Robert Way

Robert Way

Introduction

I recently published an article on Alibaba Group Holding Limited (BABA) stock, in which I also pointed out the high probability that Chinese stocks will have a favorable backdrop, at least in the short to medium term, as they have been underweight for too long and I believed this would attract some capital allocators shortly. And indeed, as Goldman Sachs analysts wrote in their latest note [May 2024, proprietary source], the Chinese market has recovered significantly despite concerns about interest rate hikes in the US, and indices such as the HSCEI and MSCI China have risen by around 14% since mid-April.

![Goldman Sachs [May 2024, proprietary source]](https://static.seekingalpha.com/uploads/2024/5/7/49513514-17150668066901772.png)

Goldman Sachs [May 2024, proprietary source]

The rebound, up 31% since late January, was driven by better-than-expected economic data and new capital market reforms. While the sustainability of this rally depends on policy execution and profit delivery, «these are seen as tactical trading opportunities, especially if foreign investors become more interested in higher-risk investments», GS analysts added in their note.

Against the backdrop of this changing narrative, I decided to pay attention to one of the largest automotive companies in China, a direct competitor of Tesla, Inc. (TSLA), to understand how attractive its prospects appear today.

What’s Going On With BYD?

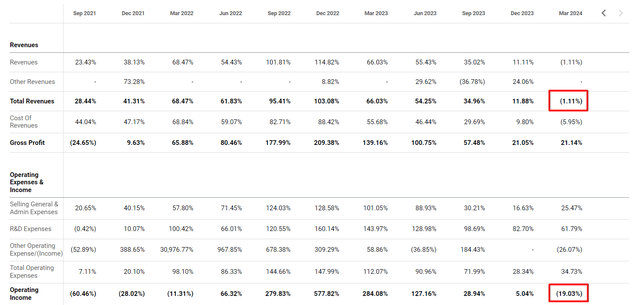

BYD Company Limited (OTCPK:BYDDF) (OTCPK:BYDDY), a major player in the global electric vehicle market, has been growing its sales and EPS by 24% and 28% annually since 2015, respectively, according to Seeking Alpha Premium data. However, it has suffered sales declines in Q1 FY2023 if we convert RMB sales to USD sales (in RMB the sales growth amounted to almost 4%, based on the latest periodic report). The company’s operating profit fell by more than 19% in USD compared to the previous year:

Seeking Alpha, author’s notes

However, the same downtrend was true regarding Tesla’s deliveries.

BYD sold 300,114 EVs in the first quarter of this year, it said in a filing to the Shenzhen Stock Exchange late on Monday, down from a record quarterly high of 526,409 units sold in the previous three-month period, when it surpassed Tesla.

Source: Reuters

Tesla delivered 386,810 vehicles globally in the first three months of 2024, down 8.5% from a year earlier. It was the company’s lowest quarterly performance since the third quarter of 2022.

Source: WSJ

These fluctuations are typical challenges for companies in a competitive and maturing market. While the prevalence of EV usage is increasing around the world, competition is making it difficult for industry leaders and pioneers to continue to grow.

Exponential Value / Bloomberg, TME newsletter

Both BYD and Tesla have had to contend with intense competition in China, where there are more than 129 electric vehicle brands. Price competition in the region gave BYD and Tesla a temporary boost last year but has led to a decline in sales/deliveries this year. Despite these challenges, the global EV car sales neared 14 million in 2023, 95% of which were in China, Europe, and the United States with 31 countries having passed the 5% threshold. In other words, every 1 out of 5 sold cars were electric. I believe BYD still has a huge untapped market in China, where it will remain the leader in EV sales and continue to hinder Tesla’s growth. Why do I think so?

First, if you look at the statistics of vehicles per capita (more specifically, vehicles per 1,000 people), you’ll find that this figure is 860 in the US and over 500-600 in most developed countries in Europe. In China, however, despite the impressive sales figures of individual automakers like BYD, this figure is only 223 – which is about the same as Kazakhstan. This means that the country definitely does not have enough vehicles, which creates a favorable backdrop for EV manufacturers, whose share of the overall auto market is constantly growing.

Second, unlike Tesla, BYD has a big advantage in the production of batteries. In case you didn’t know, China is the world leader in rare earth reserves, which are necessary for the stable production of electric vehicles.

