish year-end sales and competition pressure have restarted discount wars, with big brands implementing steeper price cuts to clear inventories. Industry analysts also warn that many smaller EV manufacturers are facing a “do-or-die” moment. Removing subsidies and tax breaks threatens weaker businesses, exposing the industry’s natural shakeout.

That contraction is structural, rather than cyclical. Overcapacity, margin erosion and increased competition have shifted the equation for both existing and rising businesses. China’s supply system — previously praised for its breadth and durability — is no exception. Battery commoditisation and fluctuating raw material prices have pushed margins down, even as price battles spread to component suppliers.

China’s Used-Car Scam

China’s “zero-mileage” used-car export program enables manufacturers to register new vehicles as old and sell them overseas, inflating domestic sales figures while maintaining factory output despite falling local demand. The strategy puts pressure on global competitors by flooding international markets with low-cost vehicles, but it also poses reputational issues — potentially undermining Chinese EV brands abroad. While it temporarily boosts domestic revenue and reduces overcapacity, the grey market obscures the true health of China’s EV business, postponing industry consolidation and concealing fundamental issues that may surface in the future years.

What This Means for Owners and Brands

China’s existing and future EV owners face a mixed but resilient picture. Charging infrastructure and technology advancements continue to grow and many localities are loosening non-EV purchasing prohibitions to ensure accessibility. Despite reduced buyer incentives, EV adoption is widespread — aided by low-cost models and increasing familiarity. Broader industry predictions still envision EVs acquiring a higher share of total car sales in the coming years, even if the pace slows.

Charging infrastructure expansion is a top goal as cities plan network densification to enable increased EV use. China’s current and prospective EV users face a mixed but resilient picture. Charging infrastructure and technology developments are continuing to expand and many communities are easing non-EV purchase restrictions to allow accessibility. Despite lower buyer incentives, EV adoption is growing, supported by low-cost models and more awareness. Broader industry estimates still show EVs gaining a larger share of total auto sales in the future, even if the rate slows. Charging infrastructure expansion is a primary priority as cities plan network densification to support growing EV use.

Strategic Lessons and Future Trajectory

China’s EV business presently provides numerous educational lessons for governments and industry leaders worldwide:

Government assistance is important, but it must evolve: Government incentives initially drove EV sales, but removing them revealed that consumer demand is not as strong as expected.

Competitive intensity hastens maturation: Price wars and overcapacity are signs of maturity rather than weakness. Only financially prudent and innovation-driven players will survive.

Export diversification is necessary: Domestic saturation necessitates a worldwide presence. Exports are no longer a supplementary strategy, but rather a key revenue source.

Finally, China’s EV environment is entering a period of consolidation and strategic recalibration. Growth will continue, but at the expense of increased industry discipline and sharper competitive distinction. The future for EV owners remains bright — with more options and improved infrastructure — while EV brands’ sustainability increasingly rests on worldwide competitiveness as much as domestic demand.

For more motoring reads, click here.