China supports its electric vehicle (EV) market and disincentivizes domestic gas-vehicle sales. This situation is motivated by the fact that it has few oil resources but a good deal of electric capacity, mostly inexpensive coal-based generating units. Several cities in China have a lottery system to limit new gas-fueled vehicle registrations or to allocate licenses for gas-fueled cars, making a limited number of plates available each year. In contrast, China does not impose any limitations on electric vehicles, and instead, has a number of incentives and subsidies to promote EV adoption, including purchase tax exemptions and a mandate that requires automakers to produce and sell a certain number of EVs each year, or face penalties. As a result, in just a few years, China’s EV industry captured half its domestic market and crushed sales of gasoline-powered vehicles, according to recent reporting in Reuters.

Via Reuters, many of China’s established automakers have responded by offloading gasoline vehicles that struggled to find buyers at home onto overseas markets. Those models are now appearing in countries ranging from Poland to South Africa and Uruguay, and they have made up 76% of Chinese auto exports since 2020. Annual shipments have surged from about one million vehicles to more than 6.5 million this year. Even excluding electric and plug-in hybrid models, China’s gasoline-vehicle exports alone were sufficient to make the country the world’s largest auto exporter by volume last year.

Reuters reports that China’s generous electric-vehicle subsidies and industrial policies have eroded the domestic businesses of global automakers such as Volkswagen, General Motors, and Nissan by bankrolling dozens of local EV manufacturers and triggering a bruising price war. Foreign brands have struggled to compete with government-supported rivals, a dynamic that aligns with Beijing’s broader ambition to dominate strategically important industries at home and abroad.

China originally built its gasoline-vehicle sector by drawing on foreign automakers’ technology through joint ventures. It is now exporting large volumes of gasoline cars into overseas markets, while restricting such models at home. The export push is being led by state-owned legacy manufacturers, including SAIC, BAIC, Dongfeng, and Changan — companies that for decades depended on joint ventures with foreign partners for profits and engineering know-how after those relationships were launched in the 1980s.

According to Reuters, as privately owned Chinese electric-vehicle makers — led by BYD — have surged, the once-dominant joint ventures have seen their sales collapse. SAIC-GM’s annual China volume, for instance, fell from more than 1.4 million vehicles in 2020 to about 435,000 in 2024. Over the same period, SAIC’s exports, largely under its own brands and without General Motors’ involvement, jumped from nearly 400,000 vehicles to more than one million last year.

China is channeling its gasoline vehicles into regions such as Eastern Europe, Latin America, and Africa, where limited charging infrastructure constrains electric-vehicle adoption. Over the longer term, however, Beijing aims to command the global market for electric and plug-in hybrid models. To that end, Chinese automakers are developing overseas brands and tailoring vehicles with features designed to appeal to foreign consumers.

China’s Automakers

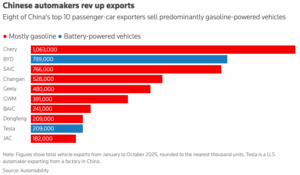

As reported by Reuters, Chery has emerged as China’s largest auto exporter, with global sales surging from 730,000 vehicles in 2020 to 2.6 million in 2024, driven largely by gasoline models that account for about four-fifths of its volume. Five other state-owned manufacturers and two private firms — Geely and Great Wall Motor — also rank among China’s top 10 exporters, most of them selling more gasoline vehicles than electric ones. China’s gasoline-vehicle exports are expected to exceed 4.3 million units this year, representing nearly two-thirds of total shipments, with only Tesla and BYD focused exclusively on battery-powered or plug-in models. BYD, now China’s second-largest exporter, has begun tilting the mix toward electrified vehicles, even as an oversupply of domestic brands makes exports central to industry growth. Global automakers increasingly view Chinese competitors as a major threat, prompting Volkswagen to consider exporting China-built cars and General Motors to pledge it will meet the challenge with competitive technology and costs.

China’s Idle Car Factories

Reuters explains that China’s industrial policies pushed automakers to construct new electric-vehicle plants instead of retooling existing gasoline-car factories, a shift reinforced by aggressive subsidies from local governments competing to attract manufacturers. Cities and provinces financed much of the factory buildout, often preparing land and erecting facilities so companies could move in immediately. The result was a massive overhang of underused gasoline-vehicle capacity as EV production accelerated. Assembly lines capable of producing as many as 20 million gasoline cars a year were left idle, creating a surplus that automakers have increasingly redirected toward export markets.

China Looks to Emerging Markets

As electric-vehicle startups expanded at home, China’s legacy automakers fanned out across global markets, tailoring exports to local demand from Poland to Australia and the developing world, according to Reuters. The push has reshaped competition, with Chinese brands flooding emerging markets with low-cost, gasoline models and eroding the share of established manufacturers, prompting responses such as Stellantis’ plans for more localized production and a GM-Hyundai partnership in South America. Mexico has become China’s largest export destination after overtaking Russia, even as it raises tariffs to 50% under U.S. pressure, lifting its market share to about 14%. Similar tensions are playing out in South Africa and Chile, where Chinese automakers are gaining double-digit market share, largely through fossil-fuel vehicles, despite government efforts to protect domestic industries. In places like Uruguay, Chinese companies are undercutting former joint-venture partners with near-clones of their own models, highlighting how surplus Chinese capacity is being redeployed to challenge incumbents worldwide.

Analysis

Primarily through the sale of gas-powered vehicles, Chinese automakers are expected to control 30% of the global auto industry in five years. While this may cause some analysts concern regarding China’s future economic dominance, the high level of subsidization required for a vehicle glut of this degree will have a negative impact on future economic growth. As David Herbert explains for Law & Liberty, “China is hoping to paper over the inability of governments to solve economic problems with increasingly costly technical solutions. This can work for a while—decades even—but the inevitable result of such a plan is the same: collapse.” The technical issue of vehicle exports can be solved through subsidies, but it will involve poor trade-offs that make the country as a whole worse off.

For inquiries, please contact [email protected].