China controls 95% of the production and supply of rare earth metals, integral to manufacturing magnets for electric vehicles (EVs) and wind farms, and this monopoly has allowed China to dictate prices and stir turmoil among end users through export controls.

Source: Reuters

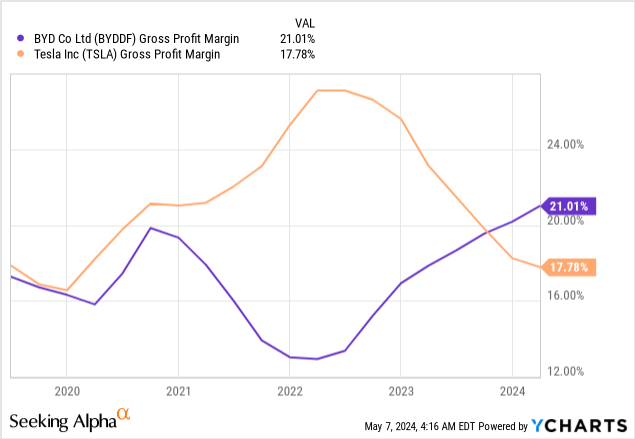

Those with such resource access should theoretically have better and more stable margins – which has actually been the case in recent months (especially considering the fact that since last summer, lithium battery cell pricing has plummeted by ~50%).

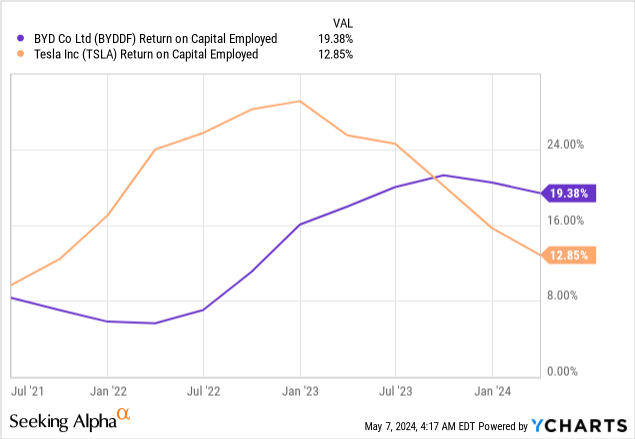

In Q1 FY2024, BYD’s gross profit increased by 27% to $3.73 billion, and ROCE – a great profitability metric – stayed above 19% while Tesla’s corresponding ratio kept falling lower:

Third, BYD’s share of the domestic mass market decreased from 89% to 78%. At the same time, the share of premium cars and exports expanded from 4% and 7% to 6% and 16%, respectively. In other words, the company began to more actively tap into new, potentially more profitable markets – including outside China. Never before in the history of the brand has this happened on such a massive scale. I think that as consumers are getting used to Chinese cars on their roads, BYD has every chance of gaining a good market share outside China through the availability of its cars.

As part of our discussion on the latest financial results, I’d also like to point out that BYD’s balance sheet looks more than solid. With a market capitalization of ~$86 billion, the company holds ~$13.2 billion in cash and ST investments. This means that the cash-to-MC ratio exceeds 15%. At the same time, according to Seeking Alpha Premium, the debt-to-equity ratio and current ratio are 0.29 and 0.66 respectively – so liquidity risks appear to be limited, as far as I can tell. BYD certainly has sufficient financial resources to aggressively penetrate other markets and continue the pricing war.

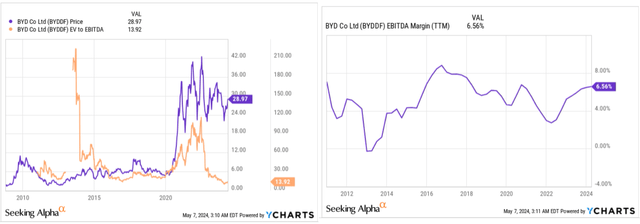

Let’s also talk about BYD’s valuation today, as this topic seems to be very interesting. If you look at the EV/EBITDA ratio – in my opinion one of the most useful valuation metrics for valuing automakers – you will see that the company’s stock remained virtually unchanged when the company’s growth rate declined. Yes, the BYD stock was and is very volatile, but its wide price range doesn’t allow it to go beyond or below its limits yet. At the same time, the EV/EBITDA ratio has dropped significantly. Back in 2020-21, the multiple was over 30-40x, now it has dropped to 13-14x. At the same time, the company’s profitability has only strengthened if we are talking about the long term:

YCharts, author’s compilation

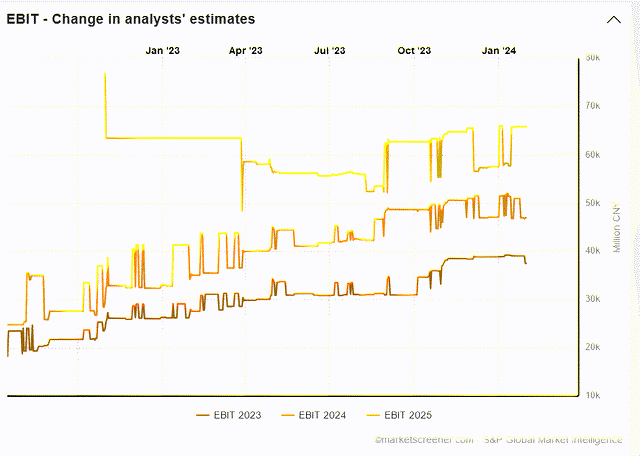

At the same time, what should justify the potential growth in the multiple – EBITDA expansion at a stable margin – is exactly what the market consensus continues to expect from BYD, if the latest data is to be believed:

Shared by @armin_brack on X

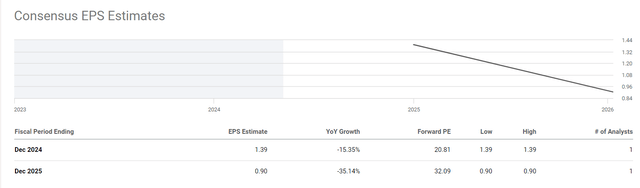

However, these predictions may no longer be relevant. Look at where the same market consensus sees BYD’s EPS growth over the next 2 years – implied P/E ratios will actually rise eating up the stock’s growth potential (if these forecasts materialize).

Seeking Alpha, BYD’s FWD EPS forecasts

The retail customer in China now seems to be more economically sensitive to inflation and other changes in the economy. I suspect that this customer is simply more cautious when it comes to how they spend their discretionary dollars. Buying a car – even on credit – is an expensive pleasure for a large part of the Chinese population, which probably explains why the number of vehicles per capita in China is so low. The Chinese economy is going through a rather unpleasant phase at the moment, judging by the news that keeps coming our way – this phase always affects ordinary people in the country and how they choose to spend their money in the short term. Uncertainty often leads to saving more than spending – perhaps this will become a more common trend in the foreseeable future. The consensus predictions could come true in this case, making the seeming undervaluation of BYD irrelevant.

Overall demand for EVs [in China] is set to fall in 2024, as consumers refrain from buying items such as cars due to concerns about job prospects and incomes. A 20% increase will not be easy to achieve, given the current weak market sentiment,» said Zhao Zhen, a sales director at Wan Zhuo Auto-a car dealer in Shanghai.

Source: Teslarati.com

It’s also worth mentioning that the EU is trying to restrict Chinese electric vehicles on its territory – a very bad sign for BYD’s international expansion plans. A report by consultancy Rhodium Group suggests that imposing tariffs of 40-50% may be necessary to deter Chinese EV exporters. Also, in view of the current geopolitical situation between China and the U.S., there’s nothing to say about BYD’s possible takeover of the American car market.

Primitive Technical Analysis Of BYDDF

The above-limiting factors prevent BYD from leaving its price range despite all the growth prospects and relatively low valuation multiples. If the new institutional buyers I mentioned at the very beginning of today’s article fail to drive the price higher, BYD will most likely try to retest its nearest support zone again. This is likely to take some time, and perhaps the business cycle of the auto market in China will turn upwards again by then – in which case BYDDF could go higher:

TrendSpider, author’s notes

This is just my view on price action without having a CMT certification, so I ask you to take these conclusions with a large dose of skepticism.

The Verdict

Despite the many words of praise for BYD Company that you read in my article today, I’m keeping a cool head and not running to buy the stock at its current levels. Yes, BYD Company has many advantages over Tesla and most other peers in China due to the specifics I described, and the shift in sentiment we’ve seen in recent weeks towards Chinese stocks could be the start of a new uptrend. However, the regulatory and macroeconomic risks surrounding the company today baffle me. If you don’t think they have a hook, you can buy BYD stock today or wait for the price to return to the demand zone. I will stay on the sidelines and watch.

Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.